Returns

Contents

# load libraries used in this notebook

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

%matplotlib inline

6.1. Returns#

Define what are returns, which is the key variable of analysis in finance (and this class).

Discuss how to think them of random variables

Discuss the key statistical “moments” that we will use to capture their behavior (i.e. how risky they are)

Discuss the normal distribution specifically

Define the concept of Excess returns

What is a return?

Lets say you paid \(𝑃_𝑡\) in date \(t\) for an asset

In date \(t+1\) the price is \(𝑃_{𝑡+1}\) and you earn some dividend as well \(𝐷_{𝑡+1}\)

Then we say that your return is

It is the gain you made (everything that you go in date t+1), divided by how much you put in ( the price of the asset)

Our data set Data contains these returns of buying an asset, earning any distributed dividends during the month, and then selling in the end of the month.

This definition works for ANY asset that has a postive price

This is the case for stocks, bonds, commodities, crypto, most real assets

The return simply normalizes the “dollar gain” by the cost of the asset.

This makes sense because price levels are arbitrary and non-stationay, so we can’t really do statistics over prices.

Lets start by loadding some return data.

Below we load a data set that has monthly reutrn data on six different assets (in fact portfolios of assets, but we will get to portfolios later)

For now we will only use one of the assets which is the United States equity market portfolios, labeled “MKT”

#Online address of the file

url="https://raw.githubusercontent.com/amoreira2/Lectures/main/assets/data/GlobalFinMonthly.csv"

# load it using pandas

# the field "na_values=-99" is telling the function that numbers "-99" are code for a missing value

# THIS VARIES DATASET by DATASET!!!!

# In this case I know that to be the case

Data = pd.read_csv(url,na_values=-99)

# here we tell to pandas to interpret the DATE column as date type

Data['Date']=pd.to_datetime(Data['Date'])

# set the date as the index

Data=Data.set_index(['Date'])

#eep only the Market column

Data=Data[['MKT']]

# look at the first few observations

Data.head()

| MKT | |

|---|---|

| Date | |

| 1963-02-28 | -0.0215 |

| 1963-03-31 | 0.0331 |

| 1963-04-30 | 0.0476 |

| 1963-05-31 | 0.0200 |

| 1963-06-30 | -0.0177 |

Comments

“.datetime” is pretty good at indentifying how to interpret the data format, but you always have to check if it interpreted correct by inspecting it

If it does not you will have to add the format manually as we discuss in section 6.7

6.1.1. How Returns are distributed?#

Lets start by looking at the moments of the distribution of returns for the “market” portfolio

This is really the portfolio of all the stocks listed in the United States

Mean and Standard Deviation

# looking at it's mean

Data['MKT'].mean()*100

# what does this number mean?

0.9051777434312205

If I have invested 1 dollar in a month t, On average I would have XXXXX in month t+1 in the sample

# looking at the market standard deviation

Data['MKT'].std()*100

# what does this number mean?

4.400314890674189

If had all my wealth, say 100k usd invested in the market in month t, then standard deviation of my wealth in date t+1 was XXXX in the sample

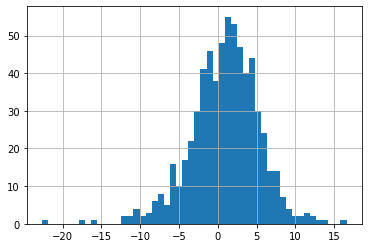

Histogram

This plots the frequency of return realization on each bin

it gives a sense of the HISTORICAL DISTRIBUTION of reuturns

(Data.MKT*100).hist(bins=50)

<matplotlib.axes._subplots.AxesSubplot at 0x272130fc760>

List two/three features that are noteworthy about this plot?

It is centered around the XXX

It has a XXX shape

The width of the part of the distribution that has the most realizations is captured by the XXX

The most extreme observation is XXX standard deviations below the mean

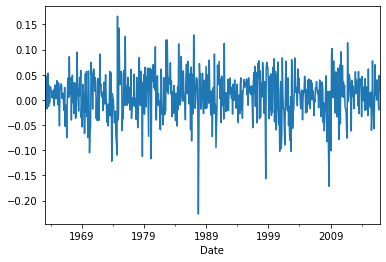

Time-Series PLOT

The time-series plot shows us in each date what was the return on the asset in each month in the sample

Data.MKT.plot()

<matplotlib.axes._subplots.AxesSubplot at 0x272131fde20>

6.1.2. A quick review of randomness and probability distributions#

Random variables

We think of the return realization, the numbers plotted above, as a random variable, i.e., a variable that we are uncertain about it’s realization.

Random variable is any thing that we don’t known

Outcome of dice throw, value of stock market in the end of the day, …

For example a dice outcome is a random variables with the following possible outcomes: (1,2,3,4,5,6)

This uncertainty is fully described by the probability distribution associated with the random variable.

What is a probability distribution?

A probability distribution describes the probability that each outcome is realized.

It can be described by a Probability Density Function (pdf).

For example, the pdf of a dice is (1,1/6) ,(2,1/6), (3,1/6), (4,1/6), (5,1/6), (6,1/6)

It can also be described by the Cumulative Density Function(cdf)

For a example, the cdf of a dice is (1,1/6) ,(2,2/6), (3,3/6), (4,4/6), (5,5/6), (6,6/6)

A pdf or cdf fully describes the uncertainty we have with respect to a particular random variable

Random variable is any thing that we don’t known

Outcome of dice throw, value of stock market in the end of the day, …

Moments

One way to summarize the information in a probability distribution is the moments

Mean or expected value \(E[𝑥]=∑𝑥_𝑖 𝑃𝑟𝑜𝑏(𝑥=𝑥_𝑖 )\) 𝑜𝑟 \(∫𝑥𝑓(𝑥)𝑑𝑥\) often uses µ as symbol

The Variance \(𝑣𝑎𝑟(𝑥)= ∑(𝑥_𝑖−𝐸[𝑥])^2 𝑃𝑟𝑜𝑏(𝑥=𝑥_𝑖 )\) 𝑜𝑟 \(∫(𝑥_𝑖−𝐸[𝑥])^2 𝑓(𝑥)𝑑𝑥 \)

(Standard deviation \(std(x)= \sqrt{𝑣𝑎𝑟(𝑥)}\))

measures average variability around the mean across successive drawings of x.

often use 𝜎 as a symbol for standard deviation and \(𝜎^2\) for variance

Skewness \(𝑠𝑘𝑒𝑤(𝑥)= ∑(𝑥_𝑖−𝐸[𝑥])^3 𝑃𝑟𝑜𝑏(𝑥=𝑥_𝑖 )\) 𝑜𝑟 \(∫(𝑥_𝑖−𝐸[𝑥])^3 𝑓(𝑥)𝑑𝑥\)

Measures asymmetry in the distribution

Kurtosis \(𝑘𝑢𝑟𝑡(𝑥)= ∑(𝑥_𝑖−𝐸[𝑥])^4 𝑃𝑟𝑜𝑏(𝑥=𝑥_𝑖 )\) 𝑜𝑟 \(∫(𝑥_𝑖−𝐸[𝑥])^4 𝑓(𝑥)𝑑𝑥\)

Measures how fat the tails are

Higher order moments…

Observation: with enough moments you can represent any distribution, but in practice you only need a few

for example for the normal distribution you only need the first two: Expected value and variance!

Sample moments

Historical distrivution is NOT the TRUE distribution that we care about

Moments are never truly known in real data

Must be always estimated from some historical realization

We would like to know the “population” moments, i.e., the moments that describe how the population is generated

For example to get the expected return on the market, i.e. it’s population mean, we use the sample mean

where T is the sample size

we also call the sample average

Note that each observation in the sample is weighted equally by the frequency of the realized observations

For population means they are weighted by the expected frequency, i.e. the probabilities

We say that the sample average is an ESTIMATOR for the true expected value

6.1.3. The Normal distribution#

Most of what we do does not depend on the assumption of normality

But normal distributions are very useful in statistical tests

And they are also not a bad approximation for return data at low frequency (monthly/year)

Probability that any random draw form a Normal distribution random variable \(\tilde{x}\) is within \(n=1\) standard deviation from the mean is 0.6826

\(n=2,Prob(\cdot)=0.9550\)

it is convenient to to transform a normally distributed r.v. into units of standard deviations from it’s mean

This follows the “standard” normal distribution, which has mean 0 and and standard deviation 1

can you show that is indeed the case that z has mean zero and standard devaiton 1?

This means that the normal distribution is completely characterized by it’s first two moments

This means that the investment problem is much more tractable too!

Only two moments to worry about:

The expected return of the portfolio

it’s variance

The probability of really bad tail events will follow immediately from these two!

How to evaluate whether returns are normal?

The standard approach is to look at higher moments.

Because the normal is entired descibed by the first two moments, looking at these higher moments can give us a clue if that is really true for the data at hand.

Here are a few:

Skewness

Kurtosis

Frequency of extreme return realizations

3 sigma events should almost never happen for a normal random variable

once every 500 periods

\[PROB(|R-E{R}|>3\sigma(R))\]

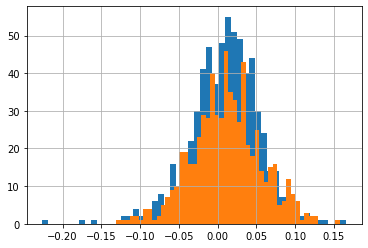

A nice thing to do is to simulate data generated by a normal with same sample mean and standard deviation as the normal, and compare it with the actual data

# get you estimators

mu=Data.MKT.mean()

std=Data.MKT.std()

# sample sze

T=Data.MKT.count()

# simulate from a nomral distributiion wiht same mean, standard devation and sample size

X=pd.Series(np.random.normal(mu,std,T))

Data.MKT.hist(bins=50)

X.hist(bins=50)

<AxesSubplot:>

what happens if we increase the mean?

what happens if we increase the standard deviation?

for the same standard mean and standard deviation what do you notice when you compare the real data and the simulated data?

This is only one simulation! Everytime you run the cell again it will draw a new set of realizations. Try it!

Lets look at higher moments of our data and the normal simulation

Skewness

What is the skewness of a normal distrbiution?

Does that hold for the simulation? Why not?

[Data.MKT.skew(), X.skew()]

[-0.5053783766354294, -0.11814774419178325]

Kurtosis

What is the Kurtosis of a normal distribution?

Does that hold in our simulation? Why not?

[Data.MKT.kurtosis(),X.kurtosis()]

[1.9881305187934846, 0.2796480959378349]

Number of Extreme realizations

To evaluate how close a distribution is to the normal distribution we typically look at how many observations in the real data are below a certain number of standard devations of the mean

X=pd.Series(np.random.normal(mu,std,T))

threshold=4

# counts for the real data

A=((Data.MKT-Data.MKT.mean())<-threshold*Data.MKT.std())

# counts for simulated data (which we know it is normal!)

B=((X-X.mean())<-threshold*X.std())

[A.sum(),B.sum()]

[2, 0]

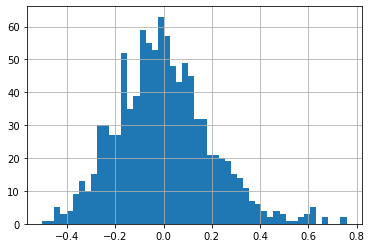

Simulating the Simulation

As we saw above, each simulation is naturally different.

Like our sample, it is simply one draw of the distribution

-How often does the higher moments come the way that they do in our sample?

# I am initializing an array with 1000 zero entries

kurt=np.zeros(1000)

#now each step of the for loop I am drawing one realization of sample exactly as large as our sample

for i in range(0,1000):

X=pd.Series(np.random.normal(mu,std,T))

kurt[i]=X.kurtosis()

pd.Series(kurt).hist(bins=50)

<matplotlib.axes._subplots.AxesSubplot at 0x2721502f250>

If you compare this distribution with the kurtosis that we found on our data, what do you conclude?

Why we might care about deviations from normality?

Volatility and Variance

We know how to compute variance and what they are

where \(\overline{R_{MKT}}=\sum_{t=1}^T\frac{R_{MKT,t}}{T}\) is the sample mean.

So for each series we get a number. We oftern refer to the standard deviation as the “vol” or the volatility of an asset.

Variance and volatility have the same content, but volatility is in the same unit as returns, and not square returns, so it easier to have intuition about what it means.

For example, if the market has a vol of 20% per year, and if the market return is assumed to be normally distributed, I know that there is about a 2.5% probability that I will loose 40% of my investment by the end of the year!

But what risk should you care about? What stock should be risky for you?

The great insight from Harry Markowitz was to think of risk in terms of what the stock adds to your portfolio

Just like meat can be good for you if you are not eating any meat, it is terrible if you are eating a lot of it

What investors should care about is, just like eaters, their final diet. If a given stock brings a lot of what you already have, it will be bad for you, i.e., risky.

So volatility is a good gauge of risk at the portfolio level, because it is asking how your whole portfolio behaves, which you obvisoulsy should care about. If it goes down a lot, it means you cannot buy stuff!

But when thinking about a specific stock, it’s volatility means very little.

Unless your entire portfolio is just that stock, you don’t really need to bear the stock risk–if you have 1% in a stock and the stock drops to ZERO, that is only 1% in your portfolio, so at most you lose 1%. So whatever volatility this stock might have you SHOULD not perceive the stock as very risky for you.

As long, of course, your position in the stock remians small.

Note that if this stock would move together with other pieces of your portfolio then your calculation should be very different. If this stock goes to zero exactly when your other assets are also losing a lot of money, this will feel very risky trade.

The way to measure this degree of commonality between your portfolio and this particular stock is the covariance

#Lets reimport the data set and now keep the other assets

Data = pd.read_csv(url,na_values=-99)

Data['Date']=pd.to_datetime(Data['Date'])

Data=Data.set_index(['Date'])

Data.head()

| Date | RF | MKT | USA30yearGovBond | EmergingMarkets | WorldxUSA | WorldxUSAGovBond | |

|---|---|---|---|---|---|---|---|

| 0 | 1963-02-28 | 0.0023 | -0.0215 | -0.001878 | 0.098222 | -0.002773 | NaN |

| 1 | 1963-03-31 | 0.0023 | 0.0331 | 0.003342 | 0.014149 | 0.000371 | 0.001913 |

| 2 | 1963-04-30 | 0.0025 | 0.0476 | -0.001843 | -0.147055 | -0.003336 | 0.008002 |

| 3 | 1963-05-31 | 0.0024 | 0.0200 | -0.001807 | -0.012172 | -0.000186 | 0.004689 |

| 4 | 1963-06-30 | 0.0023 | -0.0177 | 0.001666 | -0.055699 | -0.011160 | 0.003139 |

The Covariance matrix of a set of stocks is the matrix where cell \((i,j)\) has the covariance between asset \(i\) and asset \(j\):

# here for two assets

Data[['MKT','WorldxUSA','USA30yearGovBond','WorldxUSA','WorldxUSAGovBond']].cov()

| MKT | WorldxUSA | USA30yearGovBond | WorldxUSA | WorldxUSAGovBond | |

|---|---|---|---|---|---|

| MKT | 0.001936 | 0.001255 | 0.000104 | 0.001255 | 0.000182 |

| WorldxUSA | 0.001255 | 0.002175 | -0.000017 | 0.002175 | 0.000419 |

| USA30yearGovBond | 0.000104 | -0.000017 | 0.001226 | -0.000017 | 0.000264 |

| WorldxUSA | 0.001255 | 0.002175 | -0.000017 | 0.002175 | 0.000419 |

| WorldxUSAGovBond | 0.000182 | 0.000419 | 0.000264 | 0.000419 | 0.000407 |

note that the diagonal cell \((i,i)\) has the covariance between asset \(i\) and asset \(i\), which is just the variance of asset \(i\)

Question: Why did I take out the risk-free rate when computing the variance?

Another way of looking at this is the correlation matrix, which normalizes the covariances by the volatility of each asset:

Data[['MKT','WorldxUSA','USA30yearGovBond','WorldxUSA','WorldxUSAGovBond']].corr()

| MKT | WorldxUSA | USA30yearGovBond | WorldxUSA | WorldxUSAGovBond | |

|---|---|---|---|---|---|

| MKT | 1.000000 | 0.611369 | 0.067779 | 0.611369 | 0.204491 |

| WorldxUSA | 0.611369 | 1.000000 | -0.010180 | 1.000000 | 0.444938 |

| USA30yearGovBond | 0.067779 | -0.010180 | 1.000000 | -0.010180 | 0.373123 |

| WorldxUSA | 0.611369 | 1.000000 | -0.010180 | 1.000000 | 0.444938 |

| WorldxUSAGovBond | 0.204491 | 0.444938 | 0.373123 | 0.444938 | 1.000000 |

What is noteworthy about these relationships?

What is safer for an US investor? US bond portfolio or World bond portfolio?

What is safer for an international investor? US bond portfolio or World bond portfolio?

6.1.4. Excess returns#

It is convenient to decompose the return earned in terms of what you earn due to

compensation for waiting (time-value of money)

compensation for bearing risk (risk premium)

To do the decomposition, we will do the following:

We first define an “excess return”: the return minus the risk-free rate

We typically use the returns of a 3-month treasury bill to measure \(R_f\)

So the excess return of the market is

\[R^e_{MKT}=R_{MKT}-R_f\]i.e. how much more I would get if I invested in the market instead of a short-term risk-free U.S. treasury bond

We call the Expected difference, the Risk-Premium

\[E[R_i^e]=E[R_i-R_f]\]It is how much more you expect to get by investing in asset \(i\) instead of the risk-free asset

When asset \(i\) is the total market portfolio of US equities, we call this, the Equity Risky Premium

The Equity Risky Premium

The expected difference in return earned by investing in the aggreagate stock market portfolio instead of the risk-free rate

One good estimate of it simply uses the sample mean

(Data.MKT-Data.RF).mean()*100

0.5140340030911901

What does this mean?

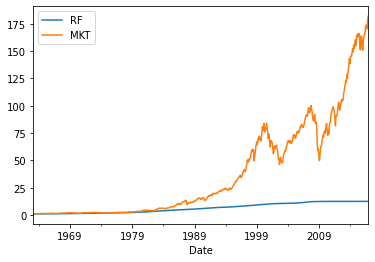

Lets look at how much money one would have if they had invested 1 dollar in the market and kept reinvesting until the end of our sample

lets then compare with an investment in the risk-free rate

(1+Data[['RF','MKT']]).cumprod().plot()

<matplotlib.axes._subplots.AxesSubplot at 0x272170afd30>

This means that someone that invested 1 dollar in the market in 63, would have 182 dollars today.

A tota return of 182/1-1=18,100%

If you invested in the risk-free rate you would have

12.5/1-1= 1,150% which is a bit above the inflation in this same period

(1+Data[['RF','MKT']]).cumprod().tail(1)

(1+Data[['RF','MKT']]).prod()

RF 12.472682

MKT 181.954557

dtype: float64

Why Excess returns are useful?

All asset returns have both the risk-free component in it and the risk-premium component.

The risk-free component is directly observed– for example in dollars it is convention to use the yield on the 3 month US goverment treasury bill

The average risk-free rate of the last 30 years tells you nothing about the risk-less rate today BECAUSE you can directly observe it. It is literally the rate of return that you get for sure if you buy a tbill and hold ultill maturity–and this rate of return is know in advance becasue we know the final price of the tbill.

The particular instrument that you use to measure the risk-free rate might vary depending on a variety of complicated considerations

Is it funded instrument vs not funded (bills vs swaps)

Acessible to everyone or only banks (bill vs fed funds)

Can you borrow at this rate (bills vs your broker lending rate)

But the important point is that at any given moment you know the true risk-free rate. There is no point in estimating it

Trading Interpretation

Excess reutrns have a nice trading interpretation.

For example the excess return on the market (portfolio) is

This is really a portfolio that has weights 1 on the market and -1 on the risk-free rate

This type of portfolio is very important

We call it a “self-financed portfolio” or “zero cost portfolio”

The key is you are not putting any capital in it because you borrow 1 dollar to invest 1 dollar in the market (or in any other assets)

Reality is a bit more complicated

we will discuss this later, but in practice you always have to put some capital on the trade

some investors don’t really need to put much like banks and dealers, but others like retail investors are asked to put much more.And often the amount of capital that you have to put on a “zero-cost” trade fluctuates with liquidity conditions (a lot during crises, not much during booms)

These portfolios are nevertheless super useful empirically to understand the data even if in the real world you cannot directly buy the zero cost portfolios without putting capital

Why is it that a broker dealer will ask you to put some capital to back the trade?

6.1.5. Sample averages vs Population Expectations#

How to go from the SAMPLE to the POPULATION distribution?

We are interested in the true distribution of an asset returns going forward

But we only have it’s historical behavior.

How do we extrapolate from it to the future?

We need a model!

In most of this class we will use a model where the distribution of excess returns is constant (does not vary over time).

under this assumption the sample mean of the asset excess return is a good estimator for the expected return of the asset going forward

under the assumption that investors expected the average, the standard deviaiton is a good measure of the asset risk, becasue it measures deviations from expectations

This however is not a good model for the risk-free rate!The risk-free rate obviously move over time!

Time-variation in the risk-free rate as all about time-variaiton in what investors expected to get from investign in the tbill and none of it as risk/deviations of expectation

why?

Becasue we know that investor know the tbill yield so they perfectly know what they will get from investing in the tbill–and that is the reason we call it risk-free rate!

Reality is a bit more complicated

This “constant premiuns” with time-varying risk-free rate allows us to go a long way.

But of course the data is more complicated!

you might be able to predict the excess returns of an asset and in this case, i.e. there is time time-variation in the return premium to hold the assey

In this case volatility will over-estimate the degree of risk, since part of the movement was not surprising to you– so it is not risk

certainly in the data there is some evidecne that we can predict excess returns a little bitbut by and large the constant premium assumption is a good approximation for an asset as the market portoflio

Obvioulsy not good a approximation for an assets that it’s riskness has changed– Evergrande bonds have a very different risk today vs 5 years ago!