4. Introduction to Asset Returns#

🎯 Learning Objectives

By the end of this chapter, you should be able to:

Define and compute total returns

Build returns from price and dividend data, recognizing that “return” is the normalized gain relative to the initial price and works for any positive‐priced asset.Strip out the risk-free rate

Convert raw returns to excess returns so that every subsequent statistic measures compensation over a truly “safe” alternative.Introduce the idea of a risk premium

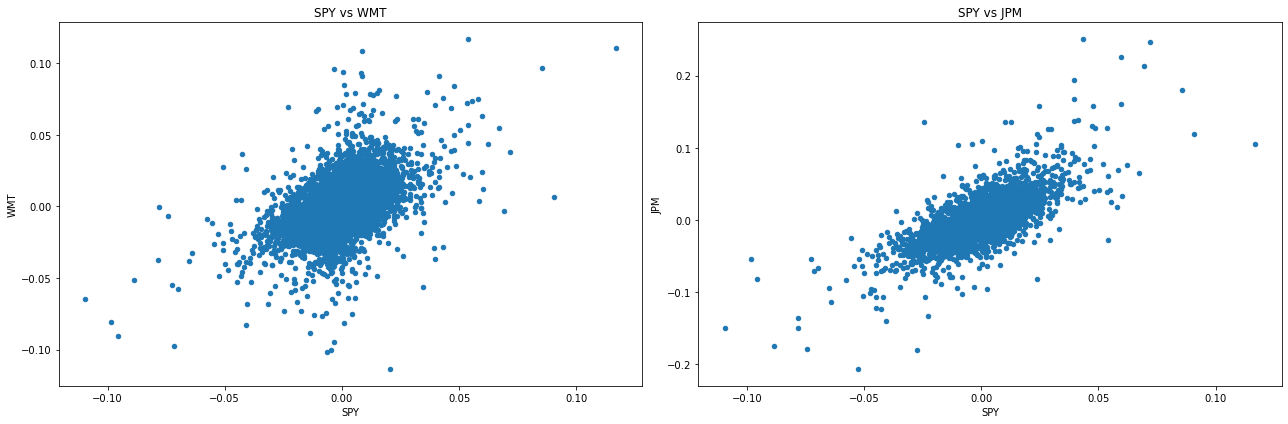

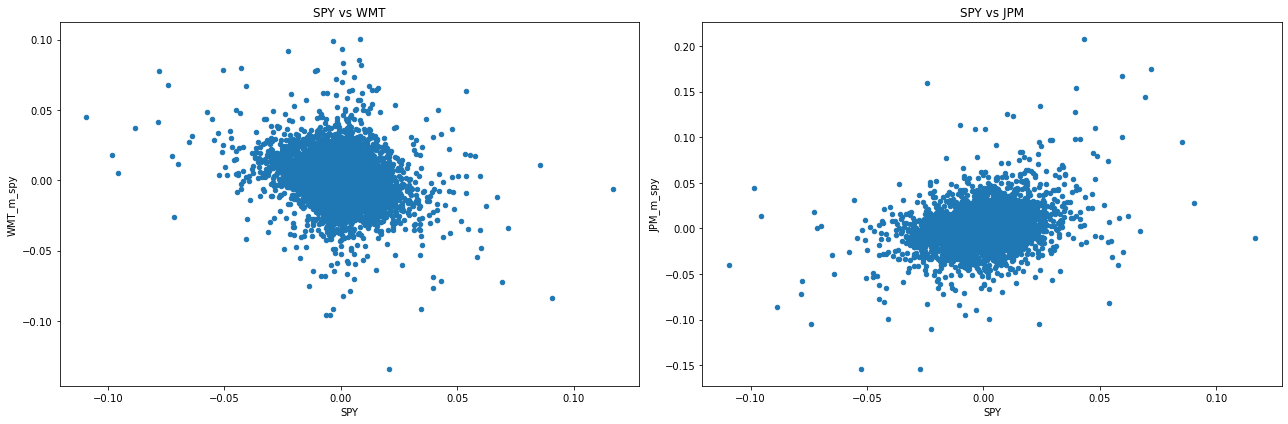

Understand that the expected value of excess return is the reward for bearing risk, and that estimating it requires a long view of historical dataMotivate the need for a factor model

See why differing betas demand a formal model and set the stage for multi-factor extensions covered in later notebooks.

4.1. What is a return?#

Lets say you paid \(𝑃_𝑡\) in date \(t\) for an asset

In date \(t+1\) the price is \(𝑃_{𝑡+1}\) and you earn some dividend as well \(𝐷_{𝑡+1}\)

Then we say that your return is

It is the gain you made (everything that you go in date t+1), divided by how much you put in ( the price of the asset)

This definition works for ANY asset that has a positive price

This is the case for stocks, bonds, commodities, crypto, most real assets

The return simply normalizes the “dollar gain” by the cost of the asset.

In practice there are many types of distributions that are economically like a dividend but have different names: cash dividends, stock dividends, capital gain distributions, rights offerings, acquisition related distributions, splits

Lets start by loading Price and Dividend data on a single stock

# first we connect with WRDS database using the wrds package so we need to install it first and import it

%pip install wrds

import wrds

# lets connect with the wrds database

conn = wrds.Connection()

WRDS recommends setting up a .pgpass file.

Created .pgpass file successfully.

You can create this file yourself at any time with the create_pgpass_file() function.

Loading library list...

Done

#We now get daily prices and dividends for the UNH stock

# lets not think too hard how we did that--the function is defined above--but for now--lets just used it

df_UNH=get_daily_wrds_single_ticker('UNH',conn)

df_UNH

[92655]

| P | D | |

|---|---|---|

| date | ||

| 1984-10-18 | 4.87500 | 0.0 |

| 1984-10-19 | 4.68750 | 0.0 |

| 1984-10-22 | 4.68750 | 0.0 |

| 1984-10-23 | 4.56250 | 0.0 |

| 1984-10-24 | 4.68750 | 0.0 |

| ... | ... | ... |

| 2024-12-24 | 506.10001 | 0.0 |

| 2024-12-26 | 511.14999 | 0.0 |

| 2024-12-27 | 509.98999 | 0.0 |

| 2024-12-30 | 507.79999 | 0.0 |

| 2024-12-31 | 505.85999 | 0.0 |

10131 rows × 2 columns

#How do we construct returns?

# what .shift does?

df_UNH['ret']=?

df_UNH

| P | D | ret | |

|---|---|---|---|

| date | |||

| 1984-10-18 | 4.87500 | 0.0 | NaN |

| 1984-10-19 | 4.68750 | 0.0 | -0.038462 |

| 1984-10-22 | 4.68750 | 0.0 | 0.000000 |

| 1984-10-23 | 4.56250 | 0.0 | -0.026667 |

| 1984-10-24 | 4.68750 | 0.0 | 0.027397 |

| ... | ... | ... | ... |

| 2023-12-22 | 520.31000 | 0.0 | 0.000827 |

| 2023-12-26 | 520.03003 | 0.0 | -0.000538 |

| 2023-12-27 | 522.78998 | 0.0 | 0.005307 |

| 2023-12-28 | 524.90002 | 0.0 | 0.004036 |

| 2023-12-29 | 526.46997 | 0.0 | 0.002991 |

9879 rows × 3 columns

df_UNH['ret'].mean()

0.0009104234710832472

If I have invested 100 dollars in a random month in the sample, on average I would have 100.09 in month t+1 in the sample

A return of

Suppose that at the start of the sample we invested 1 dollar in this stock and got all the dividends and used to buy more of the stock,

how many dollars we would have at the end of the sample?

What is the cumulative return on our investment?

What is the annualized return?

What is the dividend yield?

Suppose we are now at the end of the sample

You have 1000 dollars invested in this stock in the end of the sample, the next day there’s a 16% chance your portfolio’s value will fall below a certain amount. How would you estimate that value?

Now suppose you want to know this value in one year? What is your estimate of this value?

What is the expected value of your holdings in one year? How should you think about estimating this?

What can you plot to have a sense of the distribution of 1 day returns? And 1 year returns?

What plot can you to give you a sense of how these returns varying over time?

What drives these returns? Why do they vary over time?

4.2. Decomposing Returns#

Returns of an individual stock can be driven by many things

Time-value of money. There are periods where you can get very high returns even in perfectly safe assets

Common factors, examples: all stocks went up because of a stronger economy, all stocks went down because of a financial crisis

Individual factors impacting the stock: A new drug/a new technology that the firm sells. Anything specific to the firm

When investing is essential to understand where your performance comes from

We will build towards a framework of investing that thinks differently about investing on systematic risk and idiosyncratic risk

The first step will be to build this decomposition, which will start now and culminate in our factor models lecture

4.2.1. Striping the risk-free rate#

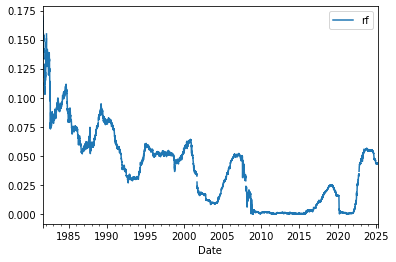

In this class we will do a lot of decomposing, but lets start by stripping down the “time-value of money” piece

We first define an “excess return”: the return minus the risk-free rate

We typically use the returns of a 3-month treasury bill to measure the risk-free rate

this obviously should be currency dependent

We will denote \(rf\) for the risk-free rate

We often add superscript “e” to denote an excess return.

so if \(r^i\) stands for the return of stock \(i\), then \(r^{e,i}\) is it’s excess return

Conceptually you want to use the risk-free asset for the relevant holding period you are evaluating the asset returns, but for this class you can think of the “Fed Funds Rate” or the “3-month treasury-bill rate”

from pandas_datareader.data import DataReader

import datetime

# Define the date range

start_date = datetime.datetime(1960, 1, 1) # Start date (adjust as needed)

end_date = datetime.datetime.now() # End date

df_rf = DataReader("DGS3MO", "fred", start_date, end_date)

df_rf.reset_index(inplace=True)

df_rf.columns = ["Date", "rf"]

df_rf.rf=df_rf.rf/100

df_rf.set_index("Date", inplace=True)

df_rf.plot()

<AxesSubplot:xlabel='Date'>

How do we interpret this rate?

Say if I invested in the tbill in 2005 how much money I would have in the end of 3 months? And in the end of the year?

Lets get another stock to play with and merge it together with our risk-free return

df=get_daily_wrds_single_ticker('NVDA',conn,dividends=False)

df=df.merge(df_rf, left_index=True, right_index=True,how='left')

df

[86580]

| ret | rf | |

|---|---|---|

| date | ||

| 1999-01-25 | 0.104762 | 0.0444 |

| 1999-01-26 | -0.077586 | 0.0446 |

| 1999-01-27 | -0.003115 | 0.0447 |

| 1999-01-28 | -0.003125 | 0.0449 |

| 1999-01-29 | -0.047022 | 0.0448 |

| ... | ... | ... |

| 2024-12-24 | 0.003938 | 0.0440 |

| 2024-12-26 | -0.002068 | 0.0435 |

| 2024-12-27 | -0.020868 | 0.0431 |

| 2024-12-30 | 0.003503 | 0.0437 |

| 2024-12-31 | -0.023275 | 0.0437 |

6527 rows × 2 columns

Lets construct another column called ‘ret_e’ for excess returns

What is the trading interpretation of such series?

Is it the “return” to which strategy exactly?

How the historical distributions of ret and rete compare?

Are their averages similar?

are their historical standard deviations similar?

Do they have similar interpretation?

Is the standard-deviation of risk-free rate useful to tell you the distribution of you returns in the end of 3 months for an investments in the risk-free asset?