3.4. Pandas#

3.4.1. Introduction#

import pandas as pd

%matplotlib inline

This lecture begins the material on pandas which is the library that allows us to work with data

To start, we will import the pandas package and give it the alias

pd, which is conventional practice.

There are two types of collections: Series, for a single variable, that is one columns with multiple rows, and a DataFrame, for multiple variables , that is multiple rows and columns

3.4.1.1. Series#

The first main pandas type we will introduce is called Series.

A Series is a single column of data, with row labels for each observation.

pandas refers to the row labels as the index of the Series.

Below, we create a Series which contains the Google Stock price every other year starting in 2005. ( This is made up!)

# this creates a lsit with the stock prices of google from 2005 to 2015

values = [5.6, 5.3, 4.3, 4.2, 5.8, 5.3, 4.6, 7.8, 9.1, 8., 5.7]

# this creates a list with the years from 2005 to 2015

years = list(range(2005, 2016, 1))

# this creates a pandas series with the stock prices of google from 2005 to 2015

Google = pd.Series(data=values, index=years, name="Google Stock Price")

# lets see what it looks like

Google

We can look at the index and values in our Series.

Google.index

Int64Index([1995, 1997, 1999, 2001, 2003, 2005, 2007, 2009, 2011, 2013, 2015], dtype='int64')

Google.values

array([5.6, 5.3, 4.3, 4.2, 5.8, 5.3, 4.6, 7.8, 9.1, 8. , 5.7])

3.4.1.1.1. What Can We Do with a Series object?#

.head and .tail

Often, our data will have many rows, and we won’t want to display it all at once.

The methods .head and .tail show rows at the beginning and end

of our Series, respectively.

Google.head()

1995 5.6

1997 5.3

1999 4.3

2001 4.2

2003 5.8

Name: Unemployment, dtype: float64

Google.tail()

2007 4.6

2009 7.8

2011 9.1

2013 8.0

2015 5.7

Name: Unemployment, dtype: float64

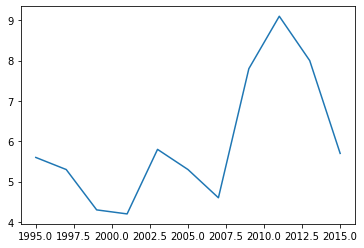

3.4.1.2. Basic Plotting#

We can also plot data using the .plot method.

Google.plot()

<AxesSubplot:>

Note

This is why we needed the

%matplotlib inline— it tells the notebook to display figures inside the notebook itself. Also, pandas has much greater visualization functionality than this, but we will study that later on.

3.4.1.3. Indexing#

Sometimes, we will want to select particular elements from a Series.

We can do this using .loc[index_items]; where index_items is

an item from the index, or a list of items in the index.

We will see this more in-depth in a coming lecture, but for now, we demonstrate how to select one or multiple elements of the Series.

Google.loc[2007]

4.3

Google.loc[[2008, 2010, 2015]]

2008 4.2

2010 5.3

2015 5.7

Name: Google Stock Price, dtype: float64

3.4.1.4. DataFrame#

A DataFrame is how pandas stores one or more columns of data.

We can think a DataFrames a multiple Series stacked side by side as columns.

This is similar to a sheet in an Excel workbook or a table in a SQL database.

In addition to row labels (an index), DataFrames also have column labels.

We refer to these column labels as the columns or column names.

Below, we create a DataFrame that contains the Stock price in the end of each year starting in 2005 for a few US tech stocks.

(This is made up)

# create dictionary with stock prices of google, apple, amazon, microsoft, and facebook

#

data = {

"Amazon": [5.9, 5.6, 4.4, 3.8, 5.8, 4.9, 4.3, 7.1, 8.3, 7.9, 5.7],

"Microsoft": [4.5, 4.3, 3.6, 4. , 5.7, 5.7, 4.9, 8.1, 8.7, 7.4, 5.1],

"Google": [5.3, 5.2, 4.2, 4. , 5.7, 5.2, 4.3, 7.6, 9.1, 7.4, 5.5],

"Facebook": [6.6, 6., 5.2, 4.6, 6.5, 5.5, 4.5, 8.6, 10.7, 8.5, 6.1],

"Apple": [5.6, 5.3, 4.3, 4.2, 5.8, 5.3, 4.6, 7.8, 9.1, 8., 5.7]

}

# create a pandas dataframe with the stock prices of google, apple, amazon, microsoft, and facebook

stock_prices = pd.DataFrame(data, index=years)

stock_prices

| Amazon | Microsoft | Apple | |||

|---|---|---|---|---|---|

| 2005 | 5.9 | 4.5 | 5.3 | 6.6 | 5.6 |

| 2006 | 5.6 | 4.3 | 5.2 | 6.0 | 5.3 |

| 2007 | 4.4 | 3.6 | 4.2 | 5.2 | 4.3 |

| 2008 | 3.8 | 4.0 | 4.0 | 4.6 | 4.2 |

| 2009 | 5.8 | 5.7 | 5.7 | 6.5 | 5.8 |

| 2010 | 4.9 | 5.7 | 5.2 | 5.5 | 5.3 |

| 2011 | 4.3 | 4.9 | 4.3 | 4.5 | 4.6 |

| 2012 | 7.1 | 8.1 | 7.6 | 8.6 | 7.8 |

| 2013 | 8.3 | 8.7 | 9.1 | 10.7 | 9.1 |

| 2014 | 7.9 | 7.4 | 7.4 | 8.5 | 8.0 |

| 2015 | 5.7 | 5.1 | 5.5 | 6.1 | 5.7 |

This is one way to create a dataframe

We can retrieve the index and the DataFrame values as we did with a Series.

stock_prices.index

Int64Index([2005, 2006, 2007, 2008, 2009, 2010, 2011, 2012, 2013, 2014, 2015], dtype='int64')

stock_prices.values

array([[ 5.9, 4.5, 5.3, 6.6, 5.6],

[ 5.6, 4.3, 5.2, 6. , 5.3],

[ 4.4, 3.6, 4.2, 5.2, 4.3],

[ 3.8, 4. , 4. , 4.6, 4.2],

[ 5.8, 5.7, 5.7, 6.5, 5.8],

[ 4.9, 5.7, 5.2, 5.5, 5.3],

[ 4.3, 4.9, 4.3, 4.5, 4.6],

[ 7.1, 8.1, 7.6, 8.6, 7.8],

[ 8.3, 8.7, 9.1, 10.7, 9.1],

[ 7.9, 7.4, 7.4, 8.5, 8. ],

[ 5.7, 5.1, 5.5, 6.1, 5.7]])

What Can We Do with a DataFrame?

A lot stuff!

This will be the main way we will work with data in Python

3.4.1.4.1. .head and .tail#

As with Series, we can use .head and .tail to show only the

first or last n rows.

stock_prices.head()

| Amazon | Microsoft | Apple | |||

|---|---|---|---|---|---|

| 2005 | 5.9 | 4.5 | 5.3 | 6.6 | 5.6 |

| 2006 | 5.6 | 4.3 | 5.2 | 6.0 | 5.3 |

| 2007 | 4.4 | 3.6 | 4.2 | 5.2 | 4.3 |

| 2008 | 3.8 | 4.0 | 4.0 | 4.6 | 4.2 |

| 2009 | 5.8 | 5.7 | 5.7 | 6.5 | 5.8 |

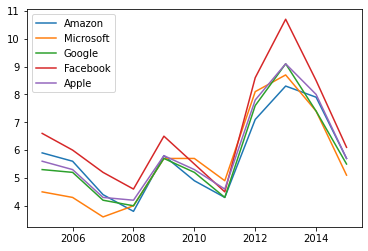

3.4.1.5. Plotting#

We can generate plots with the .plot method.

Notice we now have a separate line for each column of data.

stock_prices.plot()

<AxesSubplot:>

3.4.2. Indexing#

We can also do indexing using .loc.

This is slightly more advanced than before because we can choose subsets of both row and columns.

stock_prices.loc[2005, "Apple"]

5.6

stock_prices.loc[[2005,2008], "Facebook"]

2005 6.6

2008 4.6

Name: Facebook, dtype: float64

stock_prices.loc[2005, ["Microsoft", "Google"]]

Microsoft 4.5

Google 5.3

Name: 2005, dtype: float64

stock_prices.loc[:, "Microsoft"]

2005 4.5

2006 4.3

2007 3.6

2008 4.0

2009 5.7

2010 5.7

2011 4.9

2012 8.1

2013 8.7

2014 7.4

2015 5.1

Name: Microsoft, dtype: float64

# `[string]` with no `.loc` extracts a whole column

stock_prices["Apple"]

2005 5.6

2006 5.3

2007 4.3

2008 4.2

2009 5.8

2010 5.3

2011 4.6

2012 7.8

2013 9.1

2014 8.0

2015 5.7

Name: Apple, dtype: float64

3.4.2.1. Computations with Columns#

pandas can do various computations and mathematical operations on columns.

Let’s take a look at a few of them.

# Divide by 100

stock_prices / 100

| Amazon | Microsoft | Apple | |||

|---|---|---|---|---|---|

| 2005 | 0.059 | 0.045 | 0.053 | 0.066 | 0.056 |

| 2006 | 0.056 | 0.043 | 0.052 | 0.060 | 0.053 |

| 2007 | 0.044 | 0.036 | 0.042 | 0.052 | 0.043 |

| 2008 | 0.038 | 0.040 | 0.040 | 0.046 | 0.042 |

| 2009 | 0.058 | 0.057 | 0.057 | 0.065 | 0.058 |

| 2010 | 0.049 | 0.057 | 0.052 | 0.055 | 0.053 |

| 2011 | 0.043 | 0.049 | 0.043 | 0.045 | 0.046 |

| 2012 | 0.071 | 0.081 | 0.076 | 0.086 | 0.078 |

| 2013 | 0.083 | 0.087 | 0.091 | 0.107 | 0.091 |

| 2014 | 0.079 | 0.074 | 0.074 | 0.085 | 0.080 |

| 2015 | 0.057 | 0.051 | 0.055 | 0.061 | 0.057 |

# Find maximum

stock_prices["Apple"].max()

9.1

# Find the difference between two columns

# Notice that pandas applies `-` to _all rows_ at once

# We'll see more of this throughout these materials

stock_prices["Google"] - stock_prices["Apple"]

2005 -0.3

2006 -0.1

2007 -0.1

2008 -0.2

2009 -0.1

2010 -0.1

2011 -0.3

2012 -0.2

2013 0.0

2014 -0.6

2015 -0.2

dtype: float64

# Find correlation between two columns

stock_prices['Apple'].corr(stock_prices["Microsoft"])

0.9523890760029825

# find correlation between all column pairs

stock_prices.corr()

| Amazon | Microsoft | Apple | |||

|---|---|---|---|---|---|

| Amazon | 1.000000 | 0.875654 | 0.964415 | 0.967875 | 0.976016 |

| Microsoft | 0.875654 | 1.000000 | 0.951379 | 0.900638 | 0.952389 |

| 0.964415 | 0.951379 | 1.000000 | 0.987259 | 0.995030 | |

| 0.967875 | 0.900638 | 0.987259 | 1.000000 | 0.981308 | |

| Apple | 0.976016 | 0.952389 | 0.995030 | 0.981308 | 1.000000 |

3.4.2.2. Data Types#

We asked you to run the commands unemp.dtype and

unemp_region.dtypes and think about the outputs.

You might have guessed that they return the type of the values inside each column.

Occasionally, you might need to investigate what types you have in your DataFrame when an operation isn’t behaving as expected.

Google.dtype

dtype('float64')

stock_prices.dtypes

Amazon float64

Microsoft float64

Google float64

Facebook float64

Apple float64

dtype: object

DataFrames will only distinguish between a few types.

Booleans (

bool)Floating point numbers (

float64)Integers (

int64)Dates (

datetime) — we will learn this soonCategorical data (

categorical)Everything else, including strings (

object)

In the future, we will often refer to the type of data stored in a

column as its dtype.

Let’s look at an example for when having an incorrect dtype can

cause problems.

Suppose that when we imported the data the South column was

interpreted as a string.

stock_prices_str = stock_prices.copy()

stock_prices_str["Apple"] = stock_prices_str["Apple"].astype(str)

stock_prices_str.dtypes

Amazon float64

Microsoft float64

Google float64

Facebook float64

Apple object

dtype: object

Everything looks ok…

stock_prices_str.head()

| Amazon | Microsoft | Apple | |||

|---|---|---|---|---|---|

| 2005 | 5.9 | 4.5 | 5.3 | 6.6 | 5.6 |

| 2006 | 5.6 | 4.3 | 5.2 | 6.0 | 5.3 |

| 2007 | 4.4 | 3.6 | 4.2 | 5.2 | 4.3 |

| 2008 | 3.8 | 4.0 | 4.0 | 4.6 | 4.2 |

| 2009 | 5.8 | 5.7 | 5.7 | 6.5 | 5.8 |

But if we try to do something like compute the sum of all the columns, we get unexpected results…

stock_prices_str.sum()

Amazon 63.7

Microsoft 62.0

Google 63.5

Facebook 72.8

Apple 5.65.34.34.25.85.34.67.89.18.05.7

dtype: object

Why this happened?

3.4.2.3. Changing DataFrames#

We can change the data inside of a DataFrame in various ways:

Adding new columns

Changing index labels or column names

Altering existing data (e.g. doing some arithmetic or making a column of strings lowercase)

3.4.2.4. Creating New Columns#

We can create new data by assigning values to a column similar to how we assign values to a variable.

In pandas, we create a new column of a DataFrame by writing:

df["New Column Name"] = new_values

Below, we create an unweighted mean of the unemployment rate across the four regions of the US — notice that this differs from the national unemployment rate.

stock_prices["ValueofEW_portfolio"] = (stock_prices["Amazon"] +

stock_prices["Apple"] +

stock_prices["Microsoft"] +

stock_prices["Google"]+

stock_prices['Facebook'])/5

# what is a easier way to accomplish this?

stock_prices.head()

| Amazon | Microsoft | Apple | ValueofEW_portfolio | |||

|---|---|---|---|---|---|---|

| 2005 | 5.9 | 4.5 | 5.3 | 6.6 | 5.6 | 5.58 |

| 2006 | 5.6 | 4.3 | 5.2 | 6.0 | 5.3 | 5.28 |

| 2007 | 4.4 | 3.6 | 4.2 | 5.2 | 4.3 | 4.34 |

| 2008 | 3.8 | 4.0 | 4.0 | 4.6 | 4.2 | 4.12 |

| 2009 | 5.8 | 5.7 | 5.7 | 6.5 | 5.8 | 5.90 |

3.4.2.5. Changing Values#

Changing the values inside of a DataFrame should be done very rarely.

Typically when you are using the dataframe to store some computation

However, it can be done by assigning a value to a location in the DataFrame.

df.loc[index, column] = value

stock_prices.loc[2015, "ValueofEW_portfolio"] = 0.0

stock_prices.tail()

| Amazon | Microsoft | Apple | ValueofEW_portfolio | |||

|---|---|---|---|---|---|---|

| 2011 | 4.3 | 4.9 | 4.3 | 4.5 | 4.6 | 4.52 |

| 2012 | 7.1 | 8.1 | 7.6 | 8.6 | 7.8 | 7.84 |

| 2013 | 8.3 | 8.7 | 9.1 | 10.7 | 9.1 | 9.18 |

| 2014 | 7.9 | 7.4 | 7.4 | 8.5 | 8.0 | 7.84 |

| 2015 | 5.7 | 5.1 | 5.5 | 6.1 | 5.7 | 0.00 |

3.4.2.6. Renaming Columns#

We can also rename the columns of a DataFrame, which is helpful because the names that sometimes come with datasets are unbearable…

For example, twe can change facebook to Meta and google became alphabet.

We can rename columns by passing a dictionary to the rename method.

This dictionary contains the old names as the keys and new names as the values.

See the example below.

names = {"Facebook": "Meta",

"Google": "Alphabet"}

stock_prices.rename(columns=names)

| Amazon | Microsoft | Alphabet | Meta | Apple | ValueofEW_portfolio | |

|---|---|---|---|---|---|---|

| 2005 | 5.9 | 4.5 | 5.3 | 6.6 | 5.6 | 5.58 |

| 2006 | 5.6 | 4.3 | 5.2 | 6.0 | 5.3 | 5.28 |

| 2007 | 4.4 | 3.6 | 4.2 | 5.2 | 4.3 | 4.34 |

| 2008 | 3.8 | 4.0 | 4.0 | 4.6 | 4.2 | 4.12 |

| 2009 | 5.8 | 5.7 | 5.7 | 6.5 | 5.8 | 5.90 |

| 2010 | 4.9 | 5.7 | 5.2 | 5.5 | 5.3 | 5.32 |

| 2011 | 4.3 | 4.9 | 4.3 | 4.5 | 4.6 | 4.52 |

| 2012 | 7.1 | 8.1 | 7.6 | 8.6 | 7.8 | 7.84 |

| 2013 | 8.3 | 8.7 | 9.1 | 10.7 | 9.1 | 9.18 |

| 2014 | 7.9 | 7.4 | 7.4 | 8.5 | 8.0 | 7.84 |

| 2015 | 5.7 | 5.1 | 5.5 | 6.1 | 5.7 | 0.00 |

stock_prices.head()

| Amazon | Microsoft | Apple | ValueofEW_portfolio | |||

|---|---|---|---|---|---|---|

| 2005 | 5.9 | 4.5 | 5.3 | 6.6 | 5.6 | 5.58 |

| 2006 | 5.6 | 4.3 | 5.2 | 6.0 | 5.3 | 5.28 |

| 2007 | 4.4 | 3.6 | 4.2 | 5.2 | 4.3 | 4.34 |

| 2008 | 3.8 | 4.0 | 4.0 | 4.6 | 4.2 | 4.12 |

| 2009 | 5.8 | 5.7 | 5.7 | 6.5 | 5.8 | 5.90 |

We renamed our columns… Why does the DataFrame still show the old column names?

Many pandas operations create a copy of your data by default to protect your data and prevent you from overwriting information you meant to keep.

We can make these operations permanent by either:

Assigning the output back to the variable name

df = df.rename(columns=rename_dict)Looking into whether the method has an

inplaceoption. For example,df.rename(columns=rename_dict, inplace=True)

Setting inplace=True will sometimes make your code faster

(e.g. if you have a very large DataFrame and you don’t want to copy all

the data), but that doesn’t always happen.

We recommend using the first option until you get comfortable with pandas because operations that don’t alter your data are (usually) safer.

names = {"Facebook": "Meta",

"Google": "Alphabet"}

stock_prices=stock_prices.rename(columns=names)

stock_prices.head()

| Amazon | Microsoft | Alphabet | Meta | Apple | ValueofEW_portfolio | |

|---|---|---|---|---|---|---|

| 2005 | 5.9 | 4.5 | 5.3 | 6.6 | 5.6 | 5.58 |

| 2006 | 5.6 | 4.3 | 5.2 | 6.0 | 5.3 | 5.28 |

| 2007 | 4.4 | 3.6 | 4.2 | 5.2 | 4.3 | 4.34 |

| 2008 | 3.8 | 4.0 | 4.0 | 4.6 | 4.2 | 4.12 |

| 2009 | 5.8 | 5.7 | 5.7 | 6.5 | 5.8 | 5.90 |

3.4.2.7. Dates in pandas#

Now lets understand date manipulation more carefully

So far our years were integer, but to work with dates it is convenient to have data type specific for it

In pandas this type is datetime

LEts import a monthly data set with returns of 50 different companies

url = "https://raw.githubusercontent.com/amoreira2/Fin418/main/assets/data/Retuns50stocks.csv"

df_returns50 = pd.read_csv(url)

df_returns50

| date | CTL | T | CSCO | FCX | XL | IVZ | AMT | WHR | IR | ... | SWK | DVN | TMO | PEP | LNC | EMR | MLM | CCI | NU | Market | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 200001 | -18.4697 | -11.5513 | 2.2170 | -17.4556 | -12.5301 | -4.0929 | 17.3824 | -10.4707 | -14.5289 | ... | -16.5975 | 6.8441 | 15.4167 | -3.1915 | -6.9312 | -4.0305 | 2.4390 | -1.5564 | -0.3040 | -3.9612 |

| 1 | 200002 | -12.9450 | -11.2245 | 20.7192 | -21.1470 | -9.8898 | 5.3057 | 37.2822 | -6.1760 | -18.2311 | ... | -8.4577 | 6.0498 | -9.7473 | -5.8608 | -25.2115 | -16.6039 | -15.1667 | 1.9763 | -7.7439 | 3.1777 |

| 2 | 200003 | 10.5502 | 10.6732 | 16.9740 | -12.2727 | 36.9397 | 24.4250 | 0.2538 | 7.9402 | 15.4976 | ... | 15.6304 | 30.5034 | 30.4000 | 8.9805 | 21.2670 | 16.5981 | 33.8028 | 17.4419 | 14.2857 | 5.3500 |

| 3 | 200004 | -34.0067 | 4.6083 | -10.3274 | -20.2073 | -13.9955 | 0.9670 | -5.6962 | 11.0874 | 6.0734 | ... | 11.8483 | -0.9009 | -4.9080 | 5.1971 | 4.7836 | 3.2941 | 11.5789 | 1.3201 | 0.0000 | -5.9530 |

| 4 | 200005 | 10.3980 | -0.2853 | -17.8724 | -4.5455 | 25.8793 | -8.7719 | -20.2685 | -12.4338 | -2.5672 | ... | -8.8983 | 24.2857 | -4.1935 | 11.4140 | 11.3106 | 8.1686 | -7.4198 | -31.7590 | 3.3721 | -3.8871 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 175 | 201408 | 5.8359 | -1.7702 | -0.9512 | -2.2837 | 6.0174 | 9.1948 | 4.4602 | 7.8029 | 2.3984 | ... | 4.6312 | -0.1060 | -1.0617 | 4.9830 | 5.0582 | 1.2569 | 5.7394 | 7.1852 | 4.5330 | 4.0171 |

| 176 | 201409 | -0.2440 | 0.8009 | 1.4806 | -10.2282 | -2.4868 | -3.3301 | -4.6755 | -4.8164 | -5.9635 | ... | -2.3934 | -9.2814 | 1.3643 | 1.3569 | -2.6526 | -2.2493 | -1.5425 | 1.7230 | -2.6095 | -2.5129 |

| 177 | 201410 | 1.4429 | 0.1703 | -2.7811 | -11.7534 | 2.1405 | 2.5076 | 4.1333 | 18.1257 | 11.1072 | ... | 5.4623 | -11.9977 | -3.3936 | 3.3086 | 2.5009 | 2.3650 | -9.3222 | -2.9927 | 11.3995 | 2.1178 |

| 178 | 201411 | -0.4098 | 1.5499 | 12.9546 | -5.7895 | 4.8406 | 0.3459 | 7.7026 | 8.6428 | 0.7027 | ... | 0.8543 | -1.7167 | 9.9685 | 4.0865 | 3.4149 | 0.2498 | 3.0106 | 6.3620 | 2.6140 | 2.1149 |

| 179 | 201412 | -2.9188 | -5.0594 | 0.6331 | -12.9981 | -2.7872 | -2.0813 | -5.5042 | 4.0662 | 0.9198 | ... | 2.2872 | 4.2055 | -2.9778 | -4.8801 | 1.8365 | -3.1686 | -8.0973 | -4.2965 | 6.4623 | -0.3616 |

180 rows × 52 columns

Note that the data was not imported correctly

df_returns50.info()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 180 entries, 0 to 179

Data columns (total 52 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 date 180 non-null int64

1 CTL 180 non-null float64

2 T 180 non-null float64

3 CSCO 180 non-null float64

4 FCX 180 non-null float64

5 XL 180 non-null float64

6 IVZ 180 non-null float64

7 AMT 180 non-null float64

8 WHR 180 non-null float64

9 IR 180 non-null float64

10 WFT 180 non-null float64

11 YUM 180 non-null float64

12 CVS 180 non-null float64

13 GD 180 non-null float64

14 TYC 180 non-null float64

15 EL 180 non-null float64

16 MUR 180 non-null float64

17 CTAS 180 non-null float64

18 CBSA 180 non-null float64

19 SNV 180 non-null float64

20 CAM 180 non-null float64

21 DLTR 180 non-null float64

22 CAH 180 non-null float64

23 DTE 180 non-null float64

24 SSP 180 non-null float64

25 PSA 180 non-null float64

26 EXC 180 non-null float64

27 TKR 180 non-null float64

28 CMA 180 non-null float64

29 ORCL 180 non-null float64

30 MS 180 non-null float64

31 RSG 180 non-null float64

32 ACAS 180 non-null float64

33 AGN 180 non-null float64

34 MMM 180 non-null float64

35 ETFC 180 non-null float64

36 CAR 180 non-null float64

37 MDR 180 non-null float64

38 NOV 180 non-null float64

39 PCH 180 non-null float64

40 BAX 180 non-null float64

41 JCI 180 non-null float64

42 SWK 180 non-null float64

43 DVN 180 non-null float64

44 TMO 180 non-null float64

45 PEP 180 non-null float64

46 LNC 180 non-null float64

47 EMR 180 non-null float64

48 MLM 180 non-null float64

49 CCI 180 non-null float64

50 NU 180 non-null float64

51 Market 180 non-null float64

dtypes: float64(51), int64(1)

memory usage: 73.2 KB

from datetime import datetime

# Create a date parser function that will allow pandas to read the dates in the format we have them

date_parser = lambda x: datetime.strptime(x, "%Y%m")

# Use pd.read_csv with the date_parser

df_returns50 = pd.read_csv(url, parse_dates=['date'], date_parser=date_parser)

df_returns50.info()

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 180 entries, 0 to 179

Data columns (total 52 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 date 180 non-null datetime64[ns]

1 CTL 180 non-null float64

2 T 180 non-null float64

3 CSCO 180 non-null float64

4 FCX 180 non-null float64

5 XL 180 non-null float64

6 IVZ 180 non-null float64

7 AMT 180 non-null float64

8 WHR 180 non-null float64

9 IR 180 non-null float64

10 WFT 180 non-null float64

11 YUM 180 non-null float64

12 CVS 180 non-null float64

13 GD 180 non-null float64

14 TYC 180 non-null float64

15 EL 180 non-null float64

16 MUR 180 non-null float64

17 CTAS 180 non-null float64

18 CBSA 180 non-null float64

19 SNV 180 non-null float64

20 CAM 180 non-null float64

21 DLTR 180 non-null float64

22 CAH 180 non-null float64

23 DTE 180 non-null float64

24 SSP 180 non-null float64

25 PSA 180 non-null float64

26 EXC 180 non-null float64

27 TKR 180 non-null float64

28 CMA 180 non-null float64

29 ORCL 180 non-null float64

30 MS 180 non-null float64

31 RSG 180 non-null float64

32 ACAS 180 non-null float64

33 AGN 180 non-null float64

34 MMM 180 non-null float64

35 ETFC 180 non-null float64

36 CAR 180 non-null float64

37 MDR 180 non-null float64

38 NOV 180 non-null float64

39 PCH 180 non-null float64

40 BAX 180 non-null float64

41 JCI 180 non-null float64

42 SWK 180 non-null float64

43 DVN 180 non-null float64

44 TMO 180 non-null float64

45 PEP 180 non-null float64

46 LNC 180 non-null float64

47 EMR 180 non-null float64

48 MLM 180 non-null float64

49 CCI 180 non-null float64

50 NU 180 non-null float64

51 Market 180 non-null float64

dtypes: datetime64[ns](1), float64(51)

memory usage: 73.2 KB

# Set the date column as the index

df_returns50.set_index("date", inplace=True)

df_returns50.index

DatetimeIndex(['2000-01-01', '2000-02-01', '2000-03-01', '2000-04-01',

'2000-05-01', '2000-06-01', '2000-07-01', '2000-08-01',

'2000-09-01', '2000-10-01',

...

'2014-03-01', '2014-04-01', '2014-05-01', '2014-06-01',

'2014-07-01', '2014-08-01', '2014-09-01', '2014-10-01',

'2014-11-01', '2014-12-01'],

dtype='datetime64[ns]', name='date', length=180, freq=None)

We can index into a DataFrame with a DatetimeIndex using string

representations of dates.

For example

# Data corresponding to a single date

df_returns50.loc["2005-01", :]

| CTL | T | CSCO | FCX | XL | IVZ | AMT | WHR | IR | WFT | ... | SWK | DVN | TMO | PEP | LNC | EMR | MLM | CCI | NU | Market | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| date | |||||||||||||||||||||

| 2005-01-01 | -8.0914 | -6.5483 | -6.6253 | -3.0604 | -3.6961 | 7.0064 | -1.5217 | -1.3726 | -7.3724 | 5.7895 | ... | -2.919 | 4.4964 | -0.8281 | 2.8736 | -0.3749 | -4.0799 | 0.6709 | -1.4423 | -0.7958 | -2.6552 |

1 rows × 51 columns

# Data for all days between New Years Day and June first in the year 2000

df_returns50.loc["01/2003":"06/2003", :]

| CTL | T | CSCO | FCX | XL | IVZ | AMT | WHR | IR | WFT | ... | SWK | DVN | TMO | PEP | LNC | EMR | MLM | CCI | NU | Market | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| date | |||||||||||||||||||||

| 2003-01-01 | 3.233500 | -8.8528 | 2.0611 | 11.8594 | -2.8350 | -8.3333 | 43.9093 | -0.4787 | -8.8249 | -6.9371 | ... | -23.0191 | -1.3072 | -9.6919 | -4.1213 | 3.182400 | -7.708899 | -4.7619 | 5.3333 | -5.4054 | -2.3392 |

| 2003-02-01 | -9.660399 | -14.8936 | 4.5625 | -9.3234 | -5.4889 | -18.9610 | -7.6772 | -4.5603 | 0.9170 | 7.7503 | ... | -3.0428 | 6.4018 | -3.1370 | -5.3360 | -12.155000 | 1.134700 | -5.0342 | -1.7722 | -1.4808 | -1.5390 |

| 2003-03-01 | 0.930700 | -3.5577 | -7.1531 | 0.1763 | 0.4511 | -2.3504 | 17.6972 | -0.4669 | -2.1800 | -5.6693 | ... | -6.0635 | 0.1452 | 2.8409 | 4.7756 | -1.164800 | -3.654100 | 0.1088 | 41.7526 | -0.5714 | 1.0325 |

| 2003-04-01 | 6.702900 | 18.1082 | 15.5624 | 2.0528 | 16.2758 | 24.0886 | 20.2899 | 9.0965 | 14.2265 | 6.5131 | ... | 0.1667 | -1.9079 | 0.3867 | 8.2000 | 15.339300 | 11.797100 | 7.0989 | 15.8182 | 7.1839 | 8.2762 |

| 2003-05-01 | 14.329400 | 8.9897 | 9.4000 | 26.8053 | 5.7716 | 11.4311 | 34.9398 | 7.0107 | -0.2496 | 12.7268 | ... | 17.4157 | 10.0529 | 16.1255 | 2.1257 | 8.886101 | 3.930000 | 16.3003 | 30.7692 | 9.2326 | 6.3471 |

| 2003-06-01 | 3.668000 | 0.3535 | 2.3157 | 11.6173 | -4.1011 | 12.9241 | -1.2277 | 11.9508 | 8.0365 | -7.6075 | ... | -1.2875 | 2.6923 | -0.3791 | 1.0407 | 2.385100 | -2.294500 | -1.7539 | -6.7227 | 3.5891 | 1.6336 |

6 rows × 51 columns

3.4.2.8. DataFrame Aggregations#

Let’s talk about aggregations.

Loosely speaking, an aggregation is an operation that combines multiple values into a single value.

For example, computing the mean of three numbers (for example

[0, 1, 2]) returns a single number (1).

We will use aggregations extensively as we analyze and manipulate our data.

Thankfully, pandas makes this easy!

3.4.2.8.1. Built-in Aggregations#

pandas already has some of the most frequently used aggregations.

For example:

Mean (

mean)Variance (

var)Standard deviation (

std)Minimum (

min)Median (

median)Maximum (

max)etc…

Note

When looking for common operations, using “tab completion” goes a long way.

df_returns50.mean()

CTL 0.543043

T 0.420712

CSCO 0.272205

FCX 1.562149

XL 0.795499

IVZ 1.184839

AMT 1.819912

WHR 1.448373

IR 1.238221

WFT 1.072977

YUM 1.521299

CVS 1.248207

GD 1.351494

TYC 0.860400

EL 1.022905

MUR 1.307606

CTAS 0.873001

CBSA 0.839838

SNV 0.333623

CAM 1.294745

DLTR 1.551786

CAH 1.056583

DTE 1.100076

SSP 1.682069

PSA 1.685901

EXC 0.931623

TKR 1.400294

CMA 0.592855

ORCL 0.836469

MS 0.489803

RSG 1.215401

ACAS 1.536324

AGN 1.527276

MMM 1.046845

ETFC 0.078211

CAR 2.628951

MDR 1.817811

NOV 2.050656

PCH 0.890657

BAX 0.921694

JCI 1.496786

SWK 1.201223

DVN 1.245351

TMO 1.574135

PEP 0.842792

LNC 1.240616

EMR 0.889204

MLM 1.019899

CCI 1.533439

NU 0.931297

Market 0.487743

dtype: float64

As seen above, the aggregation’s default is to aggregate each column.

However, by using the axis keyword argument, you can do aggregations by

row as well.

df_returns50.mean(axis=1)

date

2000-01-01 -3.620535

2000-02-01 -3.927663

2000-03-01 13.901192

2000-04-01 0.988890

2000-05-01 1.003367

...

2014-08-01 3.464653

2014-09-01 -3.517967

2014-10-01 1.356545

2014-11-01 1.745494

2014-12-01 0.175312

Length: 180, dtype: float64

What is the finance interpretation of the time-series above?

3.4.2.9. Transforms#

Many analytical operations do not necessarily involve an aggregation.

The output of a function applied to a Series might need to be a new Series.

Some examples:

Compute the percentage change in average firm size from month to month.

Calculate the cumulative sum of elements in each column.

3.4.2.9.1. Built-in Transforms#

pandas comes with many transform functions including:

Cumulative sum/max/min/product (

cum(sum|min|max|prod))Difference (

diff)Elementwise addition/subtraction/multiplication/division (

+,-,*,/)Percent change (

pct_change)Number of occurrences of each distinct value (

value_counts)Absolute value (

abs)

Again, tab completion is helpful when trying to find these functions.

How do I compute the cumulative return of an equal weighted portfolio of these stocks?

3.4.2.10. Boolean Selection#

We have seen how we can select subsets of data by referring to the index or column names.

However, we often want to select based on conditions met by the data itself.

Some examples are:

Restrict analysis to all individuals older than 18.

Look at data that corresponds to particular time periods.

Analyze only data that corresponds to a recession.

Obtain data for a specific product or customer ID.

We will be able to do this by using a Series or list of boolean values to index into a Series or DataFrame.

#lets find all dates that the CVS stock has a monthly return lower than -10%

df_returns50.loc[df_returns50["CVS"]<-10,"CVS"]

date

2000-01-01 -12.2382

2001-06-01 -29.6904

2001-10-01 -27.8389

2002-09-01 -13.7462

2005-10-01 -15.7316

2009-11-01 -12.1530

2010-06-01 -15.3335

2010-08-01 -12.0886

Name: CVS, dtype: float64

Suppose I want to see how another stock, say CSCO, performed in these dates.

What do I do?

What is happening behind the scenes is boolean selection

df_returns50["CVS"]<-10

date

2000-01-01 True

2000-02-01 False

2000-03-01 False

2000-04-01 False

2000-05-01 False

...

2014-08-01 False

2014-09-01 False

2014-10-01 False

2014-11-01 False

2014-12-01 False

Name: CVS, Length: 180, dtype: bool