Portfolios

Contents

#lets first import the data

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

%matplotlib inline

#GlobalFinMonthly

url="https://raw.githubusercontent.com/amoreira2/Lectures/main/assets/data/GlobalFinMonthly.csv"

Data = pd.read_csv(url,na_values=-99)

# tell python Date is date:

Data['Date']=pd.to_datetime(Data['Date'])

# set an an index

Data=Data.set_index(['Date'])

7. Portfolios#

In this section we will learn how to do some basic math at portfolio level. You will know how to calculate return, expected return, and volatility given portfolio weights.

A portfolio is described by a set of assets and a set of weights invested in each asset.

7.1. Portfolio weights#

The portfolio weight for stock \(j\) , denoted \(w_j\), is the fraction of a portfolio value held in stock \(j\)

\[w_j=\frac{\text{Dollar held in stock j}}{\text{Dollar value of portfolio}}\]By construction, the portfolio weights allways add up to one: you invest all you got somewhere, and nothing more

This doesn’t mean that you can’t borrow to invest, just means that you will have a negative weight somewhere offsetting the positive position in the other assets

\[\sum_{j=1}^N w_j=1\]In matrix notation

\[\mathbf{1}'W=1\]where \(\mathbf{1}\) is a N by 1 vector of 1’s (i.e. a vector with entry 1 in each position) and \(W\) is the N by 1 vector of portfolio weights

7.2. Portfolio returns#

Where \(R\) is the N by 1 vector of realized asset returns

I use big R and big W here to emphasize that they are vectors, like (\([r^{RF},r^{MKT},..]\)), (\([w^{RF},w^{MKT},..]\)),

I use litlle \(r_p\) becasue the return on a portfolio is just a scalar

For example:

This below is the vector of return realization for a particular date

Data.loc['1963-02']

| RF | MKT | USA30yearGovBond | EmergingMarkets | WorldxUSA | WorldxUSAGovBond | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 1963-02-28 | 0.0023 | -0.0215 | -0.001878 | 0.098222 | -0.002773 | NaN |

Since the return on a portfolio is a weighted sum of the returns on the securities, we need to determine how the distribution of this sum of r.v. (\(R_p\)) is related to the orignal distribution of eah r.v. (the individual securities returns \(R_j\), \(j=1...N\)).

The analysis of portfolio risk becomes much simpler by assuming that return distributions are normal.

This means we only need to worry about mean and variance (even if we care about these really bad tail events)

# lets start by constructing an equal-weighted portfolio

W=np.ones(6)/6

W.shape

# W is a 6 by 1 matrix

(6,)

np.sum(W)

0.9999999999999999

Data.loc['9/2008']

# R is a 1 by 6 matrix

| RF | MKT | USA30yearGovBond | EmergingMarkets | WorldxUSA | WorldxUSAGovBond | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2008-09-30 | 0.0015 | -0.0909 | 0.023693 | -0.174897 | -0.144244 | -0.031262 |

Data.loc['9/2008'] @ W

Date

2008-09-30 -0.069352

dtype: float64

What do we do to construct the returns for all the months?

Data.shape

(647, 6)

Rp=Data @ W

Rp

Date

1963-02-28 NaN

1963-03-31 0.009196

1963-04-30 -0.015689

1963-05-31 0.002154

1963-06-30 -0.012909

...

2016-08-31 0.002242

2016-09-30 0.003725

2016-10-31 -0.021774

2016-11-30 -0.024827

2016-12-31 0.004597

Length: 647, dtype: float64

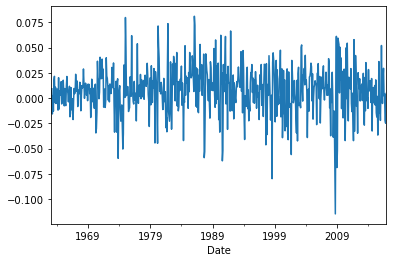

Rp.plot()

<AxesSubplot:xlabel='Date'>

Rp.mean()

0.007367453311403502

7.3. Portfolio Expected returns#

The expected return of a portfolio is the portfolio weighted average of the expected returns of the individual assets.

Can you use the definition of expected values we learn in notebook 3 to verify that this is correct?

Lets compute for our EW portfolio:

# To make sure we do the matrix multiplication correctly, it is good to see the shape of matrix first

print(W.shape)

print(Data.mean().shape)

(6,)

(6,)

# We use transpose function `T` to transpose W to a 1 by 6 matrix

W.T @ Data.mean()

0.007376761284897114

It should be true that taking the sample mean of our portfolio return realizations should give the same answer

(Data @ W).mean()

0.007367453311403502

or more directly

Rp.mean()

0.007367453311403502

7.4. Portfolio Variance#

Empirically the easiest way to compute the variance of a portfolio is to simply take the variance of the portfolio.

This returns to us the Realized variance of the portfolio in the sample

Rp.var()

0.000546192756487486

#or also

(Data @ W).var()

0.000546192756487486

When think about optimal portfolio construction is useful to have a way to go from the variance/covariances of the individual assets to variance of the portfolio

Two asset case:

where we used that \(Var(x)=Cov(x,x)\)

We then distribute the terms

This yields the classic formula

N-asset case

From the “term distribution” above it is intuitive what the N asset case would look like

For a portfolio of 50 assets, this expression has 50 variance terms and 2450 covariance terms!

We can write

where \(Cov(R)\) is the N by N variance covariance matrix of the assets and W is the vector of weights

An aside

Why is this?

Where we used that covariance is a linear operator(can take constants out of it, one at a time) and that it is symmetric(cov(x,y)=cov(y,x)), so the covariance is a symmetic matrix X’=X.

print(W.shape)

print(Data.cov().shape)

(6,)

(6, 6)

Data.cov()

| RF | MKT | USA30yearGovBond | EmergingMarkets | WorldxUSA | WorldxUSAGovBond | |

|---|---|---|---|---|---|---|

| RF | 6.942408e-06 | -0.000002 | 0.000003 | -0.000003 | 1.864051e-09 | 0.000004 |

| MKT | -2.377807e-06 | 0.001936 | 0.000104 | 0.001280 | 1.254553e-03 | 0.000182 |

| USA30yearGovBond | 3.048525e-06 | 0.000104 | 0.001226 | -0.000211 | -1.662154e-05 | 0.000264 |

| EmergingMarkets | -2.911724e-06 | 0.001280 | -0.000211 | 0.003544 | 1.650762e-03 | 0.000243 |

| WorldxUSA | 1.864051e-09 | 0.001255 | -0.000017 | 0.001651 | 2.174723e-03 | 0.000419 |

| WorldxUSAGovBond | 3.905048e-06 | 0.000182 | 0.000264 | 0.000243 | 4.191618e-04 | 0.000407 |

W @ Data.cov() @ W

0.0005455164562658994

We can check that this vector notation deliver the same as the double sum by using two for loops

cov=Data.cov()

covariance_sum=0 #initiate the sum at zero

for i in cov.index: # loop across all assets

for j in cov.columns:

i_pos=cov.index.get_loc(i) # this gets the position of the particular asset so we can locate the proper posiiton on the vector

j_pos=cov.columns.get_loc(j) # same thing, but for the other asset in the double sum

covariance_sum=covariance_sum+cov.loc[i,j]*W[i_pos]*W[j_pos]

covariance_sum

0.0005455164562658997

to get the volatility, i.e. , standard deviation:

(W.T@ Data.cov() @ W)**0.5

0.023356293718522624

Again, as we did before, the sample variance of the portfolio return realizations we constructed above should exactly match this:

Rp.std()

0.02337076713519447

Takeways

To compute the in sample variance of a portfolio you have two options

Compute the time-series the portfolio returns. This will give you one time-series whch you can simply compute the variance (“.var()” method

You can estimate the covariance matrix across assets using .cov() method and apply the quadratic formula “W @ Data.cov() @ W”

They are identical approaches and produce the same result.

Option 2 is easier and more intuitive , but option 1 is important to understand portfolio maximization which we will do soon

A comment on sample moments vs populational moments

We care about the population variance, i.e. what is the true variance of these assets going forward

We use the realized variance to the extent it help us estimate this.

Just like with average returns and expected returns

The key assumption, which tends to be ok over long time-peridos (say acorss years) is that the volatility is kind of stable, so we use the overall variance to gauge what the population is.

We will later discuss methods that deal with time-variation in these moments, but for now lets think as the population moments being constant

dealing wiht the risk-free rate

Again the risk-free rate is different, becasue as we discussed variation in the risk-free rate directly tracks what people expect to get from investing in the risk-free asset in different points in time, and not risk, so the formal way to think about it is what people call the Law of interated expectations

So the overal variance of a series is the sum of the vairance of what people expected at a point in time and the average value of the variance of the asset at a given point in time

For a risky asset, we think that there is very little variation in \(E_t[R]\) so the overall variance is all risk.

For a risk-less asset, there is zero risk, so the second term is zero, and all the variantion of the asset is about variation in these expectations.

This means that is wrong to add the risk-free rate when you do variance calculations because you are attributing to risk, which is variation in what people expected to earn (and that is not risk)

Diversification

A key concept in investing is diversification

The famous: “don’t put all your eggs in one basket” advice

There are potential benefits of diversifcation for an investor when there are assets that are imperfecly correlated with the investor portfolio

So lets look at this from the vantage point of a US investors that is fully invested in the US equity market portfolio and is considering the benefits of investing in other world equity markets

# here is the co-movement across the asset

Data[['MKT','WorldxUSA']].corr()

| MKT | WorldxUSA | |

|---|---|---|

| MKT | 1.000000 | 0.611369 |

| WorldxUSA | 0.611369 | 1.000000 |

What is noteworthy about this correlation matrix?

Are there any benefits of diversification?

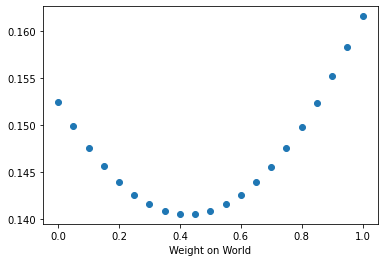

Lets compute how the variance of the investor portfolio varies as she varies her portfolio weight on the world market

w=np.arange(0,1.05,0.05)

w

array([0. , 0.05, 0.1 , 0.15, 0.2 , 0.25, 0.3 , 0.35, 0.4 , 0.45, 0.5 ,

0.55, 0.6 , 0.65, 0.7 , 0.75, 0.8 , 0.85, 0.9 , 0.95, 1. ])

D=Data.loc[:,['MKT','WorldxUSA']]

UsW=[]

# w here is a vector of weights on the US MKT and 1-w is the the weight on the international market

w=np.arange(0,1.05,0.05)

for x in w:

W=np.array([x,1-x])

# save the weight on the world market as the first element of UsW

# save the vol of the investor's portfolio as the second element of UsW

#UsW.append([1-x,((W.T @ D.cov() @ W)**0.5)*12**0.5])

Rp=D@ W

UsW.append([x,1-x,Rp.std()*12**0.5])

UsW=np.array(UsW)

# The first column of UsW is the weights on the US market

print(UsW[:,0])

# The second column of UsW is the weights on the World market

print(UsW[:,1])

# The third column of UsW is the vol of the portfolio

print(UsW[:,2])

[0. 0.05 0.1 0.15 0.2 0.25 0.3 0.35 0.4 0.45 0.5 0.55 0.6 0.65

0.7 0.75 0.8 0.85 0.9 0.95 1. ]

[1. 0.95 0.9 0.85 0.8 0.75 0.7 0.65 0.6 0.55 0.5 0.45 0.4 0.35

0.3 0.25 0.2 0.15 0.1 0.05 0. ]

[0.16154465 0.15824199 0.15517892 0.15236987 0.14982914 0.14757059

0.14560735 0.1439515 0.14261376 0.14160313 0.14092665 0.14058915

0.14059308 0.14093839 0.1416226 0.14264082 0.14398597 0.145649

0.14761916 0.14988433 0.15243138]

# Make a sacatter plot

plt.scatter(UsW[:,1],UsW[:,2])

plt.xlabel('Weight on World')

#plt.ylim([0.04,0.05])

plt.show()

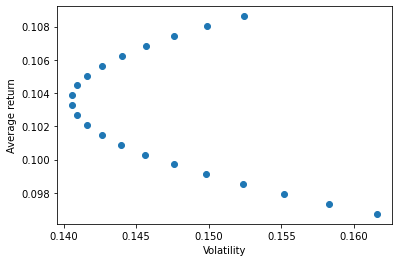

We can also look at the investment frontier that such an investor faces: How her expected returns change with the variance

Lets also look at annualized quantities for more intution

D.mean()*12

MKT 0.108621

WorldxUSA 0.096725

dtype: float64

D.std()*12**0.5

MKT 0.152431

WorldxUSA 0.161545

dtype: float64

UsW=[]

w=np.arange(0,1.05,0.05)

for x in w:

W=np.array([x,1-x])

# save the weight on the world market as the first element of UsW

# save the annulized vol of the portfolio as the second element of UsW

# save the annulized expected return of the portfolio as the third element of UsW

UsW.append([1-x,(W.T @ D.cov() @ W*12)**0.5,W.T @ np.array(D.mean())*12])

UsW=np.array(UsW)

# UsW[:,1], the annulized vol of the portfolio

# UsW[:,2], the annulized expected return of the portfolio

plt.scatter(UsW[:,1],UsW[:,2])

plt.xlabel('Volatility')

plt.ylabel('Average return')

plt.show()

Can you tell which extreme dot corresponds to each asset?

How can you find out easily?

D.mean()*12

MKT 0.108621

WorldxUSA 0.096725

dtype: float64

D.std()*12**0.5

MKT 0.152431

WorldxUSA 0.161545

dtype: float64

For the world investors, clearly they can benefit of holding a bit of the US market-and this does not depend on the preferences for risk as they can get higher returns and lower volatility through diversification

If you are a US investor and you are comfortable with the US market volatlity, why would you ever invest in an asset of lower expected return?

Why might the US investor want to invest in the world market even if if has a lower expected return and higher variance?