Note Need to trim this notebook. Certainly move the pod shop stuff , but maybe more

7. Capital Allocation#

🎯 Learning Objectives

Decompose the capital-allocation problem into two decisions.

Separate “How large should my risk portfolio be?” from “How do I spread that risk across assets?” and see why each question has distinct inputs.Compare the principal vs. delegate perspective.

Understand how required spending, liabilities, or performance evaluation alter the optimal amount of risk for an individual investor versus a professional manager.Translate expected return and covariance into optimal weights.

Apply the mean–variance framework (or its CAPM special case) to derive recommended positions across stocks, bonds, and factor portfolios.Allocate between market beta and portable alpha.

Learn the mechanics of combining a hedged long-short (zero-beta) strategy with a market position, and see how the separation theorem guides sizing.Explore the economics behind “pod shops.”

Understand why multi-manager platforms combine dozens of market-neutral pods, each run at tight risk limits and scaled to a common volatility target.

Every investor faces this question: How much risk should I take, and how should I spread that risk across different assets?

This chapter will walk you through key concepts and hands-on tools to:

Decide how much to allocate to risky vs risk-free assets.

Understand investor behavior (principal vs. delegate).

A fundamental insight of portfolio theory is that these two decisions are separable

Investor can first decide on the portfolio that has the best risk-return properties (allocation across assets)

Then–given the properties of such portfolio–investors can decide how much to allocate to it vs the risk-free rate

7.1. Who Decides How Much Risk to Take?#

Before diving into the math, let’s think about a fundamental question in portfolio construction:

💬 Who is choosing the portfolio—and what do they care about?

Every investment decision is ultimately shaped by this.

7.1.1. 🧍 A. If You’re the Principal#

You’re investing your own money, and you bear all the risks and rewards.

Your optimal portfolio depends on:

Your preferences (especially risk tolerance),

How terrible you feel if you have less than you expected

How much joy would you enjoy if you had more

Your investment horizon,

Your personal financial goals.

Minimum retirement income

Minimum balance in college fund

Minimum budget for health issues

Future purchase of a property

Your background risk

Do you have other sources of income? are they risky?

We often model the principal’s preferences using expected utility theory.

You want more wealth to consume, but are risk averse

If this utility is mean-variance, this gives rise to the classic trade-off:

where:

\( \mathbb{E}[r_p] \): expected excess return of the risky portfolio

\( \gamma \): investor’s risk aversion

\(\text{Var}(r_p)\) : portfolio variance

The mean-variance criteria will be approximately correct even for other preferences as long returns are close to normal

We will discuss deviation from normality in our risk management lecture

Your optimal portfolio is given by choosing x to maximize this quadratic function

You find any maximum by setting the derivative of the objective with respect to the choice variable to zero:

Your optimal portfolio standard deviation is

7.2. How to allocate across assets and trading strategies?#

Implicit in our discussion is that you have some desired portfolio with some Sharpe ratio \(SR_p\) and you are deciding how to invest in it.

We can already see that having a large Sharpe ratio is a nice thing to have:

Increases the growth of your portfolio per unit of risk

For the same growth , you need to take less risk

Expected growth means you are less likely to have large losses

But you have to have in mind two things

There might be stronger deviations from normality for some trading strategies–for example option based strategies

for some strategies the moments are particularly poorly estimated in short samples–again option based strategies!

Useful to always check the “realized tail” of your portfolio in a backtest–more on that soon!

How to build a portfolio that maximizes you SR?

If you know the vectors of expected excess returns across your assets and their variance covariance matrix the answer is easy $\(W=w E[R^e]\Sigma_{R}^{-1} \)\( This is the MEAN-VARIANCE EFFICIENT PORTFOLIO associated with moments \)E[R^e]\(,\)\Sigma_{R}$

\(E[R^e]\) is the vector of FORWARD LOOKING expected excess returns across assets

\(\Sigma_{R}\) is the FORWARD LOOKING variance-covariance matrix

w is a scalar that controls the overall size of your portfolio, but does not impact the SR

This same portfolio solves the all following problems

\( \max_W E[W'R^e_T]-\gamma/2 Var(W'R^e_T)\)

\( \max_W E[W'R^e_T]~~~subject~~to~~~Var(W'R^e_T)\leq Vmax \)

\( \min_W Var(W'R^e_T)~~~subject~~to~~~E[W'R^e_T]\geq Emin \)

It should not be surprising! They all want the highest SR, but use it to achieve different goals

Here is the solution for the first one

\( \max_W E[W'R^e_T]-\gamma/2 Var(W'R^e_T)\)

\( \max_W W'E[R^e_T]-\gamma/2 W'Var(R^e_T)W\)

You again find any maximum by setting the derivative of the objective with respect to the choice variable to zero. The only difference is that now you are choosing a vector!

\( E[R^e_T]-\gamma Var(R^e_T)W=0\)

\( E[R^e_T]=\gamma Var(R^e_T)W\)

\( (\gamma Var(R^e_T))^{-1}E[R^e_T]=(\gamma Var(R^e_T))^{-1}2\gamma Var(R^e_T)W\)

\( W=\frac{1}{\gamma}Var(R^e_T)^{-1}E[R^e_T] \)

Insight:

\(\frac{1}{\gamma}\) is simply a scalar that lever-delever your portfolio to hit your desired goal

The maximum Sharpe Ratio portfolio is really given by the term \( W^*=Var(R^e_T)^{-1}E[R^e_T] \)

This means that to hit a variance target or a expected return target all you need to do is solve for the leverage that implements it!

For example, suppose I want to hit an expected excess return target of \(\mu\), What is my portfolio?

Lets apply this to an international portfolio allocation problem

url="https://raw.githubusercontent.com/amoreira2/Lectures/main/assets/data/GlobalFinMonthly.csv"

Data = pd.read_csv(url,na_values=-99)

Data['Date']=pd.to_datetime(Data['Date'])

Data=Data.set_index(['Date'])

Rf=Data['RF']

Data=Data.drop(columns=['RF']).subtract(Data['RF'],axis=0)

Data.head()

| MKT | USA30yearGovBond | EmergingMarkets | WorldxUSA | WorldxUSAGovBond | |

|---|---|---|---|---|---|

| Date | |||||

| 1963-02-28 | -0.0238 | -0.004178 | 0.095922 | -0.005073 | NaN |

| 1963-03-31 | 0.0308 | 0.001042 | 0.011849 | -0.001929 | -0.000387 |

| 1963-04-30 | 0.0451 | -0.004343 | -0.149555 | -0.005836 | 0.005502 |

| 1963-05-31 | 0.0176 | -0.004207 | -0.014572 | -0.002586 | 0.002289 |

| 1963-06-30 | -0.0200 | -0.000634 | -0.057999 | -0.013460 | 0.000839 |

# lets assume the sample moments are the true moments of the distribution

muR=Data.mean()

display(muR)

SigmaR=Data.cov()

display(SigmaR)

# this inverts the variance covariance matrix

display(np.linalg.inv(SigmaR))

W= np.linalg.inv(SigmaR) @ muR

display(W)

MKT 0.005140

USA30yearGovBond 0.002523

EmergingMarkets 0.006923

WorldxUSA 0.004149

WorldxUSAGovBond 0.002054

dtype: float64

| MKT | USA30yearGovBond | EmergingMarkets | WorldxUSA | WorldxUSAGovBond | |

|---|---|---|---|---|---|

| MKT | 0.001948 | 0.000111 | 0.001292 | 0.001264 | 0.000187 |

| USA30yearGovBond | 0.000111 | 0.001227 | -0.000204 | -0.000013 | 0.000264 |

| EmergingMarkets | 0.001292 | -0.000204 | 0.003556 | 0.001661 | 0.000249 |

| WorldxUSA | 0.001264 | -0.000013 | 0.001661 | 0.002182 | 0.000422 |

| WorldxUSAGovBond | 0.000187 | 0.000264 | 0.000249 | 0.000422 | 0.000407 |

array([[ 886.9351877 , -163.1566812 , -133.47716321, -463.61463361,

260.65110274],

[-163.1566812 , 1029.7603189 , 83.97391735, 201.95839425,

-854.35594033],

[-133.47716321, 83.97391735, 462.95743432, -276.66588761,

10.81093193],

[-463.61463361, 201.95839425, -276.66588761, 1113.82507458,

-904.79801414],

[ 260.65110274, -854.35594033, 10.81093193, -904.79801414,

3826.58967227]])

array([ 1.83533361, 1.42337262, 1.60522251, -1.02642088, 3.36582305])

Can you check that the SR of portfolio w*W is invariant to little w?

Can you explain why this is happening?

What is the insight? What is the economics of this result? Does it always hold?

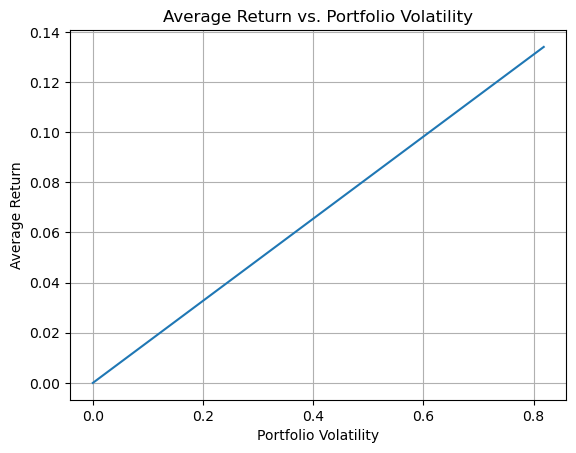

Lets look at the relationship between expected returns and volatility as we vary the size of the portfolio w, while fixing the allocation W

# Define the range of w values

w_values = np.linspace(0, 5, 100)

# Calculate the portfolio returns and volatilities for each w

portfolio_returns = []

portfolio_volatilities = []

for w in w_values:

weights = w * np.linalg.inv(SigmaR) @ muR

portfolio_return = weights @ muR

portfolio_volatility = np.sqrt(weights @ SigmaR @ weights)

portfolio_returns.append(portfolio_return)

portfolio_volatilities.append(portfolio_volatility)

# Plot the results

plt.plot(portfolio_volatilities, portfolio_returns)

plt.xlabel('Portfolio Volatility')

plt.ylabel('Average Return')

plt.title('Average Return vs. Portfolio Volatility')

plt.grid(True)

plt.show()

What does it mean that the relationship between Expected return and volatility is linear?

Is that what you expect? Is that true in general as you change portfolio weights?

7.3. Alpha bets#

It is useful to decompose your allocation in terms of “factor bets” and “alpha bets”

Most fund managers have tight limits on factor exposures anyways, so factor exposure is more of a consequence of your alpha bets that you need to control rather then a form of investing for most fund managers. If you are a large capital allocator, like a Pension fund or a university endowment then factor bets are also very important, since on average most portfolios risk must be dominated by common factors

Let’s say that you identified N trading strategies

You believe their alphas are A (N by 1)

You estimate their factor Betas B (N by 1) (single factor model for now)

And their idio variance \(\Sigma_{\epsilon}\), which is diagonal. These are idio bets after you remove the factor exposure

You have a mandate to have zero factor exposure.

What is your optimal portfolio ( we are focusing now on the composition, lets put the level of risk aside) ?

What is your allocation on each trading strategy?

Assuming you can trade the factor, how much of it you buy/sell directly?

The solution is \(w*W\) and \(w*W_f\) for any scalar w, where

\(W=A\Sigma_{\epsilon}^{-1}\)

\(W_f=-W'\Beta\)

and you pick w to control the overall volatility of your portfolio and where $\(A\Sigma_{\epsilon}^{-1}=\left[\alpha_1,\alpha_2,...,\alpha_N\right]\left[\begin{array}{ccc}\sigma^2_{\epsilon,1} & 0 & 0\\0 & \sigma^2_{\epsilon,i} & 0\\0&0&\sigma^2_{\epsilon,N}\end{array}\right]^{-1}=\left[\begin{array}{c}\frac{\alpha_1}{\sigma^2_{\epsilon,1} }\\\frac{\alpha_2}{\sigma^2_{\epsilon,2} }\\...\\\frac{\alpha_N}{\sigma^2_{\epsilon,N} }\end{array}\right]\)$

The fact that all the trading strategies are stripped out of the co-movement leads to a really clean formula

You can rewrite in terms of volatility allocations in each strategy

We refer to \(\frac{\alpha_i}{\sigma_{\epsilon,i}}\) as the strategy Appraisal Ratio. Sometimes people call this the “information ratio”. It is the “sharpe ratio” of the trading strategy striped out of factor exposure

recall that \(\sigma_{\epsilon,i}\) is the volatility of the strategy that is long the asset and short the factor in the optimal hedging

so if you set \(h=-\beta_i\)

and follows that \(E[r^e_i-h^if]=\alpha_i\) and \(Var(r^e_i-h^if)=\sigma_{\epsilon,i}^2\)

How do we do this for this international allocation problem using the US market as the common factor?

ADJUST !!!

import statsmodels.api as sm

# Define the factors and the market factor

factors = ['SMB', 'HML', 'RMW', 'CMA', 'MOM']

market_factor = 'Mkt-RF'

# Initialize lists to store the results

Alpha = []

Beta = []

residuals = []

Alpha_se = []

Hedged_factors=[]

# Run univariate regressions with the market as the factor

df_sample=df_ff6['1970':'2000']

for factor in factors:

X = sm.add_constant(df_ff6[market_factor])

y = df_ff6[factor]

model = sm.OLS(y, X).fit()

Alpha.append(model.params['const'])

Beta.append(model.params[market_factor])

residuals.append(model.resid)

Hedged_factors.append(model.params['const']+model.resid)

# What is an alternative approach to construct the hedged factor?

# Convert Alpha and Beta to numpy arrays

Alpha = np.array(Alpha)

Beta = np.array(Beta)

# Calculate the variance-covariance matrix of the residuals

Hedged_factors = pd.DataFrame(np.vstack(Hedged_factors).T)

Hedged_factors.columns = factors

residuals_matrix = np.vstack(residuals).T

Sigma_e =np.diag(np.cov(residuals_matrix.T))

# Display the results

print("Alpha:", Alpha*12)

print("Beta:", Beta)

print("Sigma_e:", Sigma_e*12)

# optimal weights for the hedged factors

W=Hedged_factors.mean()@ np.linalg.inv(Hedged_factors.cov())

# lets leverage it to have a yearly vol of 16%

W = W / np.sqrt(W @ Hedged_factors.cov() @ W.T) * 0.16

W

7.4. How to Combine the Hedged portfolio (alpha) and the Market (beta)#

If you see your investment in the factor as simply a financial issue

you care exclusively about the returns of the portfolio

Do not care how the factor (i.e. the market) might co-move with your non-financial wealth–say when the market tanks, recession is more likely and you are more likely to lose your job

Then it is basically the same as with the alphas…

But still useful to separate as you probably have different confidence on the market risk-premium than on the alphas

Recall our formula for the mean-variance efficient weights

Now this becomes really simple because the covariance of the new Hedged-MVE strategy is zero with the market

So the optimal weights are just

You invest in each strategy according to the strength of the risk-return trade-off in the strategy

Note that anything that invest proportionally in those two assets will still be tangency, i.e. if \(W^*\) is tangency \(0.3*W^*\) is tangency as well!

But how much you invest overall will depend on how much risk you want to take

Of course similar uncertainty issues might push you to deviate from this rule!

What is the optimal combination between your alpha combo portfolio and the market?

By how much can you increase your portfolio Sharpe ratio if you combine optimally combine two uncorrelated portfolios?

for any two strategies A and B that have zero correlation with each other, you can find the maximum achievable Sharpe Ratio with the simple formula

The Hedged and the market are orthogonal by construction–> we took out any beta exposure the asset might have!

If you care about the Sharpe ratio of your final portfolio, you do not care about the Sharpe ratio of a particular strategy- You instead care about the Sharpe ratio of the strategy after you hedged out your current portfolio You care about the appraisal ratio of the strategy relative to your portfolio

📝 Key Takeaways

Risk size and asset mix are separate levers. First decide how much volatility (or drawdown) you can stomach; only then choose the combination of assets or factors that delivers the best reward for that risk.

Know your maximum loss: figure out how much vol you should have in your portfolio

Portfolio composition is all about the Sharpe Ratio

Portable alpha plus market beta is a practical implementation of the separation theorem. A zero-beta long–short can be layered on top of any core market exposure to raise expected return without changing systematic risk.

Characteristic factors need the same discipline as traditional assets. Evaluate their alpha, beta, and covariance before adding them—high standalone Sharpe means little if the factor simply doubles your market risk.

Diversification is your friend, estimation uncertainty your mortal enemy