Strategy Implementation

Contents

import numpy as np

import pandas as pd

%matplotlib inline

import matplotlib.pyplot as plt

# import regression package

15.2. Strategy Implementation#

This chapter was not touched

So we have taken prices as given and discussed quantitative allocation rules that overperform relative to a standard CAPM benchmark.

An important question is whether we would be able to trade at those prices if we tried to implement the strategy.

Here start briefly by dsicussing how cleaning the data is really the most important step to make sure what you are finding is real and can be a profitable trading strategy.

We will then discuss at length liquidity issues.

15.2.1. Data Cleaning: The devil is in the details#

Eugene Fama always would tell his students: Garbage in, Garbage out

He was also able to look at a Table of a regression, or summary statistics and immediately tell that the person had done something different with the data when cleaning it. When working with raw data, it is really important to undergo careful work to check if the underlying data is indeed real

CRSP dataset is very clean already, but if you are not careful your analysis will pick up features of the data are not real

Load on microstructure effects- bid-ask bounces

Load on tiny/peny stocks

Load on stocks that are outside of your investment mandate (for example stocks that do not trade in the US)

Load on other financial instruments (closed-end funds, convertible, prefered shares..)

For example, Daniel and Moskowitz in the “Momentum Crashes” paper impose the following data requriements

(a). CRSP Sharecode 10 or 11. (i.e, common stocks; no ADRs)

(b). CRSP exchange code of 1, 2 or 3 (NYSE, AMEX or NASDAQ)

(c). Must have price at date t-13

(d). Must have return at date t-2

(e). Must have market cap at date t-1

15.2.2. Liquidity#

Liquidity is the ease of trading a security.

This can be quite complex and encompass many things, all of which impose a cost on those wishing to trade.

Sources of illiquidity:

Exogenous transactions costs = brokerage fees, order-processing costs, transaction taxes.

Demand pressure = when need to sell quickly, sometimes a buyer is not immediately available (search costs).

Inventory risk = if can’t find a buyer will sell to a market maker who will later sell position. But, since market maker faces future price changes, you must compensate him for this risk.

Private information = concern over trading against an informed party (e.g., insider). Need to be compensated for this. Private information can be about fundamentals or order flow

Obviuosly a perfect answer to this question requires costly experimentation. It would require trading and measuring how prices change in reponse to your trading behavior.

Absorption capacity

A much simpler approach is to measure the absorption capacity of the strategy.

The idea is to measure how much of the trading volume of each stock you would “use” to implement the strategy for a given position size

Specifically:

The idea is that if you trade a small share of the volume, you are likely to be able to trade at the posted prices.

To compute how much you need to trade you need to compare the desired weights in date \(t\) with the weights you have in the end of date \(t+1\).

Before trading, your weight in date \(t+1\) is

If the desired position in the stock is \(w_{i,t+1}^*\), then

\begin{align} UsedVolume_{i,t}&=\frac{position \times \bigg(w_{i,t+1}^-w_{i,t+1}(\text{before trading})\bigg)}{Volume_{i,t}} \ &=\frac{position}{Volume_{i,t}}\left(w_{i,t+1}^-\frac{w_{i,t}^*(1+r_{i,t+1})}{1+r_{t+1}^{strategy}}\right) \end{align}

\(UsedVolume_{i,t}\) is a stock-time specific statistic. Implementability will depend on how high this quantity is across time and across stocks– the lower the better.

If it is very high (i.e., close to 1), it means that your position would require almost all volume in a particular stock. It doesn’t mean that you wouldn’t be able to trade, but likely prices would move against you (i.e., go up as you buy, do down as you sell)

One very conservative way of looking at it is to look at the maximum of this statistic across stocks. This tells you the “weakest” link in your portfolio formation.

The max statistic is the right one to look at if you are unwilling to deviate from your “wish portfolio”.

But the “wish portfolio” does not take into account transaction costs

How can portfolios take into account trading costs to reduce total costs substantially?

Can we change the portfolios to reduce trading costs without altering them significantly?

One simple way of looking at this is to look at the 95/75/50 percentiles of the used volume distribution.

If it declines steeply it might make sense to avoid the 5% to 25% of the stocks that are least liquid in you portfolio

But as you deviate from the original portfolio you will have tracking error relative to the original strategy.

temp=data[['permco','date','ret', 'me_comp','vol','prc']].sort_values(['permco','date']).set_index('date').drop_duplicates()

temp=temp.reset_index()

temp[temp.duplicated(subset=['date','permco'],keep=False)]

| index | date | permco | ret | me_comp | vol | prc | |

|---|---|---|---|---|---|---|---|

| 1300 | 1300 | 1990-01-31 | 32 | -0.143836 | 582.468750 | 2162.0 | 31.250000 |

| 1301 | 1301 | 1990-01-31 | 32 | -0.131944 | 582.468750 | 3614.0 | 31.250000 |

| 1302 | 1302 | 1990-02-28 | 32 | -0.080000 | 538.256000 | 1320.0 | 28.750000 |

| 1303 | 1303 | 1990-02-28 | 32 | -0.072000 | 538.256000 | 1471.0 | 29.000000 |

| 1304 | 1304 | 1990-03-30 | 32 | 0.034783 | 554.867250 | 1829.0 | 29.750000 |

| ... | ... | ... | ... | ... | ... | ... | ... |

| 1754105 | 1754105 | 2017-10-31 | 55773 | NaN | 2508.854117 | 2.0 | NaN |

| 1754106 | 1754106 | 2017-11-30 | 55773 | -0.022126 | 2583.637062 | 95594.0 | 45.080002 |

| 1754107 | 1754107 | 2017-11-30 | 55773 | -0.145826 | 2583.637062 | 5.0 | -46.040001 |

| 1754108 | 1754108 | 2017-12-29 | 55773 | -0.016637 | 2541.522427 | 47669.0 | 44.330002 |

| 1754109 | 1754109 | 2017-12-29 | 55773 | -0.015747 | 2541.522427 | 4.0 | -45.315002 |

44814 rows × 7 columns

# data=crsp_m.copy()

# ngroups=10

def momreturns_w(data, ngroups):

# step1. create a temporary crsp dataset

_tmp_crsp = data[['permco','date','ret', 'me_comp','vol','prc']].sort_values(['permco','date']).set_index('date').drop_duplicates()

_tmp_crsp['volume']=_tmp_crsp['vol']*_tmp_crsp['prc'].abs()*100/1e6 # in million dollars like me

# step 2: construct the signal

_tmp_crsp['grossret']=_tmp_crsp['ret']+1

_tmp_cumret=_tmp_crsp.groupby('permco')['grossret'].rolling(window=12).apply(np.prod, raw=True)-1

_tmp_cumret=_tmp_cumret.reset_index().rename(columns={'grossret':'cumret'})

_tmp = pd.merge(_tmp_crsp.reset_index(), _tmp_cumret[['permco','date','cumret']], how='left', on=['permco','date'])

# merge the 12 month return signal back to the original database

_tmp['mom']=_tmp.groupby('permco')['cumret'].shift(2)

# step 3: rank assets by signal

mom=_tmp.sort_values(['date','permco']) # sort by date and firm identifier

mom=mom.dropna(subset=['mom'], how='any')# drop the row if any of these variables 'mom','ret','me' are missing

mom['mom_group']=mom.groupby(['date'])['mom'].transform(lambda x: pd.qcut(x, ngroups, labels=False,duplicates='drop'))

# create `ngroups` groups each month. Assign membership accroding to the stock ranking in the distribution of trading signal

# in a given month

# transform in string the group names

mom=mom.dropna(subset=['mom_group'], how='any')# drop the row if any of 'mom_group' is missing

mom['mom_group']=mom['mom_group'].astype(int).astype(str).apply(lambda x: 'm{}'.format(x))

mom['date']=mom['date']+MonthEnd(0) #shift all the date to end of the month

mom=mom.sort_values(['permco','date']) # resort

# step 4: form portfolio weights

def wavg_wght(group, ret_name, weight_name):

d = group[ret_name]

w = group[weight_name]

try:

group['Wght']=(w) / w.sum()

return group[['date','permco','Wght']]

except ZeroDivisionError:

return np.nan

# We now simply have to use the above function to construct the portfolio

# the code below applies the function in each date,mom_group group,

# so it applies the function to each of these subgroups of the data set,

# so it retursn one time-series for each mom_group, as it average the returns of

# all the firms in a given group in a given date

weights = mom.groupby(['date','mom_group']).apply(wavg_wght, 'ret','me_comp')

# merge back

weights=mom.merge(weights,on=['date','permco'])

weights=weights.sort_values(['date','permco'])

weights['mom_group_lead']=weights.groupby('permco').mom_group.shift(-1)

weights['Wght_lead']=weights.groupby('permco').Wght.shift(-1)

weights=weights.sort_values(['permco','date'])

def wavg_ret(group, ret_name, weight_name):

d = group[ret_name]

w = group[weight_name]

try:

return (d * w).sum() / w.sum()

except ZeroDivisionError:

return np.nan

port_vwret = weights.groupby(['date','mom_group']).apply(wavg_ret, 'ret','Wght')

port_vwret = port_vwret.reset_index().rename(columns={0:'port_vwret'})# give a name to the new time-seires

weights=weights.merge(port_vwret,how='left',on=['date','mom_group'])

port_vwret=port_vwret.set_index(['date','mom_group']) # set indexes

port_vwret=port_vwret.unstack(level=-1) # unstack so we have in each column the different portfolios, and in each

port_vwret=port_vwret.port_vwret

return port_vwret, weights

port_ret, wght=momreturns_w(crsp_m, 10)

wght.head()

| date | permco | ret | me_comp | vol | prc | volume | grossret | cumret | mom | mom_group | Wght | mom_group_lead | Wght_lead | port_vwret | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 1991-02-28 | 4 | 0.129534 | 1096.632 | 12962.0 | 27.000 | 34.997400 | 1.129534 | 0.062541 | -0.212395 | m5 | 0.004269 | m6 | 0.001975 | 0.077604 |

| 1 | 1991-03-31 | 4 | -0.027778 | 1066.170 | 15970.0 | 26.250 | 41.921250 | 0.972222 | 0.023372 | -0.008337 | m6 | 0.001975 | m6 | 0.002136 | 0.024414 |

| 2 | 1991-04-30 | 4 | -0.109524 | 949.399 | 28938.0 | 23.375 | 67.642575 | 0.890476 | -0.044041 | 0.062541 | m6 | 0.002136 | m5 | 0.002240 | 0.010956 |

| 3 | 1991-05-31 | 4 | -0.005348 | 934.168 | 20847.0 | 23.000 | 47.948100 | 0.994652 | -0.085034 | 0.023372 | m5 | 0.002240 | m4 | 0.002891 | 0.037118 |

| 4 | 1991-06-30 | 4 | -0.021739 | 917.100 | 10960.0 | 22.500 | 24.660000 | 0.978261 | -0.036073 | -0.044041 | m4 | 0.002891 | m4 | 0.002311 | -0.058240 |

# construct dollars of each stock that need to be bought (sold) at date t+1

mom=wght.copy()

mom['trade']=mom.Wght_lead*(mom.mom_group==mom.mom_group_lead)-mom.Wght*(1+mom.ret)/(1+mom.port_vwret)

# per dollar of position how much do you have to trade every month?

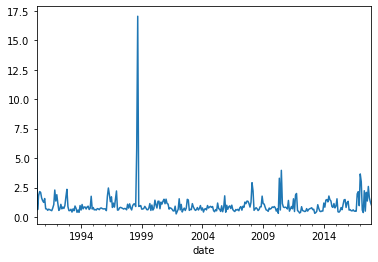

mom.groupby(['date','mom_group']).trade.apply(lambda x:x.abs().sum()).loc[:,'m1'].plot()

<matplotlib.axes._subplots.AxesSubplot at 0x7f7beac9c898>

# lets look at the most illiquid stocks, the stocks that I will likely have most trouble trading

# lets start by normalizing the amount of trade per stock volume

mom['tradepervol']=mom.trade/mom.volume

# this allow us to study how much of the volume of each stock I will be "using"

# lets choose a position size, here in millions of dollars , because that is the normalization we used for the volume data

Position=1e3 #(1e3 means one billion dollars)

threshold=0.05

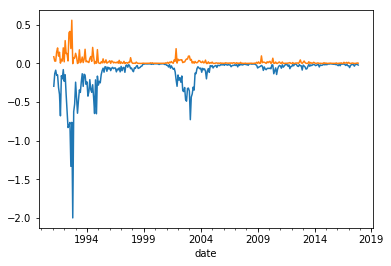

(Position*(mom.groupby(['date','mom_group']).tradepervol.quantile(threshold).loc[:,'m9'])).plot()

(Position*(mom.groupby(['date','mom_group']).tradepervol.quantile(1-threshold).loc[:,'m9'])).plot()

<matplotlib.axes._subplots.AxesSubplot at 0x211edf9b128>

Tracking error

Let $\(W^{wishportfolio}_t\)\( and \)\(W^{Implementationportfolio}_t\)$ weights , then consider the following regression

a good implementation portfolio has \(\beta=1\) and \(\sigma(\epsilon)\) and \(\alpha\approx 0\).

So one can think of \(|\beta-1|\), \(\sigma(\epsilon)\) , and \(\alpha\) as three dimensions of tracking error.

The \(\beta\) dimension can be more easily correted by levering up and down the tracking portoflio (of possible)

The \(\sigma(\epsilon)\) can only be corrected by simply making the implemenetation portoflio more similar to the wish portfolio. The cost of this is not obvious. Really depends how this tracking error relates to other stuff in your portfolio.

\(\alpha\) is the important part. The actual cost that you expect to pay to deviate from the wish portfolio

In the industry people typicall refer to tracking error as simply

The volatility of a portfolio that goes long the implementation portfolio and shorts the wish portfolio.

This mixes together \(|\beta-1|\), \(\sigma(\epsilon)\) and completely ignores \(\alpha\)

In the end the Implementation portfolio is chosen by trading off trading costs (market impact) and opportunity cost (tracking error).

So you can simply construct strategies that avoid these 5% less liquid stocks, and see how much your tracking error increases and whether these tracking errors are worth the reduction in trading costs

How to construct an Implementation portfolio?

A simple strategy: weight by trading volume -> this make sure that you use the same amount of trading volume across all your positions

Harder to implement: do not buy stocks that are illiquid now or likely to be illiquid next period. Amounts to add another signal interected to the momentum signal. Only buy if illiquid signal not too strong.

How to change our code to implement the volume-weighted approach?

def momreturns(data,lookback=12,nmonthsskip=1,wghtvar='me',returntransf='sum',nportfolios=10):

_tmp_crsp = data[['permno','date','ret', 'me','vol','prc']].sort_values(['permno','date']).set_index('date')

_tmp_crsp['volume']=_tmp_crsp['vol']*_tmp_crsp['prc'].abs()*100/1e6 # in million dollars like me

## Trading siginal construction

_tmp_crsp['ret']=_tmp_crsp['ret'].fillna(0)#replace missing return with 0

_tmp_crsp['logret']=np.log(1+_tmp_crsp['ret'])#transform in log returns

if returntransf=='sum':

_tmp_cumret = _tmp_crsp.groupby(['permno'])['logret'].rolling(lookback, min_periods=np.min([7,lookback])).sum()# sum last 12 month returns for each

elif returntransf=='std':

_tmp_cumret = _tmp_crsp.groupby(['permno'])['logret'].rolling(lookback, min_periods=np.min([7,lookback])).std()# sum last 12 month returns for each

elif returntransf=='min':

_tmp_cumret = _tmp_crsp.groupby(['permno'])['logret'].rolling(lookback, min_periods=np.min([7,lookback])).min()# sum last 12 month returns for each

elif returntransf=='max':

_tmp_cumret = _tmp_crsp.groupby(['permno'])['logret'].rolling(lookback, min_periods=np.min([7,lookback])).max()# sum last 12 month returns for each

#stock,require there is a minium of 7 months

_tmp_cumret = _tmp_cumret.reset_index()# reset index, needed to merged back below

_tmp_cumret['cumret']=np.exp(_tmp_cumret['logret'])-1# transform back in geometric returns

_tmp_cumret = pd.merge(_tmp_crsp.reset_index(), _tmp_cumret[['permno','date','cumret']], how='left', on=['permno','date'])

# merge the 12 month return signal back to the original database

_tmp_cumret['mom']=_tmp_cumret.groupby('permno')['cumret'].shift(1+nmonthsskip) # lag the 12 month signal by two months

# You always have to lag by 1 month to make the signal tradable, that is if you are going to use the signal

#to construct a portfolio in the beggining of january/2018, you can only have returns in the signal up to Dec/2017

# we are lagging one more time, because the famous momentum strategy skips a month as well

# we also labeling mom the trading signal

mom=_tmp_cumret.sort_values(['date','permno']).drop_duplicates() # sort by date and firm identifier and drop in case there

#any duplicates (IT shouldn't be, in a given date for a given firm we can only have one row)

if wghtvar=='ew':

mom['w']=1

else:

mom['w']=mom.groupby('permno')[wghtvar].shift(1) # lag the market equity that we will use in our trading strategy to construct

# value-weighted returns

mom=mom.dropna(subset=['mom','ret','me'], how='any')# drop the row if any of these variables 'mom','ret','me' are missing

mom['mom_group']=mom.groupby(['date'])['mom'].transform(lambda x: pd.qcut(x, nportfolios, labels=False,duplicates='drop'))

# create 10 groups each month. Assign membership accroding to the stock ranking in the distribution of trading signal

#in a given month

# transform in string the group names

mom[['mom_group']]='m'+mom[['mom_group']].astype(int).astype(str)

mom['date']=mom['date']+MonthEnd(0) #shift all the date to end of the month

mom=mom.sort_values(['permno','date']) # resort

# we now have the membership that will go in each portfolio

# withing a given portfolio we will simply use the firms market cap to value-weight the portfolio

# this function takes given date/set of firms given in group, and uses ret_name as the return series and

# weight_name as the variable to be used for weighting

# it returns, on number, the value weighted returns

def wavg(group, ret_name, weight_name):

d = group[ret_name]

w = group[weight_name]

try:

return (d * w).sum() / w.sum()

except ZeroDivisionError:

return np.nan

# We now simply have to use the above function to construct the portfolio

# the code below applies the function in each date,mom_group group,

# so it applies the function to each of these subgroups of the data set,

# so it retursn one time-series for each mom_group, as it average the returns of

# all the firms in a given group in a given date

port_vwret = mom.groupby(['date','mom_group']).apply(wavg, 'ret','w')

port_vwret = port_vwret.reset_index().rename(columns={0:'port_vwret'})# give a name to the new time-seires

port_vwret=port_vwret.set_index(['date','mom_group']) # set indexes

port_vwret=port_vwret.unstack(level=-1) # unstack so we have in each column the different portfolios, and in each

port_vwret=port_vwret.port_vwret

return port_vwret

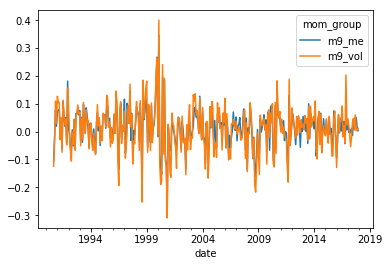

momportfolios=momreturns(crsp_m,lookback=12,nmonthsskip=1,wghtvar='me',returntransf='sum',nportfolios=10)

momportfoliosvol=momreturns(crsp_m,lookback=12,nmonthsskip=1,wghtvar='vol',returntransf='sum',nportfolios=10)

momportfolios=momportfolios.merge(momportfoliosvol,left_index=True,right_index=True,suffixes=['_me','_vol'])

momportfolios[['m9_me','m9_vol']].plot()

<matplotlib.axes._subplots.AxesSubplot at 0x211fd497e80>

# lets look at it's tracking error

y=momportfolios['m9_vol']

x=momportfolios['m9_me']

x=sm.add_constant(x)

results = sm.OLS(y,x).fit()

results.summary()

| Dep. Variable: | m9_vol | R-squared: | 0.888 |

|---|---|---|---|

| Model: | OLS | Adj. R-squared: | 0.888 |

| Method: | Least Squares | F-statistic: | 2585. |

| Date: | Tue, 01 Oct 2019 | Prob (F-statistic): | 4.82e-157 |

| Time: | 22:13:26 | Log-Likelihood: | 706.11 |

| No. Observations: | 328 | AIC: | -1408. |

| Df Residuals: | 326 | BIC: | -1401. |

| Df Model: | 1 | ||

| Covariance Type: | nonrobust |

| coef | std err | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | -0.0036 | 0.002 | -2.282 | 0.023 | -0.007 | -0.000 |

| m9_me | 1.1727 | 0.023 | 50.844 | 0.000 | 1.127 | 1.218 |

| Omnibus: | 59.076 | Durbin-Watson: | 1.991 |

|---|---|---|---|

| Prob(Omnibus): | 0.000 | Jarque-Bera (JB): | 207.760 |

| Skew: | 0.743 | Prob(JB): | 7.68e-46 |

| Kurtosis: | 6.605 | Cond. No. | 14.8 |

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

Observations:

The beta difference 1.17 vs 1 can be adjusted by taking a smaller position on the implementation portfolio

The alpha is the actual tracking error loss. How much you expect to loose.

In this case it is economically quite large -0.0036 vs \(\beta E[R]\) of 0.0045

One calculation that people do is to see how much you are getting for your momentum exposure

[momportfolios['m9_vol'].mean()/results.params[1]*12,momportfolios['m9_me'].mean()*12]

[0.02273481060808451, 0.045973481561390854]

This is very large. A decay of about 50% in the premium that you earn for trading momentum

But be careful to not over interpret this. We are working today with a very short sample, less than 20 years, for average returns tests that is not much at all.

But beta/residulas are well measured even in fairly short samples.

In addition to that you also have to eat the strategy residual risk

[results.resid.std(),momportfolios['m9_me'].std()]

[0.030886022623588822, 0.05839011395858583]

It is sizable, about 50% of the original strategy volatility

How our implemented strategy compare with the desired strategy?

url = "https://www.dropbox.com/s/9346pp2iu5prv8s/MonthlyFactors.csv?dl=1"

Factors = pd.read_csv(url,index_col=0,

parse_dates=True,na_values=-99)

Factors=Factors/100

Factors=Factors.iloc[:,0:5]

Factors['MKT']=Factors['MKT']-Factors['RF']

Factors=Factors.drop('RF',axis=1)

Factors.mean()

MKT 0.006567

SMB 0.002101

HML 0.003881

Mom 0.006557

dtype: float64

momportfolios=momportfolios.merge(Factors,left_index=True,right_index=True)

momportfolios.head()

| m0_me | m1_me | m2_me | m3_me | m4_me | m5_me | m6_me | m7_me | m8_me | m9_me | ... | m4_vol | m5_vol | m6_vol | m7_vol | m8_vol | m9_vol | MKT | SMB | HML | Mom | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2000-09-30 | -0.129798 | -0.127564 | -0.059888 | 0.010082 | -0.000143 | -0.010516 | -0.020118 | -0.062108 | -0.015532 | -0.148530 | ... | -0.078569 | -0.102002 | -0.041797 | -0.071430 | -0.042302 | -0.103630 | -0.0545 | -0.0140 | 0.0623 | 0.0215 |

| 2000-10-31 | -0.193803 | 0.015573 | -0.002240 | 0.051042 | 0.056879 | 0.002350 | -0.013423 | -0.024685 | -0.052272 | -0.083327 | ... | 0.016559 | -0.041332 | -0.034236 | -0.040717 | -0.066250 | -0.085599 | -0.0276 | -0.0377 | 0.0555 | -0.0463 |

| 2000-11-30 | -0.331351 | -0.173224 | -0.081811 | -0.055005 | -0.079905 | -0.080539 | -0.063107 | -0.054668 | -0.094147 | -0.228494 | ... | -0.164590 | -0.146529 | -0.169296 | -0.106301 | -0.155380 | -0.284814 | -0.1072 | -0.0277 | 0.1129 | -0.0244 |

| 2000-12-31 | -0.172035 | -0.064091 | -0.038472 | 0.062127 | 0.083423 | -0.009017 | -0.002741 | 0.043720 | 0.020615 | 0.085389 | ... | 0.054782 | -0.017112 | -0.028978 | 0.044208 | 0.016709 | 0.085327 | 0.0119 | 0.0096 | 0.0730 | 0.0673 |

| 2001-01-31 | 0.418582 | 0.397816 | 0.299617 | 0.095205 | 0.093103 | 0.083798 | -0.014023 | -0.010242 | -0.046882 | -0.069165 | ... | 0.165616 | 0.093876 | 0.078421 | 0.021932 | 0.019839 | 0.000049 | 0.0313 | 0.0656 | -0.0488 | -0.2501 |

5 rows × 24 columns

# things to look at:

#y=momportfolios['m9_me']

#y=momportfolios['m9_vol']

#y=momportfolios['m9_me']-momportfolios['m0_me']

y=momportfolios['m9_me']-momportfolios['m0_me']

x=momportfolios[['MKT','Mom']]

x=sm.add_constant(x)

results = sm.OLS(y,x).fit()

results.summary()

| Dep. Variable: | y | R-squared: | 0.795 |

|---|---|---|---|

| Model: | OLS | Adj. R-squared: | 0.793 |

| Method: | Least Squares | F-statistic: | 387.0 |

| Date: | Wed, 14 Nov 2018 | Prob (F-statistic): | 2.61e-69 |

| Time: | 11:48:12 | Log-Likelihood: | 322.62 |

| No. Observations: | 202 | AIC: | -639.2 |

| Df Residuals: | 199 | BIC: | -629.3 |

| Df Model: | 2 | ||

| Covariance Type: | nonrobust |

| coef | std err | t | P>|t| | [0.025 | 0.975] | |

|---|---|---|---|---|---|---|

| const | 0.0027 | 0.003 | 0.767 | 0.444 | -0.004 | 0.010 |

| MKT | -0.2234 | 0.089 | -2.505 | 0.013 | -0.399 | -0.048 |

| Mom | 1.7587 | 0.075 | 23.590 | 0.000 | 1.612 | 1.906 |

| Omnibus: | 26.262 | Durbin-Watson: | 1.981 |

|---|---|---|---|

| Prob(Omnibus): | 0.000 | Jarque-Bera (JB): | 136.262 |

| Skew: | -0.182 | Prob(JB): | 2.58e-30 |

| Kurtosis: | 7.007 | Cond. No. | 28.8 |

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

why such a large differcenc even for the strategy that follows the Momentum strategy?