The Capital Allocation Line

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

%matplotlib inline

url="https://raw.githubusercontent.com/amoreira2/Lectures/main/assets/data/GlobalFinMonthly.csv"

Data = pd.read_csv(url,na_values=-99)

Data['Date']=pd.to_datetime(Data['Date'])

Data=Data.set_index(['Date'])

df=Data[['RF','MKT']].copy()

Data.info()

<class 'pandas.core.frame.DataFrame'>

DatetimeIndex: 647 entries, 1963-02-28 to 2016-12-31

Data columns (total 6 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 RF 647 non-null float64

1 MKT 647 non-null float64

2 USA30yearGovBond 647 non-null float64

3 EmergingMarkets 647 non-null float64

4 WorldxUSA 647 non-null float64

5 WorldxUSAGovBond 646 non-null float64

dtypes: float64(6)

memory usage: 35.4 KB

8. The Capital Allocation Line#

So far we looked at an investor that is fully invested across risky assets

In this case, the only way that an investor can change the risk profile of her portfolio is by changing the relative weights across the risky assets

In practice investors can invest in the risk-free asset, which has zero volatility.

This means that they can potentially derisk their portfolio by keeping the relative weights across assets constant and simply invest more in the risk-free asset

So we will now work with excess returns and the risk-free rate, separating cleaning the risk-free component of these risky asset returns

Empirically this separation of risky returns from the risk-free cleanly separate what needs estimating (average excess returns of risky assets and their covariances) from the level of the risk-free rate at a given point in time which is observable

Constructing excess returns

#Try ommiting the axis paraemtner and see what you get. What happened?

Re=(Data[['MKT','WorldxUSA']]).subtract(Data['RF'],axis='index')

Re.tail()

| MKT | WorldxUSA | |

|---|---|---|

| Date | ||

| 2016-08-31 | 0.0050 | 0.000638 |

| 2016-09-30 | 0.0025 | 0.012536 |

| 2016-10-31 | -0.0202 | -0.020583 |

| 2016-11-30 | 0.0486 | -0.019898 |

| 2016-12-31 | 0.0182 | 0.034083 |

note: axis parameters tells along whcih axes the subtraction occurs, i.e. #along which dimension python matches both datasets

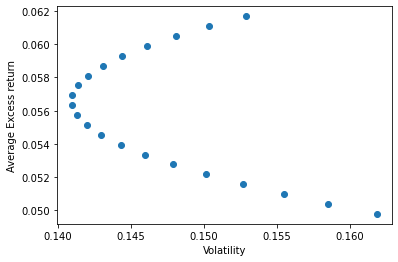

UsW=[]

w=np.arange(0,1.05,0.05)

for x in w:

#[US weight, world weight]

W=np.array([x,1-x])

#[World weight, Annualized volatility, annualized average returns]

UsW.append([1-x,(W.T @ Re.cov() @ W*12)**0.5,W.T @ np.array(Re.mean())*12])

UsW=np.array(UsW)

# annualized volatility, annualized average return

plt.scatter(UsW[:,1],UsW[:,2])

plt.xlabel('Volatility')

plt.ylabel('Average Excess return')

plt.show()

Adding the Risk-free Rate

x: pins down vector of risky weights (x in the US market, 1-x in international market)

y: determines allocation between risk-free and risky-portfolio (y in the riskfree and 1-y on the risky portfolio)

Note that the expected return term is +rf instead of +rf*y because we are using excess return instead of return. To better understand, we write out the expected return in the following way where \(R_W\) below is the return on the risky portfolio

\( \begin{align} r_p&=y\times R_f + (1-y) \times R_W \\ &= y \times R_f + (1-y) \times E[(R_W-R_f)] + (1-y) \times R_f \\ &= (1-y) \times (R_W-R_f)] + R_f \\ &=(1-y) \times R_W^e + R_f \end{align} \)

where \(R^e_W\) is the excess return on the risky portolio. $

Thus we can write:

\begin{align} E[r_p]&=E[(1-y) \times R_W^e + R_f]\ E[r_p]&=(1-y) \times E[R_W^e] + R_f \end{align}

The math for the variance of the portfolio is particular case of what we learned last chapter

\( \begin{align} Var[r_p]&=Var[(1-y) \times R_W^e + R_f] \\ Var[r_p]&=Var[(1-y) \times R_W^e] \\ &= (1-y)^2 Var[R_W^e] \end{align} \)

And the volatility (also called standard deviation)

\( \begin{align} STD[r_p]&=\sqrt{Var[r_p]}\\ &=\sqrt{Var[(1-y) \times R_W^e + R_f]} \\ &=\sqrt{Var[(1-y) \times R_W^e]} \\ &= \sqrt{(1-y)^2 Var[R_W^e]}\\ &= {(1-y)}{ STD[R_W^e]} \end{align} \)

Lets start by combining one asset, say the US market with the risk-free rate using different weights on the risk-free rate and this particular risk portfolio

Y=np.arange(0,1.1,0.1)

print(Y)

# choosing some risk-free rate

rf=(1/100)/12

# I am settign to 1% per year. Divide by 100 to put in percent as the return data

# and divided by 12 to make it monthly as the return data

[0. 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1. ]

We know compute the averagereturn and the population volatility/variance for each of the portfolios associated with the weights in \(y\)

UsW=[]

for y in Y:

varW=Re.var().iloc[0]

# variance of final portfolio since xf is the weight on the risk-free rate

# so 1-xf is the weight on the risky asset

var=(1-y)**2*(varW)

#expected excess return of risky portfolio

erW=Re.mean().iloc[0]

# expected return of finanl portfolio

er=erW*(1-y)+rf

UsW.append([y,0,var**0.5,er])

UsW

[[0.0, 0, 0.04413587129386619, 0.005973673364245237],

[0.1, 0, 0.03972228416447957, 0.005459639361154046],

[0.2, 0, 0.035308697035092956, 0.004945605358062857],

[0.30000000000000004, 0, 0.03089510990570633, 0.004431571354971665],

[0.4, 0, 0.026481522776319714, 0.003917537351880475],

[0.5, 0, 0.022067935646933094, 0.003403503348789285],

[0.6000000000000001, 0, 0.01765434851754647, 0.0028894693456980943],

[0.7000000000000001, 0, 0.013240761388159853, 0.002375435342606904],

[0.8, 0, 0.008827174258773236, 0.0018614013395157137],

[0.9, 0, 0.004413587129386618, 0.0013473673364245236],

[1.0, 0, 0.0, 0.0008333333333333334]]

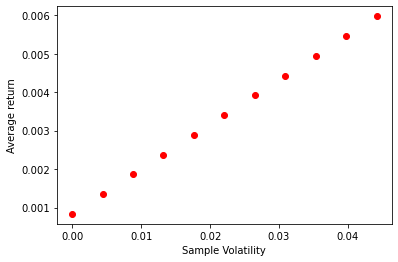

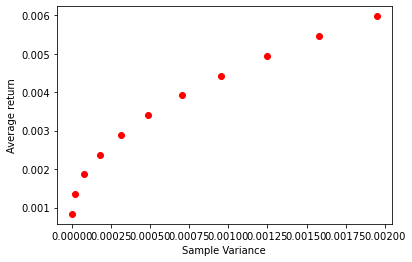

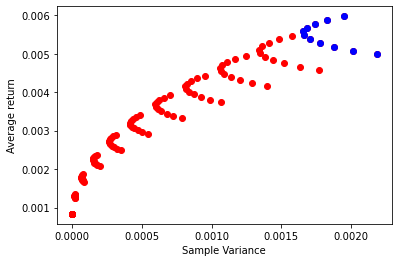

Lets now plot the resulting average return against sample volatility and variance

UsW=np.array(UsW)

# 2 is selecting the column with the volatility and 3 is selecting the column with the average excess return

fig, ax = plt.subplots()

ax.scatter(UsW[:,2],UsW[:,3],color='red')

# below I am using the boolean indexing UsW[:,0]==0 to select only portfolio with zero weight on the risk-free asset and plotting it in blue.

# recall that column 0 has the position on the risk-free asset

plt.xlabel('Sample Volatility')

plt.ylabel('Average return')

fig, ax = plt.subplots()

ax.scatter(UsW[:,2]**2,UsW[:,3],color='red')

# below I am using the boolean indexing UsW[:,0]==0 to select only portfolio with zero weight on the risk-free asset and plotting it in blue.

# recall that column 0 has the position on the risk-free asset

plt.xlabel('Sample Variance')

plt.ylabel('Average return')

Text(0, 0.5, 'Average return')

You see clearly the relationship predicted by the formulas above

The Investment frontier in ExpectedReturn-volatility space is linear because as you increase your loading on the risky asset, both expected return and volatility grow proportionally

In variance space you see that variance grows faster—since it it standard deviation to the power of 2.

So as you increase the loading o the risky asset, variance grows intially slower, and the much faster, hence the kind of concave increase in average returns

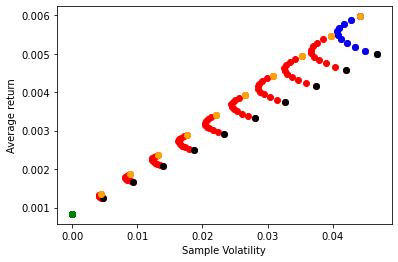

Now lets make this interesting

We will now at the same time vary the relative weight on the risk-free asset and the risky portfolio and change the coposition of the risky portoflio by changing the relative weight on the us market vs international market

We will accomplish this with the following double for loop

X=np.arange(0,1.1,0.1)

Y=np.arange(0,1.1,0.1)

UsW=[]

for y in Y:

for x in X:

#construct risky portfolio

W=np.array([x,1-x])

#variance of risky portfolio

varW=W.T @ Re.cov() @ W

# variance of final portfolio

var=(1-y)**2*(varW)

#expected excess return of risky portfolio

erW=(W.T @ np.array(Re.mean()))

# expected return of finanl portfolio

er=(W.T @ np.array(Re.mean()))*(1-y)+rf

UsW.append([y,1-x,var**0.5,er])

UsW=np.array(UsW)

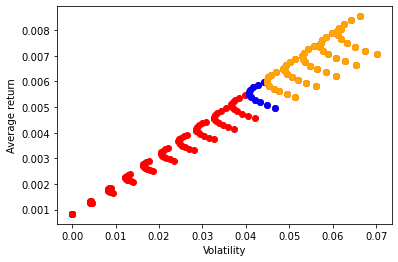

fig, ax = plt.subplots()

# 2 is selecting the column with the volatility and 3 is selecting the column with the average excess return

ax.scatter(UsW[:,2],UsW[:,3],color='red')

# below I am using the boolean indexing UsW[:,0]==0 to select only portfolio with zero weight on the risk-free asset and plotting it in blue.

# recall that column 0 has the position on the risk-free asset

ax.scatter(UsW[UsW[:,0]==0,2],UsW[UsW[:,0]==0,3],color='blue')

# risk position concentrated on the world market

ax.scatter(UsW[UsW[:,1]==1,2],UsW[UsW[:,1]==1,3],color='black')

#risk position concentratel on us market

ax.scatter(UsW[UsW[:,1]==0,2],UsW[UsW[:,1]==0,3],color='orange')

# fully invested on therisk-free asset

ax.scatter(UsW[UsW[:,0]==1,2],UsW[UsW[:,0]==1,3],color='green')

ax.set_xlabel('Sample Volatility')

ax.set_ylabel('Average return')

Text(0, 0.5, 'Average return')

What do you see above?

In orange the portfolios where the risky portfolio is exactly the US market, but has different weights on the risk-free asset

In black you portfolio comprised of the international market but with different weights on the risk-free asset

In blue you the portfolios that have exaclty zero weight on the risk-free rate, but different compositions of the risky portfolio

in green you have the portfolio that has weight of 1 on the risk-free rate

In red you have all the other portfolios which have varying risky portfolio compositions and varying weights combining this risky portfolio with the risk-free rate

How to read this plot? Say you want a portoflio with at most 0.03 monthly volatility. What does this plot tell you?

Which units are this? Can you convert it to annual units? How?

what is noteworthy about the shape of these different curves?

# in "variance space"

plt.scatter(UsW[:,2]**2,UsW[:,3],color='red')

plt.scatter(UsW[UsW[:,0]==0,2]**2,UsW[UsW[:,0]==0,3],color='blue')

plt.xlabel('Sample Variance')

plt.ylabel('Average return')

plt.show()

It is clear that someone that would like a lower risk profile can achieve this objective through the use of the risk-free asset without impacting expected returns as much

What about investors that would like to take more risk, can they benefit of the risk-free asset?

yes, if they can borrow at the risk-free rate

It means that you agree to pays some rate of return in exchange for getting a dollar today to invest.

So you have a negative weight on the risk-free rate.

Say if you have a weight of -0.5 on the risk-free rate it means that for each dollar that you have in your portfolio you are borrowing 0.5 and investing in the risky portolio 1.5 dollars

We say that you are are leveraged because your assets side (1.5 dollars) worth more than your networth (1 dollar) because you are borrowing the 0.5 dollars.

So lets see hat that looks like by considering negative weights on the risk-free asset (y<0)

UsW=[]

X=np.arange(0,1.1,0.1)

Y=np.arange(0,1.1,0.1)

for y in Y:

for x in X:

W=np.array([x,1-x])

UsW.append([y,1-x,(1-y)*(W.T @ Re.cov() @ W)**0.5,(W.T @ np.array(Re.mean()))*(1-y)+rf])

X=np.arange(0,1.1,0.1)

Y=np.arange(-0.5,0,0.1)

for y in Y:

for x in X:

W=np.array([x,1-x])

UsW.append([y,1-x,(1-y)*(W.T @ Re.cov() @ W)**0.5,(W.T @ np.array(Re.mean()))*(1-y)+rf])

UsW=np.array(UsW)

plt.scatter(UsW[:,2],UsW[:,3],color='red')

plt.scatter(UsW[UsW[:,0]==0,2],UsW[UsW[:,0]==0,3],color='blue')

# Below I am usign boolean index to select portfolio that are short the risk-free asset (i.e. they are levered) and I a plotting them in orange

plt.scatter(UsW[UsW[:,0]<0,2],UsW[UsW[:,0]<0,3],color='orange')

plt.xlabel('Volatility')

plt.ylabel('Average return')

plt.show()

What is the intepretation of a negative \(x_f\)? Doe it make sense?

What is the interpretation of a \(x_f\) above 1? Does it make sense?

Is the investors likely to be able to borrow at the risk-free rate?