6. Portfolio Math and Diversification#

🎯 Learning Objectives

In this section we will learn how to do some basic math at portfolio level. You will know how to calculate return, expected return, and volatility given portfolio weights.

By the end of this chapter, you should be able to:

See risk through a portfolio lens.

Grasp Markowitz’s insight that an asset’s danger depends on what it adds to the whole mix, not on its stand-alone volatility.Express returns, means, and variance with matrix algebra.

Use \(R_p = R W\), \(E[R_p]=W' E[R]\), and \(\text{Var}(R_p)=W' \Sigma W\) to avoid loops and scale instantly from two assets to hundreds.Quantify diversification benefits.

Investigate how adding a higher-volatility asset can lower portfolio variance when correlations are below one, and plot the US–international efficient frontier.Compute and interpret portfolio weights.

Distinguish long-only, short, and leveraged positions; verify that weights sum to one (or note where leverage breaks that rule).Decompose variance into systematic and idiosyncratic pieces.

Link portfolio math to a single-factor model: \(\text{Var}(R_p)= (W' B)^2 \text{Var}(f) + W' \text{Var}(U) W\).Identify marginal contributions to risk.

Apply (2 B (B’ W) \text{Var}(f) + 2 \text{Var}(U) W) to see which asset trims factor risk most effectively per unit of trading.Build intuition with real data.

Load five global equity and bond portfolios, construct equal-weight and custom mixes, and observe how statistics change across decades.

6.1. Why do you need to think about portfolios?#

The great insight from Harry Markowitz was to think of risk in terms of what the stock adds to your portfolio

Just like meat can be good for you if you are not eating any meat, it is terrible if you are eating a lot of it

What investors should care about is, just like eaters, their final diet. If a given stock brings a lot of what you already have, it will be bad for you, i.e., risky.

So volatility is a good gauge of risk at the portfolio level, because it is asking how your whole portfolio behaves, which you obviously should care about. If it goes down a lot, it means you cannot buy stuff!

But when thinking about a specific stock, it’s volatility means very little.

Unless your entire portfolio is just that stock, you don’t really need to bear the stock risk–if you have 1% in a stock and the stock drops to ZERO, that is only 1% in your portfolio, so at most you lose 1%. So whatever volatility this stock might have you SHOULD not perceive the stock as very risky for you.

As long, of course, your position in the stock remains small.

Note that if this stock would move together with other pieces of your portfolio then your calculation should be very different. If this stock goes to zero exactly when your other assets are also losing a lot of money, this will feel very risky trade.

The amount of covariance across stocks will be a key determinant of how much we can hold very volatile stocks without adding much overall risk to our portfolio

6.2. Portfolio weights#

The portfolio weight for stock \(j\) , denoted \(w_j\), is the fraction of a portfolio value held in stock \(j\)

\[w_j=\frac{\text{Dollar held in stock j}}{\text{Dollar value of portfolio}}\]By construction, the portfolio weights allways add up to one: you invest all you got somewhere, and nothing more

This doesn’t mean that you can’t borrow to invest, just means that you will have a negative weight somewhere offsetting the positive position in the other assets

But if the weights do not add up to one, then it is NOT a portfolio!

\[\sum_{j=1}^N w_j=1\]In matrix notation

\[\mathbf{1}'W=1\]where \(\mathbf{1}\) is a N by 1 vector of 1’s (i.e. a vector with entry 1 in each position) and \(W\) is the N by 1 vector of portfolio weights

Portfolio returns are just the dollar-weighted average of the individual position returns

Where \(R\) is the N by 1 vector of realized asset returns

I use big R and big W here to emphasize that they are vectors, like (\([r^{RF},r^{MKT},..]\)), (\([w^{RF},w^{MKT},..]\)),

I use litlle \(r_p\) becasue the return on a portfolio is just a scalar

Our Data set

We will think about portfolios using a data set that contains monthly data on returns of

diversified portfolios of US equities

XUS developed market equities (typically refered as “international” in the industry)

emerging market equities

US government bonds

XUS developed markets government bonds

We will work directly with excess returns as it is more convenient in this case

# We will import a the data set from our github repository by pointing directly to the url

url="https://raw.githubusercontent.com/amoreira2/Lectures/main/assets/data/GlobalFinMonthly.csv"

# this is a csv file so I am using pandas read_csv function and telling it that -99 means NA

Data = pd.read_csv(url,na_values=-99)

# Here I tell python that the Date column is a date, to_datetime is a pandas function that converts strings to dates

Data['Date']=pd.to_datetime(Data['Date'])

#Here I set the Date column as the index of the dataframe. This makes it easier to work with time series data as I can use date based indexing

Data=Data.set_index(['Date'])

# make it excess returns by subtracting the risk-free rate

Rf=Data['RF']

Data=Data.drop(columns=['RF']).subtract(Data['RF'],axis=0)

Data

| MKT | USA30yearGovBond | EmergingMarkets | WorldxUSA | WorldxUSAGovBond | |

|---|---|---|---|---|---|

| Date | |||||

| 1963-02-28 | -0.0238 | -0.004178 | 0.095922 | -0.005073 | NaN |

| 1963-03-31 | 0.0308 | 0.001042 | 0.011849 | -0.001929 | -0.000387 |

| 1963-04-30 | 0.0451 | -0.004343 | -0.149555 | -0.005836 | 0.005502 |

| 1963-05-31 | 0.0176 | -0.004207 | -0.014572 | -0.002586 | 0.002289 |

| 1963-06-30 | -0.0200 | -0.000634 | -0.057999 | -0.013460 | 0.000839 |

| ... | ... | ... | ... | ... | ... |

| 2016-08-31 | 0.0050 | -0.008617 | 0.024986 | 0.000638 | -0.009752 |

| 2016-09-30 | 0.0025 | -0.016617 | 0.012953 | 0.012536 | 0.009779 |

| 2016-10-31 | -0.0202 | -0.049660 | 0.002274 | -0.020583 | -0.043676 |

| 2016-11-30 | 0.0486 | -0.081736 | -0.046071 | -0.019898 | -0.050459 |

| 2016-12-31 | 0.0182 | -0.005596 | 0.002604 | 0.034083 | -0.023507 |

647 rows × 5 columns

# drop rows with missing values

Data=Data.dropna()

Data

| MKT | USA30yearGovBond | EmergingMarkets | WorldxUSA | WorldxUSAGovBond | |

|---|---|---|---|---|---|

| Date | |||||

| 1963-03-31 | 0.0308 | 0.001042 | 0.011849 | -0.001929 | -0.000387 |

| 1963-04-30 | 0.0451 | -0.004343 | -0.149555 | -0.005836 | 0.005502 |

| 1963-05-31 | 0.0176 | -0.004207 | -0.014572 | -0.002586 | 0.002289 |

| 1963-06-30 | -0.0200 | -0.000634 | -0.057999 | -0.013460 | 0.000839 |

| 1963-07-31 | -0.0039 | 0.000700 | 0.085891 | 0.005200 | -0.000799 |

| ... | ... | ... | ... | ... | ... |

| 2016-08-31 | 0.0050 | -0.008617 | 0.024986 | 0.000638 | -0.009752 |

| 2016-09-30 | 0.0025 | -0.016617 | 0.012953 | 0.012536 | 0.009779 |

| 2016-10-31 | -0.0202 | -0.049660 | 0.002274 | -0.020583 | -0.043676 |

| 2016-11-30 | 0.0486 | -0.081736 | -0.046071 | -0.019898 | -0.050459 |

| 2016-12-31 | 0.0182 | -0.005596 | 0.002604 | 0.034083 | -0.023507 |

646 rows × 5 columns

# for example here is the return on a particular month

Data.loc['2008-09']

| MKT | USA30yearGovBond | EmergingMarkets | WorldxUSA | WorldxUSAGovBond | |

|---|---|---|---|---|---|

| Date | |||||

| 2008-09-30 | -0.0924 | 0.022193 | -0.176397 | -0.145744 | -0.032762 |

Since the return on a portfolio is a weighted sum of the returns on the securities, we need to determine how the distribution of this sum of r.v. (\(R_p\)) is related to the orignal distribution of eah r.v. (the individual securities returns \(R_j\), \(j=1...N\)).

The analysis of portfolio risk becomes much simpler by assuming that return distributions are normal.

This means we only need to worry about mean and variance (even if we care about these really bad tail events)

# lets start by constructing an equal-weighted portfolio

W=np.ones((5,1))/5

W

array([[0.2],

[0.2],

[0.2],

[0.2],

[0.2]])

np.sum(W)

np.float64(1.0)

Data.loc['9/2008'] @ W

| 0 | |

|---|---|

| Date | |

| 2008-09-30 | -0.085022 |

Now lets say we want to compute the returns of your portfolio across all dates. Do we need to do a for loop?

NO! Avoid a for loop like the plague! Matrix algebra– believe it or not not–is your friend

Say R is a vector T by N of historical asset returns (T periods N assets)

Say W is a vector N by 1 of weights

Then

Is a T by 1 vector of historical portfolio returns

What is happening? Each row of R has the date t returns. When we do this “vector” multiplication we multiply each rwo of the matrix on the left with the vector on the right, so each row of the resulting vector is exactly the returns of our portforio in a given date!

Data.shape

(647, 5)

Rp=Data @ W

Rp

| 0 | |

|---|---|

| Date | |

| 1963-03-31 | 0.008275 |

| 1963-04-30 | -0.021826 |

| 1963-05-31 | -0.000295 |

| 1963-06-30 | -0.018251 |

| 1963-07-31 | 0.017418 |

| ... | ... |

| 2016-08-31 | 0.002451 |

| 2016-09-30 | 0.004230 |

| 2016-10-31 | -0.026369 |

| 2016-11-30 | -0.029913 |

| 2016-12-31 | 0.005157 |

646 rows × 1 columns

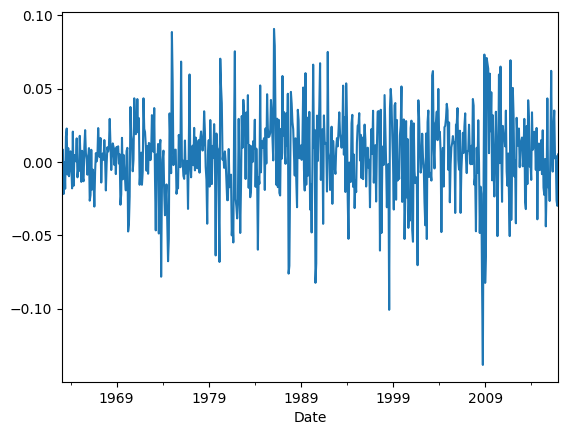

Rp.plot()

<Axes: xlabel='Date'>

Rp.mean()

np.float64(0.004144225707430341)

6.3. Portfolio Expected returns#

Averages and expectations are linear

If you expect tomorrow temperature to be 60F, how much you expect 4*”tomorrow temperature” to be?

The expected return of a portfolio is the dollar weighted average of the expected returns of the individual assets.

This means that our average estiamtor also have this property!

Lets compute for our equal weighted portfolio:

# estimate the expected return

E_hat=Data.mean()

E_hat

| 0 | |

|---|---|

| MKT | 0.005140 |

| USA30yearGovBond | 0.002523 |

| EmergingMarkets | 0.006923 |

| WorldxUSA | 0.004149 |

| WorldxUSAGovBond | 0.002054 |

# We use transpose function `T` to transpose W to a 1 by 5 matrix

W.T @ E_hat

array([0.00415789])

# or we can isntead do so the dimensions line up

E_hat @ W

array([0.00415789])

It should be true that taking the sample mean of our portfolio return realizations should give the same answer

(Data @ W).mean()

| 0 | |

|---|---|

| 0 | 0.004144 |

or more directly

Rp.mean()

np.float64(0.004144225707430341)

6.4. Portfolio Variance#

Why the portfolio variance is not just the dollar weighted averages of the asset variances?

Two asset case:

where we used that \(Var(x)=Cov(x,x)\)

This yields the classic formula

N-asset case

From the “term distribution” above it is intuitive what the N asset case would look like

For a portfolio of 50 assets, this expression has 50 variance terms and 2450 covariance terms!

We can use our matrix algebra notation to again avoid a nasty double for loop

where \(Cov(R)\) is the N by N variance covariance matrix of the assets and W is the vector of weights

print(W.shape)

print(Data.cov().shape)

(5, 1)

(5, 5)

Cov_hat=Data.cov()

Cov_hat

| MKT | USA30yearGovBond | EmergingMarkets | WorldxUSA | WorldxUSAGovBond | |

|---|---|---|---|---|---|

| MKT | 0.001950 | 0.000111 | 0.001298 | 0.001265 | 0.000187 |

| USA30yearGovBond | 0.000111 | 0.001229 | -0.000204 | -0.000013 | 0.000264 |

| EmergingMarkets | 0.001298 | -0.000204 | 0.003550 | 0.001664 | 0.000249 |

| WorldxUSA | 0.001265 | -0.000013 | 0.001664 | 0.002185 | 0.000422 |

| WorldxUSAGovBond | 0.000187 | 0.000264 | 0.000249 | 0.000422 | 0.000407 |

W.T @ Cov_hat @ W

| 0 | |

|---|---|

| 0 | 0.000792 |

We can check that this vector notation deliver the same as the double sum by using two for loops

cov=Data.cov()

covariance_sum=0 #initiate the sum at zero

for i in cov.index: # loop across all assets

for j in cov.columns:

i_pos=cov.index.get_loc(i) # this gets the position of the particular asset so we can locate the proper posiiton on the vector

j_pos=cov.columns.get_loc(j) # same thing, but for the other asset in the double sum

covariance_sum=covariance_sum+cov.loc[i,j]*W[i_pos,0]*W[j_pos,0]

covariance_sum

np.float64(0.0007923455067886969)

Diversification

A key concept in investing is diversification

The famous: “don’t put all your eggs in one basket” advice

There are potential benefits of diversifcation for an investor when there are assets that are imperfecly correlated with the investor portfolio

So lets look at this from the vantage point of a US investors that is fully invested in the US equity market portfolio and is considering the benefits of investing in other world equity markets

# here is the co-movement across the asset

Data[['MKT','WorldxUSA']].corr()

| MKT | WorldxUSA | |

|---|---|---|

| MKT | 1.000000 | 0.613103 |

| WorldxUSA | 0.613103 | 1.000000 |

What is noteworthy about this correlation matrix?

Are there any benefits of diversification?

Lets compute how the variance of the investor portfolio varies as she varies her portfolio weight on the world market

But first note that the US market is less volatile than the international market

Which portfolio you expect to have the lowest vol given that information?

Data.std()*12**0.5

| 0 | |

|---|---|

| MKT | 0.152959 |

| USA30yearGovBond | 0.121422 |

| EmergingMarkets | 0.206384 |

| WorldxUSA | 0.161923 |

| WorldxUSAGovBond | 0.069854 |

D=Data.loc[:,['MKT','WorldxUSA']]

x_us=1

x_int=1-x_us

W=np.array([x_us,x_int])

Rp=D@ W

Rp.std()*12**0.5

0.15295861105099787

International has the highest vol, US the lowest

Which portfolio achieves the lowest vol? x_us=1? x_us=0? something else?

w=np.arange(,,)

w

array([0. , 0.05, 0.1 , 0.15, 0.2 , 0.25, 0.3 , 0.35, 0.4 , 0.45, 0.5 ,

0.55, 0.6 , 0.65, 0.7 , 0.75, 0.8 , 0.85, 0.9 , 0.95, 1. ])

D=Data.loc[:,['MKT','WorldxUSA']]

UsW=[]

# w here is a vector of weights on the US MKT and 1-w is the the weight on the international market

for x_us in w:

W=np.array([x_us,1-x_us])

# save the weight on the world market as the first element of UsW

Rp=D@ W # construct time series of portfolio returns

vol=Rp.std()*12**0.5 # estimate portfolio standard deviation

# vol=((W.T @ D.cov() @ W)**0.5)*12**0.5 # the alternative way of estimating the vol

UsW.append([x_us,1-x_us,vol])

# Make a sacatter plot

plt.scatter(UsW[:,1],UsW[:,2])

plt.xlabel('Weight on World')

#plt.ylim([0.04,0.05])

plt.show()

We can also look at the investment frontier that such an investor faces: How her expected returns change with the variance

Lets also look at annualized quantities for more intution

always keep in mind that this is only the in-sample investment frontier because we are relying on the sample averages to construct it

D.mean()*12

MKT 0.061684

WorldxUSA 0.049788

dtype: float64

D.std()*12**0.5

MKT 0.152891

WorldxUSA 0.161802

dtype: float64

UsW=[]

for x_us in w:

W=np.array([x_us,1-x_us])

# save the weight on the world market as the first element of UsW

# save the annulized vol of the portfolio as the second element of UsW

# save the annulized expected return of the portfolio as the third element of UsW

vol=(W.T @ D.cov() @ W*12)**0.5

er=W.T @ np.array(D.mean())*12

UsW.append([1-x_us,vol,er])

UsW=np.array(UsW)

# UsW[:,1], the annulized vol of the portfolio

# UsW[:,2], the annulized expected return of the portfolio

plt.scatter(UsW[:,1],UsW[:,2])

plt.xlabel('Volatility')

plt.ylabel('Average excess return')

plt.show()

Which allocation should you choose?

How international investors benefit from holding US stocks?

How US investors benefit of holding international stocks?

📝 Key Takeaways

Matrix algebra is your friend. A single line replaces nested loops when calculating returns, expectations, and variance.

Diversification is all about correlations. Pairing volatile but imperfectly correlated assets can cut overall risk more than simply holding the lower-volatility asset alone.