Portfolio Optimization with constraints

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

%matplotlib inline

#GlobalFinMonthly

url="https://raw.githubusercontent.com/amoreira2/Lectures/4b95c7d60e869dffa6367c1730183b68920ed2b9/assets/data/GlobalFinMonthly.csv"

Data = pd.read_csv(url,na_values=-99)

# tell python Date is date:

Data['Date']=pd.to_datetime(Data['Date'])

# set an an index

Data=Data.set_index(['Date'])

Data=Data.rename(columns={Data.columns[1]: "MKTUS",Data.columns[2]: "BondUS",

Data.columns[3]: "EM",Data.columns[4]: "MKTxUS",Data.columns[5]: "BondxUS" })

df=(Data.drop('RF',axis=1)).subtract(Data['RF'],axis='index')

df.tail()

| MKTUS | BondUS | EM | MKTxUS | BondxUS | |

|---|---|---|---|---|---|

| Date | |||||

| 2016-08-31 | 0.0050 | -0.008617 | 0.024986 | 0.000638 | -0.009752 |

| 2016-09-30 | 0.0025 | -0.016617 | 0.012953 | 0.012536 | 0.009779 |

| 2016-10-31 | -0.0202 | -0.049660 | 0.002274 | -0.020583 | -0.043676 |

| 2016-11-30 | 0.0486 | -0.081736 | -0.046071 | -0.019898 | -0.050459 |

| 2016-12-31 | 0.0182 | -0.005596 | 0.002604 | 0.034083 | -0.023507 |

9.4. Portfolio Optimization with constraints#

Another practical issue that practioners face is that MV analysis (in it’s more pure form) does not account for several real world frictions that are more or less important depending on the investor:

Shorting an asset requires paying a borrowing fee to the owner of the asset. Shorting costs are sometimes prohibitive for small illiquid stocks

Most investors cannot really borrow at anything close to the risk-free rate–i.e., often they have to pay a substantially higher rate to borrow than to lend.

Python has the flexibility to solve the mean-variance problem numerically

Allows you to impose realistic features to our portfolio problem

Shorting costs

Borrowing costs higher than lending costs

Leverage constraints

Position limits due to investment mandates

Lets start by importing optimization package – think of a much more powerful solver (excel)

from scipy.optimize import minimize

we will now learn how to do a numerical minimization.

start by defining some useful variables

ERe=Re.mean()

print(ERe)

Cove=Re.cov()

print(Cove)

MKTUS 0.005140

BondUS 0.002523

EM 0.006923

MKTxUS 0.004149

BondxUS 0.002054

dtype: float64

MKTUS BondUS EM MKTxUS BondxUS

MKTUS 0.001948 0.000111 0.001292 0.001264 0.000187

BondUS 0.000111 0.001227 -0.000204 -0.000013 0.000264

EM 0.001292 -0.000204 0.003556 0.001661 0.000249

MKTxUS 0.001264 -0.000013 0.001661 0.002182 0.000422

BondxUS 0.000187 0.000264 0.000249 0.000422 0.000407

Modeling Borrowing limits

# the risk-free rate is special because at a given time we know exactly what the expected returns of investing

# in it, since it is risk-free!

# so it does not make sense to use the average risk-free rate in the portfolio problem, and we should rather use the one that

# we currently can invest at no risk

# here we are dividing by 12 becasue we are using annualized numbers

rf=0.01/12

print(rf)

# below is the target for monthly expected returns

Ertarget=0.06/12

print(Ertarget)

# We pick a margin requirement

margin=0.5

0.0008333333333333334

0.005

The program will choose a vector of weights that minimzies some function (of the chosen weights) subject to some constraint

we need to provide an initial condition for these weights, which essentially tells python the shape of the variable that it is choosing. Here we will start with a equal weighted portfolio

When solving minimization problems it is important to check that the exact initial conditions that you put in don’t matter.

I mean, it’s shape obviously matter, but whether is equal weighted or any other weighting scheme, the minimization should end up in the same place otherwise the numerical is not converging and you need to adjust the stop conditions

We refer to this as making sure that you are finding a “global optimum” and not a “local optimum”

n=Re.shape[1]

W0=np.ones(n)/n

W0

array([0.2, 0.2, 0.2, 0.2, 0.2])

The objective function

We need to specify the function that our minimizer will try to minimize,i.e, our objective

obviously this should be written as a function of the portfolio weights

In this case it is the variance of a portfolio with weights W

the weights will be our choice variable

The minimization function will change the weights until this variance is minimized

# STEP 1: define the objective function, which is the variance of the portfolio in our case

def func(W,Cove=Re.cov()):

return W @ Cove @ W

Finally we need to specify the set of constraints that the minimization problem must satisfy

you can specify two types of constraints: Equalities and inequalities.

Equalities:

specified as ‘eq’

For example:

{'eq', 'fun' : lambda W : W.T @ (ERe+rf) +(1-W.sum())*rf-target}defines the function

F(W)=W @ (ERe+rf) +(1-W.sum())*rf-targetand requires W to satisfy F(W)=0, i.e.,

W @ (ERe+rf) +(1-W.sum())*rf=target, or

\[W'(ERe+rf) +(1-\sum w_i)rf=target\]“target” here is the target for expected returns

Inequalities:

specified as ‘ineq’

For example:

{'ineq', 'fun' : lambda W: -W.sum()+1/margin}Defines

F(W)=-W.sum()+1/marginand requires F(W)>=0, i.e.,

\[\frac{1}{margin}\geq W.sum()\]

It is useful to create a function that returns the expected returns of our portfolio given a weight choice

def expected_return(W):

return W @ (ERe+rf) +(1-W.sum())*rf

# STEP 2: define constraint functions, we have two constraints: (1) target average return, and (2) leverage limit

Ertarget=0.12/12

cons=({'type': 'eq',

'fun' : lambda W : expected_return(W)-Ertarget},

{'type': 'ineq',

'fun' : lambda W: -W.sum()+1/margin})

cons

({'type': 'eq', 'fun': <function __main__.<lambda>(W)>},

{'type': 'ineq', 'fun': <function __main__.<lambda>(W)>})

Finally we are ready to do our minimization

options={'disp': True}: tell python to report intermediary steps so we can check if the algorithm is doing progress towards a solution.There is a variety of additional parameters that you can pass to the minimizer.

see: https://docs.scipy.org/doc/scipy/reference/generated/scipy.optimize.minimize.html

# STEP 3: solve the minimization problem with constraints and save as `sol`

sol = minimize(lambda x: func(x,Cove=Re.cov()),W0, constraints=cons, options={'disp': True})

Optimization terminated successfully (Exit mode 0)

Current function value: 0.003404665865183952

Iterations: 7

Function evaluations: 42

Gradient evaluations: 7

sol.x.sum()

2.0

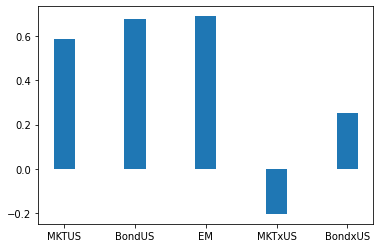

# STEP 4: get the optimal portfolio weights

sol.x

array([ 0.58565363, 0.67667759, 0.69052641, -0.20448374, 0.25162612])

Solution is saved in sol

Lets plot the optimal weights

# below I am plotting the solution weights.

width=0.3

ind=np.arange(Re.shape[1])

fig, ax = plt.subplots()

ax.bar(ind,sol.x,width)

# ax.set_xticks(np.array([0,1,2,3,4,5])+ width / 2)

ax.set_xticks(ind)

ax.set_xticklabels(Re.columns)

plt.show()

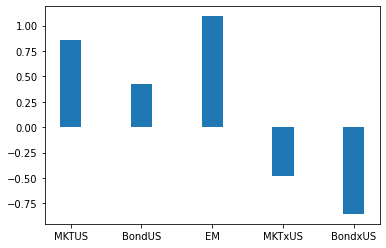

lets now introduce the realistic feature that you have to pya a spread to borrow on margin

all we need to do is to change our expected return function

And we need to redefine the constraints to they re updated

I am setting a spread of 2%

def expected_return(W,spread):

return W @ (ERe+rf) +(1-W.sum())*rf+ min(0,1-W.sum())*spread

def constraint(target,spread):

cons=({'type': 'eq',

'fun' : lambda W : expected_return(W,spread)-target},

{'type': 'ineq',

'fun' : lambda W: -W.sum()+1/margin})

return cons

Ertarget=0.12/12

spread=0.02/12

sol = minimize(lambda x: func(x,Cove=Re.cov()),W0, constraints=constraint(Ertarget,spread), options={'disp': True})

width=0.3

ind=np.arange(Re.shape[1])

fig, ax = plt.subplots()

ax.bar(ind,sol.x,width)

# ax.set_xticks(np.array([0,1,2,3,4,5])+ width / 2)

ax.set_xticks(ind)

ax.set_xticklabels(Re.columns)

plt.show()

Optimization terminated successfully (Exit mode 0)

Current function value: 0.005671948276218396

Iterations: 17

Function evaluations: 119

Gradient evaluations: 17

What do you think will happen with the sum of weights as the spread increases?

Suppose you increase this spread quite a bit, will a reduction in margin impact the optimal choice?

When the margin is more likely to bind for an investor?

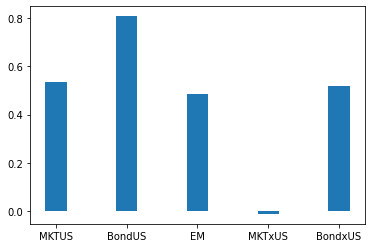

Shorting

Lets now model shorting constraints

We will mode shorting fees which can be scalar or a vector for each asset, we label this

sfThe shorting fee will be charge to any negative postion, hence

min(0,W)which has value zero if the weight is positiveWe will also change the margin constraint to account for shorting margin by simply using the absolute value of your positions

margin=0.5

def expected_return(W,spread,sf):

return W @ (ERe+rf) +(1-W.sum())*rf+ min(0,1-W.sum())*spread+(sf*np.minimum(0,W)).sum()

def constraint(target,spread,sf):

cons=({'type': 'eq',

'fun' : lambda W : expected_return(W,spread,sf)-target},

{'type': 'ineq',

'fun' : lambda W: -np.abs(W).sum()+1/margin})

return cons

To focus on the role of shortign constraints let me start with the case of zero spread and lending fee

Ertarget=0.12/12

spread=0.0/12

sf=0

sol = minimize(lambda x: func(x,Cove=Re.cov()),W0, constraints=constraint(Ertarget,spread,sf), options={'disp': True})

width=0.3

ind=np.arange(Re.shape[1])

fig, ax = plt.subplots()

ax.bar(ind,sol.x,width)

# ax.set_xticks(np.array([0,1,2,3,4,5])+ width / 2)

ax.set_xticks(ind)

ax.set_xticklabels(Re.columns)

plt.show()

Optimization terminated successfully (Exit mode 0)

Current function value: 0.0033237802440886253

Iterations: 7

Function evaluations: 42

Gradient evaluations: 7

You can do a multitude of different problems by making small changes to this code:

Borrowing at the risk-free rate is not allowed, but lending is allowed

Shorting of any asset is not allowed

Shorting of some assets are not allowed

Shorting has an extra cost

Leverage is allowed, but borrowing rate is higher than risk-free rate

How would you implement a hard shorting constraint?

How would you implement no shorting of bonds, but allow investor to short equity markets (which can be done using futures)?