Volatility timing

Contents

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

%matplotlib inline

12.1. Volatility timing#

Using daily data for month t, construct the market return “realized variance” during month t

where \(\overline{R}\) is the average return within the month

Buy the market at the closing price of month t accoding to the rule:

where \(c\) is some constant.

Hold the postions for a month

The returns of the strategy are given by

One could use a variety of other volatiltiy estimators to implement the strategy

Use Squared returns instead of variance

VIX (my favourite)

GARCH based forecasts

Regression forecasts based lagged rv

Regression forecasts based lagged rv and VIX

For this implementation which was developed in a paper of mine with Tyler Muir we simply need daily data to construct the realized variance variable (VIX is great but only available for a short sample)

Download data from WRDS

(if you have credentials)

import datetime as dt

import wrds

import psycopg2

from dateutil.relativedelta import *

# connect with their server

#conn=wrds.Connection()

# get the value-weighted market returns and date from the data base crsp.dsi

mkt_d = conn.raw_sql("""

select a.date, a.vwretd

from crsp.dsi as a

""")

# get the risk-free rate

rf_d = conn.raw_sql("""

select a.date, a.rf

from ff.factors_daily as a

""")

mkt_d=mkt_d.set_index(['date'])

mkt_d=mkt_d.set_index(pd.to_datetime(mkt_d.index),'date')

rf_d=rf_d.set_index(['date'])

rf_d=rf_d.set_index(pd.to_datetime(rf_d.index),'date')

# we merge

daily=mkt_d.merge(rf_d,how='left',left_index=True,right_index=True)

# save data locally

#daily.to_pickle('../../assets/data/daily.pkl')

Alternatively simply import from Gihub by substituting the address below

daily=pd.read_pickle('https://github.com/amoreira2/Lectures/blob/main/assets/data/daily.pkl?raw=true')

12.1.1. Constructing monthly realized variance from daily data#

You basically use pandas time series function that shifts all dates to the end of the month, so this way you are technically grouping by the end of the month day.

daily.index

DatetimeIndex(['1925-12-31', '1926-01-02', '1926-01-04', '1926-01-05',

'1926-01-06', '1926-01-07', '1926-01-08', '1926-01-09',

'1926-01-11', '1926-01-12',

...

'2020-12-17', '2020-12-18', '2020-12-21', '2020-12-22',

'2020-12-23', '2020-12-24', '2020-12-28', '2020-12-29',

'2020-12-30', '2020-12-31'],

dtype='datetime64[ns]', name='date', length=25046, freq=None)

Now I use groupby endofmonth to put all returns of given “year-month” pair together (i.e. with the same date)

from pandas.tseries.offsets import MonthEnd

endofmonth=daily.index+MonthEnd(0)

endofmonth

DatetimeIndex(['1925-12-31', '1926-01-31', '1926-01-31', '1926-01-31',

'1926-01-31', '1926-01-31', '1926-01-31', '1926-01-31',

'1926-01-31', '1926-01-31',

...

'2020-12-31', '2020-12-31', '2020-12-31', '2020-12-31',

'2020-12-31', '2020-12-31', '2020-12-31', '2020-12-31',

'2020-12-31', '2020-12-31'],

dtype='datetime64[ns]', name='date', length=25046, freq=None)

So I can jsut compute the variance of this group (say 1/1/2020,1/2/2020,…1/31/2020 will all be 1/31/2020

This will return the daily variance in that month

So the ouput will be one realized variance for each month

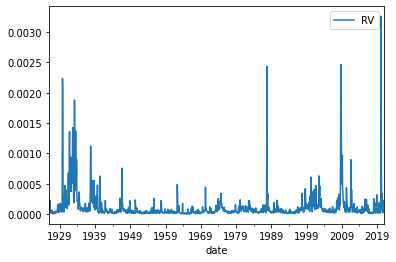

# We denote `realized variance` for the market return as `RV`

RV=daily[['vwretd']].groupby(endofmonth).var()

# rename column to clarify

RV=RV.rename(columns={'vwretd':'RV'})

RV.plot()

<AxesSubplot:xlabel='date'>

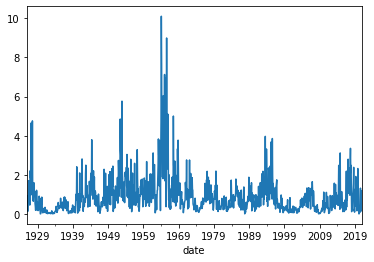

12.1.2. From signal to weights#

weight on the market:

weight on the risk-free rate: \(1-w_t\)

\(c\) controls how levered is the strategy on average.

As we saw before all timing strategies involved some in and out of the market, but you also need to determine the average position. That is the role of \(c\).

There are many ways to choose c

while c does not impact the strategy Sharpe Ratio, it impacts the amount of leverage that the strategy will take

Here lets keep it simple and simply choose it so that the postion on the market is 1 on average

implies \(c=\frac{1}{E[\frac{1}{rv_t}]}\)

# calculate weights for the risky assets (market)

c=1/(1/RV.RV).mean()

RV['Weight']=c/RV.RV

RV.Weight.plot()

RV.Weight.mean()

0.918452009960208

# plot the weights on the risk-free rate

(1-RV.Weight).plot()

plt.show()

12.1.3. Aggregate daily returns to monthly returns#

Since the strategy will trade monthly, we now need to construct monthly returns

we do that by cumulating daily returns within a month

# aggregate daily returns to monthly returns

Ret=(1+daily).groupby(endofmonth).prod()-1

# rename columns to clarify

Ret.tail()

| vwretd | rf | |

|---|---|---|

| date | ||

| 2020-08-31 | 0.068549 | 0.0 |

| 2020-09-30 | -0.034910 | 0.0 |

| 2020-10-31 | -0.020180 | 0.0 |

| 2020-11-30 | 0.123639 | 0.0 |

| 2020-12-31 | 0.044672 | 0.0 |

# have we discussed merge before?

# Merge Ret (monthly return) with RV (realized variance and weights)

df=RV.merge(Ret,how='left',left_index=True,right_index=True)

df.tail()

| RV | Weight | vwretd | rf | |

|---|---|---|---|---|

| date | ||||

| 2020-08-31 | 0.000024 | 1.323402 | 0.068549 | 0.0 |

| 2020-09-30 | 0.000228 | 0.139017 | -0.034910 | 0.0 |

| 2020-10-31 | 0.000154 | 0.206066 | -0.020180 | 0.0 |

| 2020-11-30 | 0.000090 | 0.353568 | 0.123639 | 0.0 |

| 2020-12-31 | 0.000027 | 1.185148 | 0.044672 | 0.0 |

12.1.4. Construct strategy returns#

Now to construct the strategy return recall that we use the relaized variance in month t to buy the market at the closing of month t and earn the return accrued in month t+1

So we need to lag our weights, or lead the returns

I will call the strategy as \(\textbf{VMS}\) (Volatility Managed Strategy)

# compare with the weight before . It simply shifts the weght from month t to month t+1

df.Weight.shift(1).tail()

date

2020-08-31 0.435234

2020-09-30 1.323402

2020-10-31 0.139017

2020-11-30 0.206066

2020-12-31 0.353568

Name: Weight, dtype: float64

# now construct the return of the strategy

df['VMS']=df.Weight.shift(1)*df.vwretd+(1-df.Weight.shift(1))*df.rf

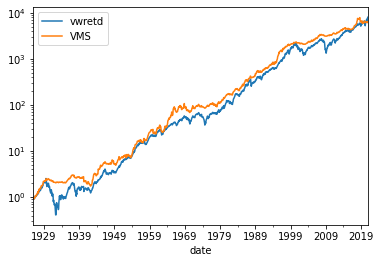

We can see the cumulative returns of the market and the volatility managed strategy

(df[['vwretd','VMS']]+1).cumprod().plot(logy=True)

<AxesSubplot:xlabel='date'>

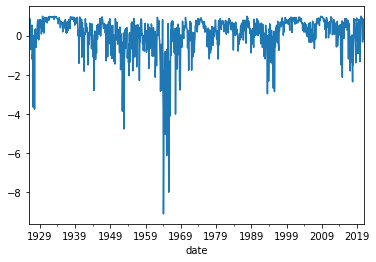

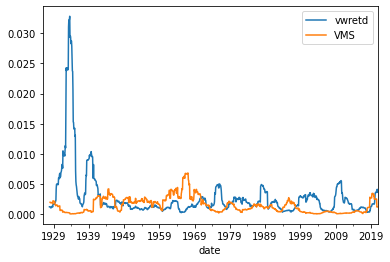

Volatility is more stable

df[['vwretd','VMS']].rolling(window=24).var().plot()

<AxesSubplot:xlabel='date'>

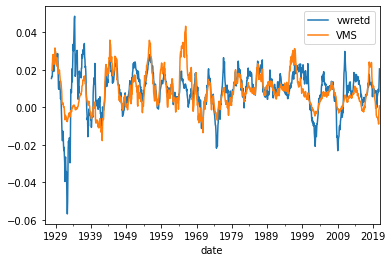

Average returns

df[['vwretd','VMS']].rolling(window=24).mean().plot()

<AxesSubplot:xlabel='date'>

Sharpe ratio

The VMS strategy ends up with a 20% higher Sharpe Ratio

(df[['vwretd','VMS']].subtract(df.rf,axis=0).mean()/df[['vwretd','VMS']].std())*12**0.5

vwretd 0.431226

VMS 0.513687

dtype: float64

Tail risk

The VMS bears substantially less tail risk as well

We can look at the bottom 0.5% returns

df[['vwretd','VMS']].quantile(q=0.005)

vwretd -0.187543

VMS -0.133776

Name: 0.005, dtype: float64