12. Performance Evaluation#

🎯 Learning Objectives

Frame performance through risk-adjusted metrics.

Distinguish raw returns from Sharpe ratio and alpha; see why investors focus on excess return per unit of risk and on intercepts from factor regressions.Run an alpha test with the CAPM (and beyond).

Subtract the risk-free rate, regress the strategy’s returns on the market factor, interpret ( \alpha ), ( \beta ), t-statistics, and p-values, and decide whether apparent out-performance is statistically real.Quantify estimation error and sampling variation.

Recognize that every backtest statistic is itself a random variable; learn to compute standard errors, confidence bands, and rolling Sharpe ratios to judge stability through time.Diagnose and mitigate over-fitting.

Understand how data-mining inflates t-stats, learn the dangers of tuning on noise, and practice safeguards such as white-noise checks, cross-validation, and multiple-testing adjustments.Design robust backtests with true out-of-sample evidence.

Build hold-out periods, k-fold splits, and alternating-month/-year samples; evaluate whether a discovery survives when it has never been seen by the model.Combine strategies intelligently.

Explore the joint evaluation of momentum and value portfolios, estimating optimal weights in one subsample and validating them in another; appreciate how covariance matters as much as individual Sharpe ratios.Detect publication and incubation bias.

Compare pre- and post-publication performance, measure how fame or capital influx erodes returns, and adjust expectations accordingly.Translate diagnostics into portfolio sizing.

Use a clear, calibrated discovery process to accept, size, or discard strategies based on the reliability of their alpha and the robustness of their risk profile.

Our premise here is that you are looking to invest in the portfolio with the highest Sharpe Ratio.

Once we have our trading strategy. Lets say we have been trading for N days and have returns \([r_1,r_2,....r_N]\)

What do we do?

12.1. Alpha Test#

subtract the risk-free rate

Choose a factor model–We will work with CAPM for now

Run a regression of your asset on the factor(s)

Then this relation predicts that the intercept, the alpha, should be zero

It is important here that both the test assets and the reference portfolios are all excess returns. This makes the test really simple. If you use returns instead the prediction about the intercept will be different because of the risk-free rate

We refer to these assets on the Left Hand Side of the regression as Test Assets and the asset on the right as the model, which is the candidate tangency portfolio.

So far we have be working with the market as such factor–as the candidate MVE.

This means that we can use this to test whether a new strategy adds value relative to another strategy (i.e. the model).

If the model is “right” than we will fail to reject that the alphas are zero, i.e. the relationship between average returns and betas holds and you cannot get any extra return without increasing your loading on the factor

Test whether the alpha is positive or any particular threshold

Test if \(\alpha_i \geq \underline{\alpha} \)

You basically do a standard t-test

\[t=\frac{\alpha_i-\underline{\alpha} }{\sigma(\alpha_i)}\]for \(\underline{\alpha}=0\) We say

if \(|t|\geq 1.64\) there is a 90% chance that the factor is MVE

if \(|t|\geq 1.96\) there is a 5% chance that the factor is MVE

if \(|t|\geq 2.1\) there is a 2.5% chance that the factor is MVE

if \(|t|\geq 2.6\) there is a 1% chance that the factor is MVE

OR reinstated from this class perspective

If \(t>2,6\), there is a 99% change that the test asset when optimally combined with the factor will produce a higher Sharpe Ratio than the factor alone

But often you will have a hurdle rate higher than zero. For example a pod-shop might want have pods that have sufficiently large alphas

12.2. Why we focus on Alpha?#

The Time-series regression asks the following question:

Can I replicate the average return I get in asset \(i\) by investing in the factor? The betas are exactly such replicating portfolio

Having a non-zero alpha DOES NOT mean that you prefer asset \(i\) to the factor!

But it does mean, that you can do better by investing in both assets

Obviously with a negative weight if the alpha is negative

and a positive weight if the alpha is positive

The alpha test literally asks if the factor is the tangency portfolio with respect to the investment opportunity that includes the test asset (the asset in the left of the regression) and the factor (the asset on the right)

A different way to put it is that a non-zero alpha means that the asset expands the mean-variance frontier relative to an opportunity set that only has the reference factor

Example:

Suppose you are a principal at Citadel deciding on a new pod to the hedge fund.

You are monitoring performance of several outside groups. What do you have to see to invite them to join citadel?

Alternatively you can think about a new trading idea that you monitor it’s theoretical performance but has not yet deployed capital into it. What do you have to see before going in?

Of course, the decision will depend on many things. Lets say

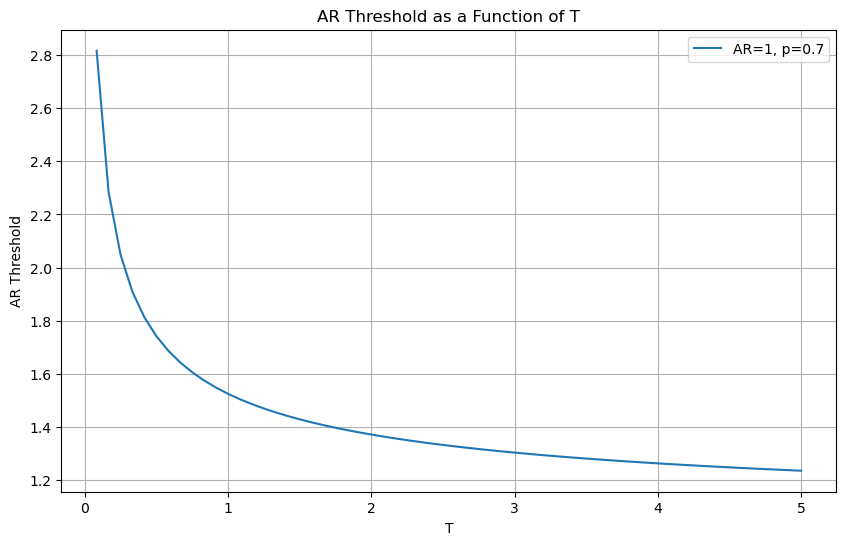

You want to be p=70% certain that the appraisal ratio is higher than 1

We can rewrite in terms of the appraisal ratio

from scipy.stats import norm

def plot_alpha_threshold(ar, T_max,p):

"""

Plots the threshold for alpha as a function of T.

Parameters:

ar (float): Appraisal ratio

sigma (float): Volatility

T_max (int): Maximum value of T to plot

"""

T = np.arange(1, T_max + 1)

tvalue=norm.ppf(p)

alpha_threshold = (tvalue/np.sqrt(T/12)+ar)

plt.figure(figsize=(10, 6))

plt.plot(T/12, alpha_threshold, label=f'AR={ar}, p={p}')

plt.xlabel('T')

plt.ylabel('AR Threshold')

plt.title('AR Threshold as a Function of T')

plt.legend()

plt.grid(True)

plt.show()

# Example usage

plot_alpha_threshold(ar=1, T_max=5*12,p=0.7)

You have a very stringent rule early on, but converge to your target over time as uncertainty shrinks

It takes 1 year with Appraisal ratios close to 1.5

After the first year it decays very slowly

But the big takeway is : The longer the sample, the lower the realized Appraisal/alpha needs to be for me to be convinced that these returns were produced by a high alpha strategy

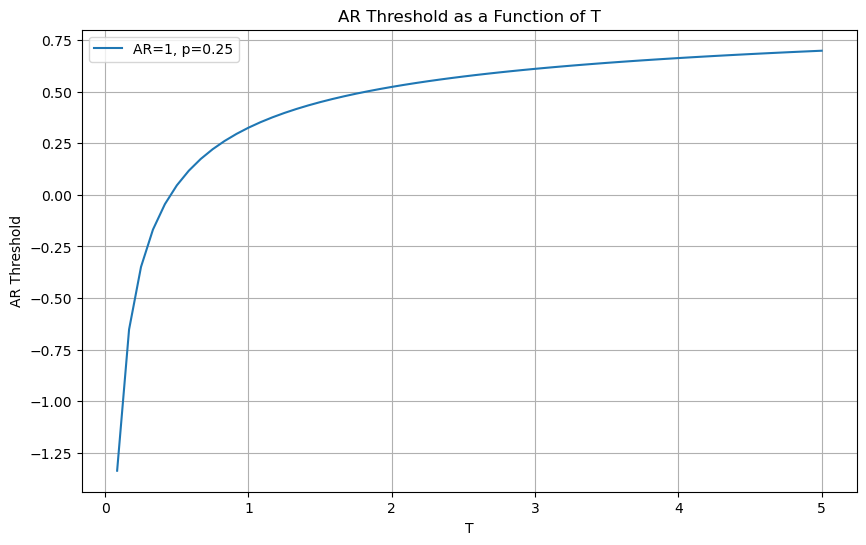

When to fire a pod? When Give up on a strategy?

Lets say you give up ona strategy or pod when you are p=75% confident that their AR is below your target

plot_alpha_threshold(ar=1, T_max=5*12,p=0.25)

Now we have the opposite.

You are quite lenient early on (because uncertainty is high)

But very quickly start to expecting high Appraisal Ratios

By the end of the first year, the pod/strategy has to have an AR higher than 0.25

Aside: There is a tight link between the t-stat of the time-series regression and the appraisal ratio

Note that is the t-stat was constructed under the assumption that returns are i.i.d., we have

Therefore we have $\( Appraisal=\frac{\alpha}{\sigma_e} =\frac{\alpha}{\sigma(\alpha)\sqrt{T}} =\frac{\text{t-stat}}{\sqrt{T}} \)$

12.3. Example: MVE allocation across factors#

def MVE(df,VolTarget=0.1/12**0.5):

# strategy estimation

VarR=df.cov()

ER=df.mean()

W=ER@np.linalg.inv(VarR)

VarW=W@VarR@W

# leverage to target volatility

w= VolTarget/VarW**0.5

Ww=w*W

SR=(df@Ww).mean()/(df@Ww).std()*12**0.5

vol=(df@Ww).std()*12**0.5

# Estimate alpha of Ww portfolio relative to market in estimation period

x = sm.add_constant(df['Mkt-RF'])

y = df @ Ww

regresult = sm.OLS(y, x).fit()

alpha = regresult.params[0]*12

t_alpha = regresult.tvalues[0]

AR=alpha/(regresult.resid.std()*12**0.5)

return {'SR': SR, 'Vol': vol,'Alpha': alpha,'tAlpha': t_alpha,'AR': AR}

df_ff6=get_factors('ff6',freq='monthly').dropna()

MVE(df_ff6.drop(columns='RF'))

c:\Users\alan.moreira\Anaconda3\lib\site-packages\pandas_datareader\famafrench.py:114: FutureWarning: The argument 'date_parser' is deprecated and will be removed in a future version. Please use 'date_format' instead, or read your data in as 'object' dtype and then call 'to_datetime'.

df = read_csv(StringIO("Date" + src[start:]), **params)

c:\Users\alan.moreira\Anaconda3\lib\site-packages\pandas_datareader\famafrench.py:114: FutureWarning: The argument 'date_parser' is deprecated and will be removed in a future version. Please use 'date_format' instead, or read your data in as 'object' dtype and then call 'to_datetime'.

df = read_csv(StringIO("Date" + src[start:]), **params)

c:\Users\alan.moreira\Anaconda3\lib\site-packages\pandas_datareader\famafrench.py:114: FutureWarning: The argument 'date_parser' is deprecated and will be removed in a future version. Please use 'date_format' instead, or read your data in as 'object' dtype and then call 'to_datetime'.

df = read_csv(StringIO("Date" + src[start:]), **params)

c:\Users\alan.moreira\Anaconda3\lib\site-packages\pandas_datareader\famafrench.py:114: FutureWarning: The argument 'date_parser' is deprecated and will be removed in a future version. Please use 'date_format' instead, or read your data in as 'object' dtype and then call 'to_datetime'.

df = read_csv(StringIO("Date" + src[start:]), **params)

c:\Users\alan.moreira\Anaconda3\lib\site-packages\pandas_datareader\famafrench.py:114: FutureWarning: The argument 'date_parser' is deprecated and will be removed in a future version. Please use 'date_format' instead, or read your data in as 'object' dtype and then call 'to_datetime'.

df = read_csv(StringIO("Date" + src[start:]), **params)

c:\Users\alan.moreira\Anaconda3\lib\site-packages\pandas_datareader\famafrench.py:114: FutureWarning: The argument 'date_parser' is deprecated and will be removed in a future version. Please use 'date_format' instead, or read your data in as 'object' dtype and then call 'to_datetime'.

df = read_csv(StringIO("Date" + src[start:]), **params)

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\3217549347.py:18: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

alpha = regresult.params[0]*12

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\3217549347.py:19: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

t_alpha = regresult.tvalues[0]

{'SR': 1.2117990142576063,

'Vol': 0.10000000000000002,

'Alpha': 0.10439151284806436,

'tAlpha': 8.74047758202913,

'AR': 1.1247290000979995}

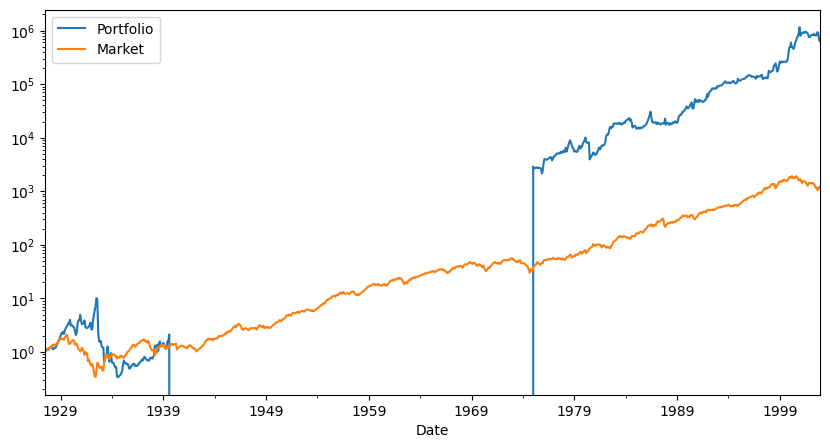

Large Sharp ratios in estimation sample

Gigantic alpha

This example is particularly extreme because the strategy is literally using full sample information about the moments

The strategy is guaranteed to do amazing ..in sample

This is not even a valid trading strategy

What is a Valid Trading Strategy?

A trading strategy is a procedure that maps any information known up to time t, into a set of trading instructions for time \(T>t\).

the mean-variance analysis we did so far was not a valid trading strategy:

we used data of the whole sample to estimate the weights of our strategy and evaluated the strategy in the same sample

If you construct the MVE portfolio in a sample and use the CAPM to test if that strategy has alpha in that sample, you mechanically will find that the strategy indeed has alpha. You constructed it to be MVE

It has the most severe form of look-ahead” bias.

It is very important that the trading strategy only uses information that is known at the time of the trade

you obviously cannot trade on info that you don’t know

The weights of a trading strategy must either:

Add up to 1. So it describes what you do with your entire capital.

Or add up to 0. So the strategy is self-financing. For example, borrow 1 dollar at the risk-free rate and buy 1 dollar worth of the market portfolio

Every time you trade on the excess returns, you can think of the weights “adding up to zero”, because it is a long-short portfolio that is long the risky asset and financing with the risk-free rate

In practice all strategies demand some capital as no bank allow us to borrow without putting some capital in, but these self financed strategies are quite convenient to work with.

Lets now replicate how a trader could implement this strategy in reality

They obviously would not be able to trade in the same sample that they estimate the returns moments that was the input for optimization– this would violate the information requirement state above.

To replicate this will split in two samples

Estimation sample up to 2013

Testing sample 2014-2024

def MVE(df_est,df_test,VolTarget=0.1/12**0.5):

# strategy estimation

VarR=df_est.cov()

ER=df_est.mean()

W=ER@np.linalg.inv(VarR)

VarW=W@VarR@W

# leverage to target volatility

w= VolTarget/VarW**0.5

Ww=w*W

SR=(df_test@Ww).mean()/(df_test@Ww).std()*12**0.5

vol=(df_test@Ww).std()*12**0.5

# Estimate alpha of Ww portfolio relative to market in estimation period

x = sm.add_constant(df_test['Mkt-RF'])

y = df_test @ Ww

regresult = sm.OLS(y, x).fit()

alpha = regresult.params[0]*12

t_alpha = regresult.tvalues[0]

AR=alpha/(regresult.resid.std()*12**0.5)

return {'SR': SR, 'Vol': vol,'Alpha': alpha,'tAlpha': t_alpha,'AR': AR}

# estimate and test in the same period (up to 2013)

print(MVE(df_ff6[:'2013'].drop(columns='RF'),df_ff6[:'2013'].drop(columns='RF')))

# estimate with data up to 2013 and test in the period (2014-2024)

print(MVE(df_ff6[:'2013'].drop(columns='RF'),df_ff6['2014':].drop(columns='RF')))

{'SR': 1.3561433527237596, 'Vol': 0.09999999999999996, 'Alpha': 0.1246857103192843, 'tAlpha': 9.17651440156582, 'AR': 1.3003526338233706}

{'SR': 0.5815780691881101, 'Vol': 0.11920484907925707, 'Alpha': 0.034829878422109814, 'tAlpha': 1.0202350059123126, 'AR': 0.31614968598421284}

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\985445017.py:18: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

alpha = regresult.params[0]*12

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\985445017.py:19: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

t_alpha = regresult.tvalues[0]

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\985445017.py:18: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

alpha = regresult.params[0]*12

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\985445017.py:19: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

t_alpha = regresult.tvalues[0]

What do you see here?

Is that expected?

Why this is happening?

we can’t even reject a zero alpha?

Is 10 years enough time to tell? Maybe the sample is too short

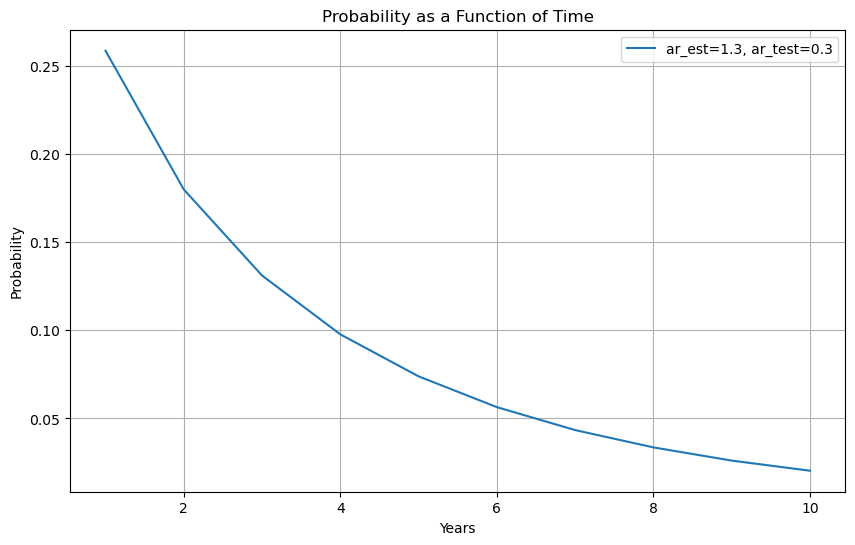

Key question is: If we think our AR is 1.3, would 10 years be enough to reject the null of zero alpha?

Under the null that our strategy indeed has such high alpha as in the estimation sample, what is the probability you observe an alpha as low as we observe for a sample of T years?

The pvalue associate with a particular realized alpha

# Define the parameters

alpha_est = 0.12

alpha_test = 0.038

ar_est=1.3

ar_test=0.3

sigmae_test=alpha_test/ar_test #( I am recovering the sigmae from the AR)

T = np.arange(1, 11) # 10 years

# Calculate the probabilities that we would observe such low alpha in a sample that large if out estimation sample is correct

probabilities = norm.cdf((alpha_test - alpha_est)/sigmae_test * np.sqrt(T))

# Plot the probabilities

plt.figure(figsize=(10, 6))

plt.plot(T , probabilities, label=f'ar_est={ar_est}, ar_test={ar_test}')

plt.xlabel('Years')

plt.ylabel('Probability')

plt.title('Probability as a Function of Time')

plt.legend()

plt.grid(True)

plt.show()

This give us a quickly way to diagnostic if the sample is large enough

For example, if you shrink the sample you will see that observing such low alpha becomes increasingly likely suggesting the test sample would not be large enough

You have to design your test sample having in mind what do you want to test

Thinking clearly about the desired size of your estimation sample is very important

A sample that is too short, will not allow you properly test your strategy

You see that with 1 year of sample and a mediocre alpha you still assign north of 20% probability that the strategy has the alpha in the estimation sample

You want to leave enough data so that you can actually test the strategy

12.4. The basic problem of overfitting#

In these example we are testing some fixed strategy

In practice we use data to design the strategy

Any sample estimate is itself a random variable. The uncertainty in these estimates may encourage us to:

Select signals that are pure noise with no real predictive power.

Select real signals but overweight their importance to the model.

Reject signals that are real but that did not show up in the sample.

When choosing model weights, implicitly and explicitly (through optimization) we assign weights that exaggerate the overfitting problem.

Here is a fun twitter thread about this basic problem

It has this really nice plot that illustrates the fundamental issue

12.5. Be clear about you goal#

The central goal is to calibrate your discovery process

You want to invest in strategies that have alpha, disregard the ones that don’t

You need to know that you are keeping strategies that are good enough

BUT are not so tough that you are discarding good ideas

Ideas are limited after all

The better you know the quality of your discovery, the easier will be the size your positions

12.6. How to guard against it?#

Additional diagnostics

Think harder about your Backtests

Estimation/validation/Out of Sample analysis

12.6.1. Additional Diagnostics#

You should look at many many things!

Strategy Sharpe Ratio

Report t-stat of mean return

Alpha and t-stat of alpha

Confidence intervals around key results including SR

Cumulative return and drawdown graphs

where the performance is coming form? Is it steady? When it does poorly?

Report percentage of observations with +/- 3 std events

Remove “influential data points”: Calculate fraction of data points needed to halve estimated Sharpe ratio.

When comparing Strategies, always do it over the same sample period**

We will now split up our code in terms of strategy weight estimation and diagnostics

This makes the function very portable to evaluate alternative strategies

def MVE(df,VolTarget):

VarR=df.cov()

ER=df.mean()

W=ER@np.linalg.inv(VarR)

VarW=W@VarR@W

w= VolTarget/VarW**0.5

Ww=w*W

return Ww

Ww=MVE(df_ff6['1963':str(1993)].drop(columns='RF'),VolTarget=0.1/12**0.5)

Ww

array([0.28438373, 0.41158513, 0.60546531, 1.55642918, 1.05920795,

0.42952517])

Here is our diagnostic function

It is still incomplete as we will be adding additional diagnostics through the notebook

you should think as a function that we add all diagnostics you want to see and then you run any strategy through it

def Diagnostics(W,df,R=None):

results={}

Rf=df['RF']

Factor=df['Mkt-RF']

df=df.drop(columns=['RF'])

if R is None:

# we use the returns of the portfolio if R is provided or construct the returns from the weights

R=df @ W

T=R.shape[0]

results['SR']=(R).mean()/(R).std()*12**0.5

results['SR_factor']=(Factor).mean()/(Factor).std()*12**0.5

results['Vol']=(R).std()*12**0.5

results['Vol_factor']=(Factor).std()*12**0.5

results['mean']=(R).mean()*12

results['t_mean']=(R).mean()/(R).std()*T**0.5

results['mean_factor']=(Factor).mean()*12

results['t_mean_factor']=(Factor).mean()/(R).std()*T**0.5

# Estimate alpha of Ww portfolio relative to market in estimation period

x = sm.add_constant(Factor)

y = R

regresult = sm.OLS(y, x).fit()

results['alpha'] = regresult.params[0]*12

results['t_alpha']= regresult.tvalues[0]

results['AR']= results['alpha']/(regresult.resid.std()*12**0.5)

results['tails']=(R <-3*R.std()).mean()+(R >3*R.std()).mean()

results['tails_factor']=(Factor <-3*Factor.std()).mean()+(Factor >3*Factor.std()).mean()

results['min_ret']=R.min()

results['min_factor']=Factor.min()

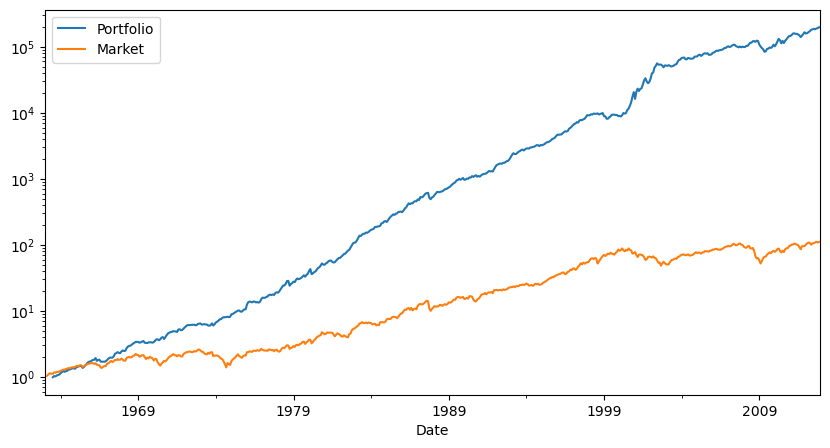

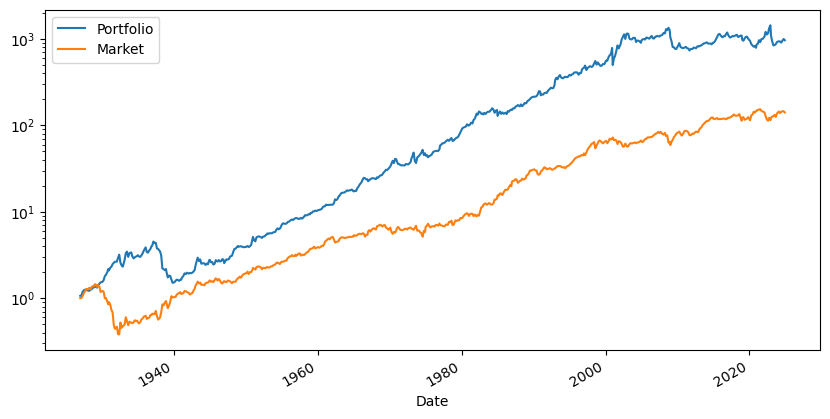

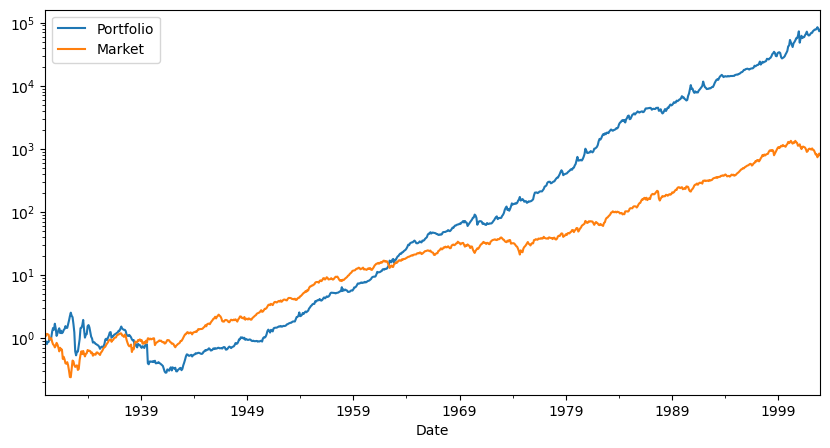

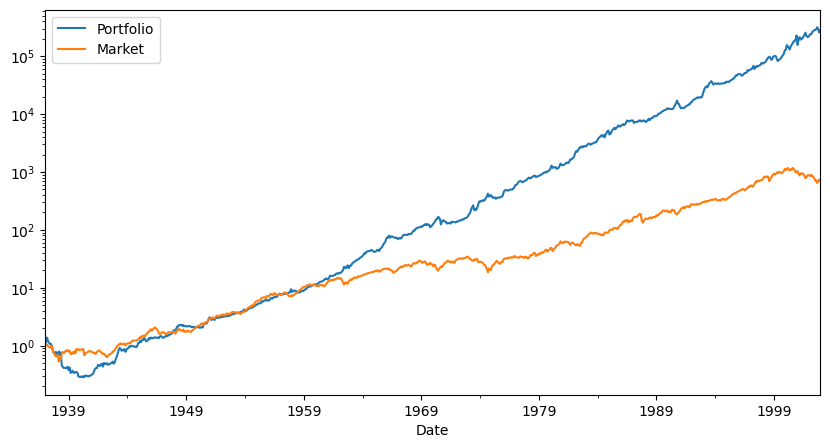

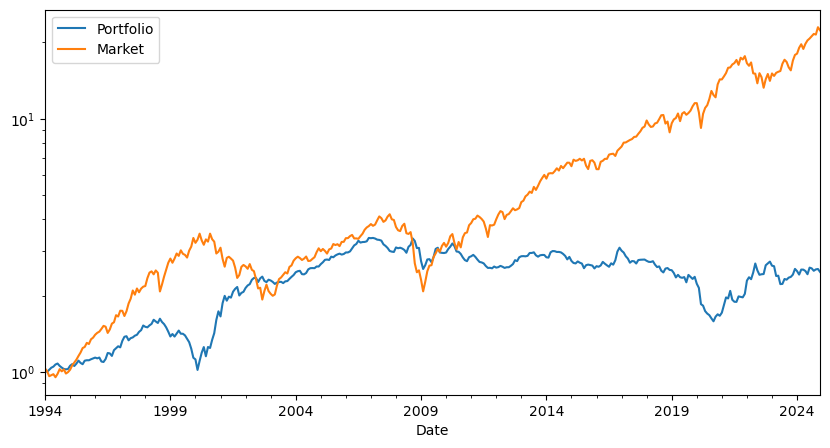

fig, ax = plt.subplots(1,figsize=(10,5))

# cumulative returs

(R+Rf+1).cumprod().plot(logy=True)

(Rf+Factor+1).cumprod().plot(logy=True)

plt.legend(['Portfolio','Market'])

### Things to add that we discuss below

# 2. Drawdown plots

# 3. Fraction of observation to half the mean returns

# 4. Sharpe Ratio standard deviation/t-test

results['t_SR']=0 # to be implemented

results['t_SR_factor']=0 # to be implemented

results['fraction_tohalf']=0 # to be implemented

results['fraction_tohalf_factor']=0 # to be implemented

formatted_dict = {key: [value] for key, value in results.items()}

return pd.DataFrame(formatted_dict).T

split_year=2012

df_est=df_ff6['1963':str(split_year)]

Volmkt=df_est['Mkt-RF'].std()

Ww=MVE(df_est.drop(columns='RF'),VolTarget=Volmkt)

df_test=df_ff6[str(split_year+1):]

Results=pd.DataFrame()

Results['Est']=Diagnostics(Ww,df_est)

Results['Test']=Diagnostics(Ww,df_test)

Results

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\2254644634.py:25: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['alpha'] = regresult.params[0]*12

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\2254644634.py:26: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['t_alpha']= regresult.tvalues[0]

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\2254644634.py:25: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['alpha'] = regresult.params[0]*12

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\2254644634.py:26: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['t_alpha']= regresult.tvalues[0]

| Est | Test | |

|---|---|---|

| SR | 1.344552 | 0.655413 |

| SR_factor | 0.360988 | 0.883752 |

| Vol | 0.156294 | 0.180788 |

| Vol_factor | 0.155800 | 0.150080 |

| mean | 0.210145 | 0.118491 |

| t_mean | 9.507416 | 2.270417 |

| mean_factor | 0.056242 | 0.132633 |

| t_mean_factor | 2.544511 | 2.541407 |

| alpha | NaN | 0.056015 |

| t_alpha | NaN | 1.125779 |

| AR | NaN | 0.336644 |

| tails | 0.020000 | 0.006944 |

| tails_factor | 0.008333 | 0.013889 |

| min_ret | -0.215281 | -0.144920 |

| min_factor | -0.232400 | -0.133900 |

| t_SR | 0.000000 | 0.000000 |

| t_SR_factor | 0.000000 | 0.000000 |

| fraction_tohalf | 0.000000 | 0.000000 |

| fraction_tohalf_factor | 0.000000 | 0.000000 |

To complete our diagnostics it remains

Compute the volatility of a Sharpe ratio

Compute the fraction of data points needed to halve the Sharpe ratio

Drawdowns and cumulative return plots

What is the volatility of the Sharpe Ratio?

SR is different because it is not an average, thus our standard way to compute standard errors don’t quite work out

We have two options:

we can assume normal distribution to get

\[\sigma(SR)=\sqrt{\frac{1}{T-1}(1+SR^2/2)}\]We can bootstrap from the data with replacement to create alternative sample

Bootstraping

Instead of assuming returns have a particular distribution we can sample from the realized distribution to obtain alternative realization of the world

Here how it works

Draw from the data with replacement T times. This gives you a “new sample”.

Construct The sharpe ratio in this sample, save it

Do that M times and compute the standard deviation of the SR across samples

You can also directly look at the 5% worse realizations

This give you the different SR that can be produced by the same truth

Can ask questions like: how bad the SR is likely to be with only 1 year of data

# Sharpe ratio standard error using the normal assumption

def SR_vol(R):

SR=R.mean()/R.std()

T=R.shape[0]

return (1/(T-1)*(1+SR**2/2))**0.5

SR_vol(df_est['Mkt-RF'])

# Sharpe ratio standard error using the bootstrap method

def SR_vol_boot(R,N):

SR=np.array([])

T=R.shape[0]

for i in range(N):

Rs=R.sample(n=T, replace=True)

SR=np.append(SR,Rs.mean()/Rs.std())

return Rs.std(), np.percentile(SR, 5)

print(SR_vol(df_ff6['Mkt-RF']))

SR_vol_boot(df_ff6['Mkt-RF'],10000)

0.036991266164612846

(0.04393346361568302, 0.06800667732507118)

# fraction to half. Code is incomplete. I need to remove the point that has the most impact on the Sharpe Ratio, not the first point. \

# which point should I remove?

def fractiontohalf(R):

SR=R.mean()/R.std()

target_sharpe=SR/2

T=R.shape[0]

removed_points = 0

while SR > target_sharpe:

# this is simply the first point. What is the point that I should take out for maximum impact?

idx_to_remove = R.index[0]. # Find the index of the point with the maximum impact on the Sharpe Ratio

print(R.loc[idx_to_remove])

R = R.drop(idx_to_remove)

SR= R.mean() / R.std()

removed_points += 1

return removed_points/T

fractiontohalf(df_ff6['Mkt-RF'])

0.161

0.1366

0.1365

0.1247

0.1247

0.1216

0.11349999999999999

0.113

0.1114

0.1084

0.10279999999999999

0.1018

0.0959

0.09570000000000001

0.09539999999999998

0.09050000000000001

0.0895

0.0883

0.08710000000000001

0.0842

0.084

0.08220000000000001

0.0815

0.03116531165311653

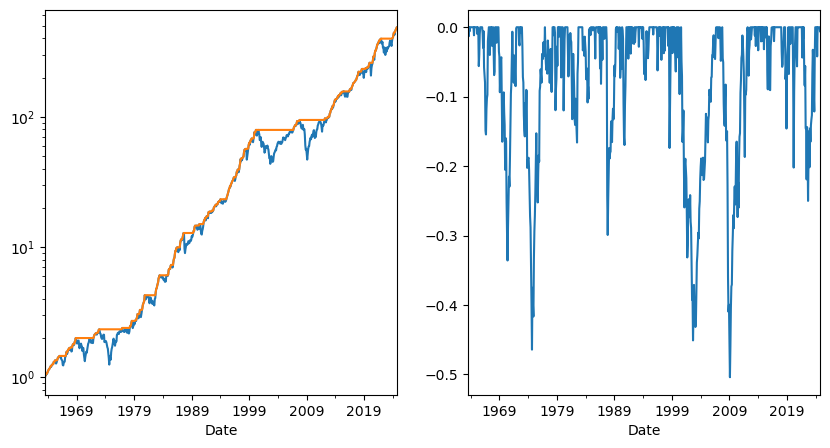

Drawdown plots

-It is common to look at how long are the periods where you are losing money on a strategy

-This might inform you how sticky your clients need to be. For example might inform how long the lockup in your fund might need to be

-This is also relevant for Hedge funds where hedge fund managers are compensated only when they go above the high-water mark

-or much more basically how long are going to be the painful periods where you are losing money

We simply subtract from the cumulative return of the strategy, it’s peak performance up to that point and divide by the peak. This tell you the cumulative return from the most recent peak at a given point.

fig,ax=plt.subplots(1,2,figsize=(10,5))

cumulative_performance=(df_ff6['Mkt-RF']+df_ff6.RF+1).cumprod()

running_max =cumulative_performance.cummax()

drawdown = (cumulative_performance- running_max)/running_max

cumulative_performance.plot(ax=ax[0],logy=True)

running_max.plot(ax=ax[0],logy=True)

drawdown.plot(ax=ax[1])

<Axes: xlabel='Date'>

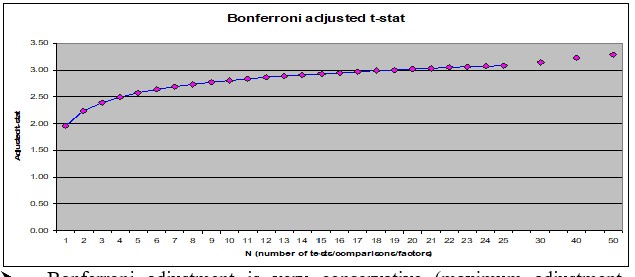

12.6.2. Adjusting for Discarded Signals#

Often we look at many signals to find the one

This makes conventional thresholds for t-tests too small

There are many different adjustments for this

Bonferroni T-stats is frequently used but it is quite conservative (rejects too frequently)

You go form 1.96 to 3 as you look at 20 signals instead of 1

Correction changes the most as you go from 1 to 5 signals

How to use this?

If you know that you are trying many things you have to adjust your hurdle

Example:

Say you tried 100 different ideas in a 24 month period

What fraction will look good from perspective of an alpha test that selects strategies with t-test>1.64 even if they are actually all bad

R=pd.DataFrame(norm.rvs(loc=0,scale=0.16/12**0.5,size=(24,100)))

t=R.mean()/(R.std()/24**0.5)

(t>1.64).sum()

4

Suppose there is one good one.

What is your hit rate?

How often you will find the correct idea?

Things to do: Change cutoff, change Sharpe ratio,change sample size

SR=1

t_cutoff=2

Nmonths=48

number_of_correct=0

number_of_wrong=0

Ideas=100

simulations=1000

for i in range(1,simulations):

R=pd.DataFrame(norm.rvs(loc=0,scale=1,size=(Nmonths,Ideas)))

# first strategy is the good one

R.iloc[:,0]=R.iloc[:,0]+SR/12**0.5

t=R.mean()/(R.std()/Nmonths**0.5)

number_of_correct+= (t.iloc[0]>t_cutoff).sum()

number_of_wrong+= (t.iloc[1:]>t_cutoff).sum()

hit_rate=number_of_correct/(number_of_correct+number_of_wrong)

print(hit_rate,number_of_correct/simulations)

0.17073976221928666 0.517

12.7. How to split you sample?#

A few popular approaches are

Rolling window estimation

Use odd months to estimate signals and even months to compute returns and test signals. Repeat by switching odd and even months.

Split sample in half, estimation and test sample

Split in three: estimation, test for model selection, hold-out sample

Aplication 1: optimal combitation of Momentum and value strategies

We will split our sample into two halves:

take all observations from odd months in even years and even months in odd years (i.e., if starting in 1980, this would look like: 01/1980, 03/1980, … , 11/1980, 02/1981, 04/1981, … 12/1981, 01/1982, 03/1982, …); and

the opposite (take all observations from even months in even years and odd months in odd years).

A nice thing to do in halves is that we can cross-validated use first sample 1 as estimation sample and sample2 as test sample, and then invert.

If you have lot of data one might split the data in 5 folds and do the estimation in one and test on the rest.

You are not testing particular weights but an approach to portfolio construction, i.e., a trading rule

Here we will test the MVE approach of doing things. You can test all sort of different approaches

Lets construct both samples by using a function that returns True if the number is odd and then apply this function to the months and years of our dataset.

# construct function that identifies if a number is odd

def sample(df):

def is_odd(num):

return num % 2 != 0

# create a sample that selects the even years and odd months

evenyear_oddmonth=(is_odd(df.index.year)==False) & (is_odd(df.index.month)==True)

# create a sample that selects the odd years and even months

oddyear_evenmonth=(is_odd(df.index.year)==True) & (is_odd(df.index.month)==False)

# join the two samples

sample1=evenyear_oddmonth | oddyear_evenmonth

# creates the mirror sample

sample2=~sample1

return sample1,sample2

df_ff6=get_factors('ff6',freq='monthly')

sample1,sample2=sample(df_ff6)

sample1

c:\Users\alan.moreira\Anaconda3\lib\site-packages\pandas_datareader\famafrench.py:114: FutureWarning: The argument 'date_parser' is deprecated and will be removed in a future version. Please use 'date_format' instead, or read your data in as 'object' dtype and then call 'to_datetime'.

df = read_csv(StringIO("Date" + src[start:]), **params)

c:\Users\alan.moreira\Anaconda3\lib\site-packages\pandas_datareader\famafrench.py:114: FutureWarning: The argument 'date_parser' is deprecated and will be removed in a future version. Please use 'date_format' instead, or read your data in as 'object' dtype and then call 'to_datetime'.

df = read_csv(StringIO("Date" + src[start:]), **params)

c:\Users\alan.moreira\Anaconda3\lib\site-packages\pandas_datareader\famafrench.py:114: FutureWarning: The argument 'date_parser' is deprecated and will be removed in a future version. Please use 'date_format' instead, or read your data in as 'object' dtype and then call 'to_datetime'.

df = read_csv(StringIO("Date" + src[start:]), **params)

c:\Users\alan.moreira\Anaconda3\lib\site-packages\pandas_datareader\famafrench.py:114: FutureWarning: The argument 'date_parser' is deprecated and will be removed in a future version. Please use 'date_format' instead, or read your data in as 'object' dtype and then call 'to_datetime'.

df = read_csv(StringIO("Date" + src[start:]), **params)

c:\Users\alan.moreira\Anaconda3\lib\site-packages\pandas_datareader\famafrench.py:114: FutureWarning: The argument 'date_parser' is deprecated and will be removed in a future version. Please use 'date_format' instead, or read your data in as 'object' dtype and then call 'to_datetime'.

df = read_csv(StringIO("Date" + src[start:]), **params)

c:\Users\alan.moreira\Anaconda3\lib\site-packages\pandas_datareader\famafrench.py:114: FutureWarning: The argument 'date_parser' is deprecated and will be removed in a future version. Please use 'date_format' instead, or read your data in as 'object' dtype and then call 'to_datetime'.

df = read_csv(StringIO("Date" + src[start:]), **params)

array([False, True, False, ..., False, True, False])

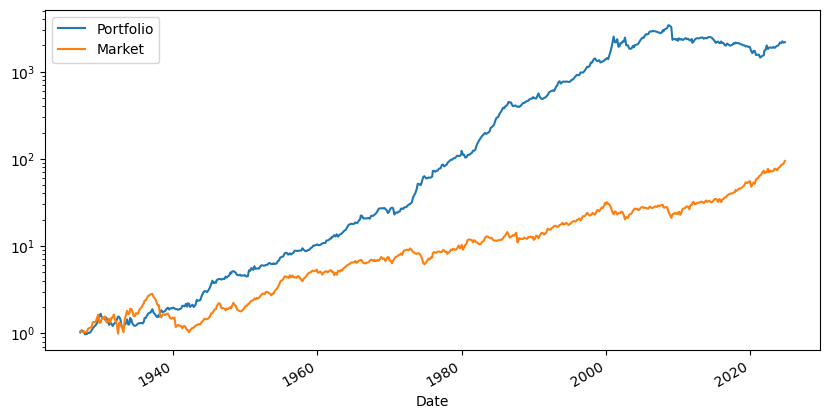

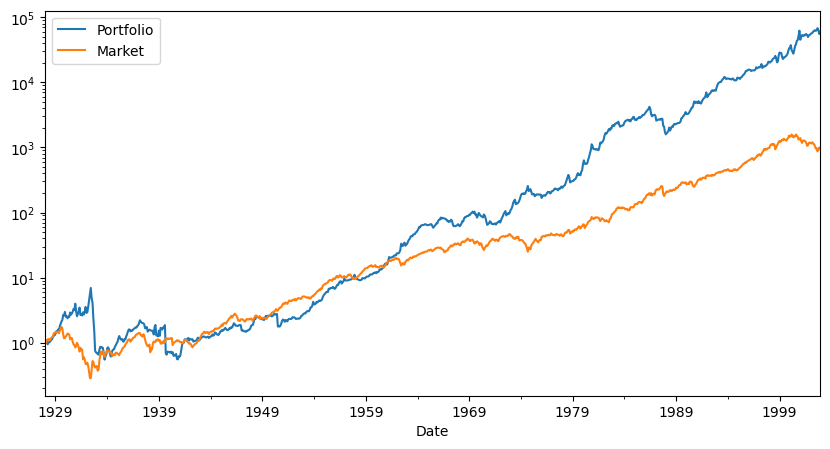

We can now use our diagnostic functions

df_est=df_ff6.loc[sample1,['HML','MOM','Mkt-RF','RF']]

df_test=df_ff6.loc[sample2,['HML','MOM','Mkt-RF','RF']]

Ww=MVE(df_est[['HML','MOM']],VolTarget=df_est['Mkt-RF'].std())

Ww=np.append(Ww,0) # I am setting the weight of the market to zero. Function that we created expects the same number of risky asset passed

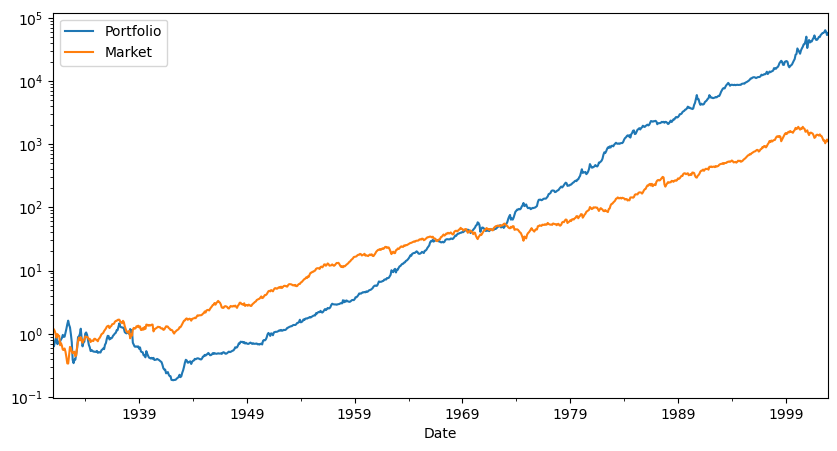

Results=pd.DataFrame()

Results['Test_s2_est1']=Diagnostics(Ww,df_test)

df_est=df_ff6.loc[sample2,['HML','MOM','Mkt-RF','RF']]

df_test=df_ff6.loc[sample1,['HML','MOM','Mkt-RF','RF']]

Ww=MVE(df_est[['HML','MOM']],VolTarget=df_est['Mkt-RF'].std())

Ww=np.append(Ww,0)

Results['Test_s1_est2']=Diagnostics(Ww,df_test)

Results

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\1740476391.py:24: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['alpha'] = regresult.params[0]*12

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\1740476391.py:25: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['t_alpha']= regresult.tvalues[0]

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\1740476391.py:24: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['alpha'] = regresult.params[0]*12

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\1740476391.py:25: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['t_alpha']= regresult.tvalues[0]

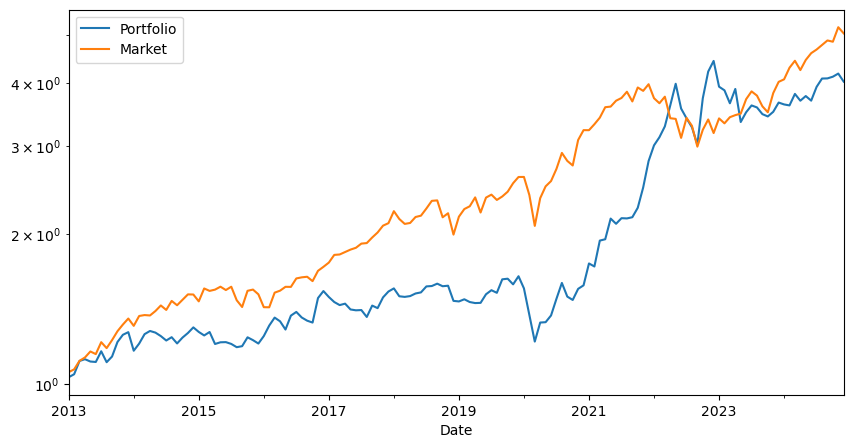

| Test_s2_est1 | Test_s1_est2 | |

|---|---|---|

| SR | 0.643446 | 0.821442 |

| SR_factor | 0.472651 | 0.415249 |

| Vol | 0.202262 | 0.170955 |

| Vol_factor | 0.180817 | 0.189092 |

| mean | 0.130145 | 0.140430 |

| t_mean | 4.504124 | 5.750093 |

| mean_factor | 0.085463 | 0.078520 |

| t_mean_factor | 2.957760 | 3.215126 |

| alpha | 0.149375 | 0.146594 |

| t_alpha | 5.224558 | 5.977245 |

| AR | 0.753935 | 0.860749 |

| tails | 0.013605 | 0.017007 |

| tails_factor | 0.017007 | 0.011905 |

| min_ret | -0.370722 | -0.284959 |

| min_factor | -0.291300 | -0.238200 |

| t_SR | 0.000000 | 0.000000 |

| t_SR_factor | 0.000000 | 0.000000 |

| fraction_tohalf | 0.000000 | 0.000000 |

| fraction_tohalf_factor | 0.000000 | 0.000000 |

What do we learn?

What looks suspicious?

We are combining two factors that had very famous professors publishing them around 1990.

Does that matter?

Does that change the interpretation of the results?

12.7.1. Robustifying your Backtests#

Calculate TRUE out of sample Sharpe ratios: Have a hold-out sample not used in backtest to test out of sample performance.

Be careful to not use out of sample results for tunning and model choice

If you use result of the test sample to choose a model parameter or pick a strategy–evaluate in a third holdout sample

Be very careful for information of the test sample to not leak into the estimation.

For example, your idea might be motivated by a few months where you know these firms did well.

Be sure to check the results are not driving by this

When tuning/model choice is needed you must have

Estimation

Test sample

Hold out sample

Keep track of your discarded ideas going forward

Application 2: fine-tuning the look-back window

Now we will compare a variety of models to see which one works best outside of the test sample

So we will have the estimation sample where we will estimate the different models– which in this case will be strategies with different look-back windows

What is a look-back window?

It is the window the we use to estimate our moments

The trade-off here is:

If you make too short you just pick up noise

If you make too long the moments might not be that informative about future data

Particularly true in he case of volatility, but also true for correlations and expected returns

Particularly severe when dealing with individual assets and not characteristic-based strategies

You also want to have enough left to do actual evaluation of your strategies ( see the discussion before)

We will split the sample in two.

Last 20 years will be the hold out sample

The remaining of the sample estimation+test,

holdout_sample=df_ff6.index.year>2023-21

df_hold=df_ff6.loc[holdout_sample,['HML','MOM','Mkt-RF','RF']]

df_EstTest=df_ff6.loc[~holdout_sample,['HML','MOM','Mkt-RF','RF']]

We will now do the estimation fine-tuning.

Lets start by building a code that gets our desired window, do the estimation and construct the return series on the test sample

window=60

df=df_EstTest.copy()

# Use data that is not in the holdout sample to estimate the strategy

df['Strategy']=np.nan

# loop over the test sample

for d in df.index[window:]:

# select the first 36 months of the sample ( and then add one more month at the tail and drop the last month on the head each time we loop over the sample)

df_temp=df.loc[d - pd.DateOffset(months=window):d - pd.DateOffset(months=1)].copy()

# construct optimal portfolio given these 36 months

X=MVE(df_temp[['HML','MOM']],VolTarget=df_temp['Mkt-RF'].std())

# save the returns of the strategy and the market on the FOLLOWING month

# this month does NOT enter the estimation of the strategy

df.at[d,'Strategy']= df.loc[d,['HML','MOM']] @ X

df

| HML | MOM | Mkt-RF | RF | Strategy | |

|---|---|---|---|---|---|

| Date | |||||

| 1927-01-01 | 0.0454 | 0.0036 | -0.0006 | 0.0025 | NaN |

| 1927-02-01 | 0.0294 | -0.0214 | 0.0418 | 0.0026 | NaN |

| 1927-03-01 | -0.0261 | 0.0361 | 0.0013 | 0.0030 | NaN |

| 1927-04-01 | 0.0081 | 0.0430 | 0.0046 | 0.0025 | NaN |

| 1927-05-01 | 0.0473 | 0.0300 | 0.0544 | 0.0030 | NaN |

| ... | ... | ... | ... | ... | ... |

| 2002-08-01 | 0.0328 | 0.0190 | 0.0050 | 0.0014 | 0.034597 |

| 2002-09-01 | 0.0145 | 0.0913 | -0.1035 | 0.0014 | 0.073791 |

| 2002-10-01 | -0.0394 | -0.0558 | 0.0784 | 0.0014 | -0.065174 |

| 2002-11-01 | -0.0126 | -0.1633 | 0.0596 | 0.0012 | -0.127139 |

| 2002-12-01 | 0.0214 | 0.0964 | -0.0576 | 0.0011 | 0.079017 |

912 rows × 5 columns

Note that we have no observations early on as we need at the 36 months to estimate and none after 2002, that is the sample that we will hold out

Now lets call out Diagnostics

Only detail is that we have to pass the strategy return and not the weights since those are not fixed

# I am passing the returns of the strategy as the returns of the portfolio

# I cannot pass the weight becasue the weight is not constant over time

df=df.dropna()

Diagnostics(0,df,R=df['Strategy'])

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\2254644634.py:25: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['alpha'] = regresult.params[0]*12

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\2254644634.py:26: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['t_alpha']= regresult.tvalues[0]

| 0 | |

|---|---|

| SR | 0.630255 |

| SR_factor | 0.465408 |

| Vol | 0.235094 |

| Vol_factor | 0.185698 |

| mean | 0.148169 |

| t_mean | 5.310620 |

| mean_factor | 0.086425 |

| t_mean_factor | 3.097629 |

| alpha | 0.153550 |

| t_alpha | 5.457830 |

| AR | 0.653936 |

| tails | 0.018779 |

| tails_factor | 0.014085 |

| min_ret | -0.470448 |

| min_factor | -0.238200 |

| t_SR | 0.000000 |

| t_SR_factor | 0.000000 |

| fraction_tohalf | 0.000000 |

| fraction_tohalf_factor | 0.000000 |

So far, is this a true out of sample test?

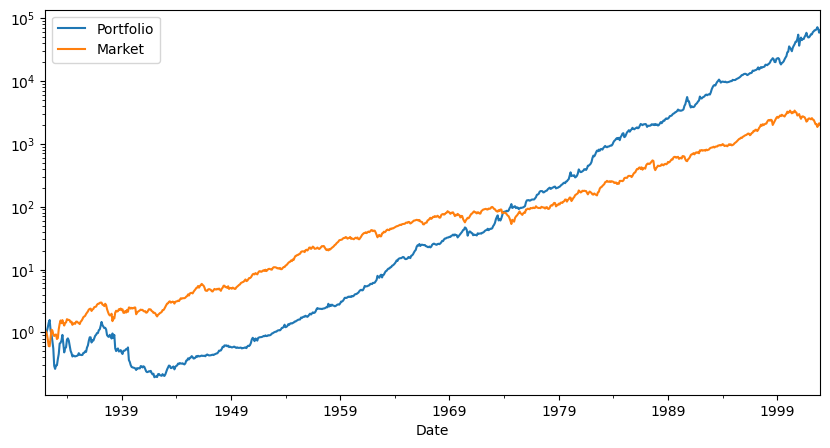

Now that we have this code we can put in a function so we can evaluate for different lookbacks

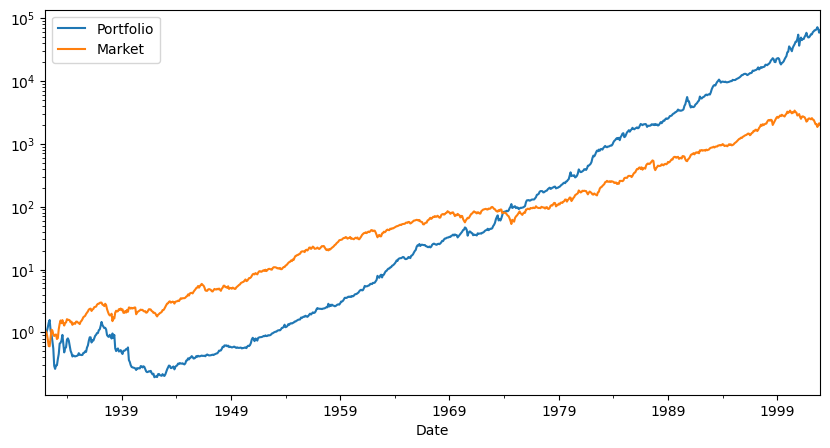

def RollingEval(df,window):

# Use data that is not in the holdout sample to estimate the strategy

df['Strategy']=np.nan

# loop over the test sample

for d in df.index[window:]:

# select the first 36 months of the sample ( and then add one more month at the tail and drop the last month on the head each time we loop over the sample)

df_temp=df.loc[d - pd.DateOffset(months=window):d - pd.DateOffset(months=1)].copy()

# construct optimal portfolio given these 36 months

X=MVE(df_temp[['HML','MOM']],VolTarget=df_temp['Mkt-RF'].std())

# save the returns of the strategy and the market on the FOLLOWING month

# this month does NOT enter the estimation of the strategy

df.at[d,'Strategy']= df.loc[d,['HML','MOM']] @ X

return df

Returns=RollingEval(df_EstTest,12)

Returns=Returns.dropna()

Diagnostics(0,Returns,R=Returns['Strategy'])

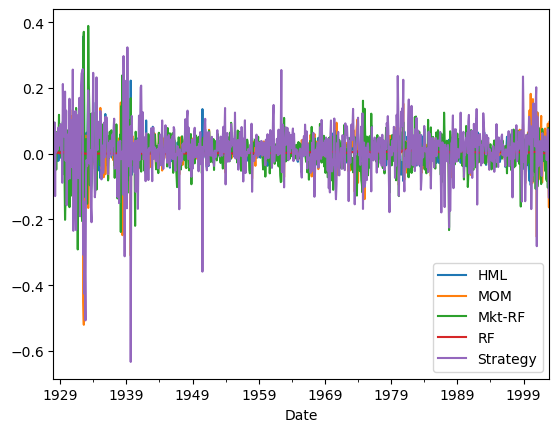

Returns.plot()

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\2254644634.py:25: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['alpha'] = regresult.params[0]*12

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\2254644634.py:26: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['t_alpha']= regresult.tvalues[0]

<Axes: xlabel='Date'>

windows=[6,12,24,36,48,60,72,120]

Results=pd.DataFrame([],index=Results.index,columns=windows,dtype=float)

for w in windows:

Returns=RollingEval(df_EstTest,w)

Returns=Returns.dropna()

Results[w]=Diagnostics(0,Returns,R=Returns['Strategy'])

Results

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\2254644634.py:25: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['alpha'] = regresult.params[0]*12

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\2254644634.py:26: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['t_alpha']= regresult.tvalues[0]

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\2254644634.py:25: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['alpha'] = regresult.params[0]*12

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\2254644634.py:26: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['t_alpha']= regresult.tvalues[0]

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\2254644634.py:25: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['alpha'] = regresult.params[0]*12

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\2254644634.py:26: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['t_alpha']= regresult.tvalues[0]

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\2254644634.py:25: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['alpha'] = regresult.params[0]*12

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\2254644634.py:26: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['t_alpha']= regresult.tvalues[0]

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\2254644634.py:25: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['alpha'] = regresult.params[0]*12

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\2254644634.py:26: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['t_alpha']= regresult.tvalues[0]

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\2254644634.py:25: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['alpha'] = regresult.params[0]*12

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\2254644634.py:26: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['t_alpha']= regresult.tvalues[0]

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\2254644634.py:25: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['alpha'] = regresult.params[0]*12

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\2254644634.py:26: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['t_alpha']= regresult.tvalues[0]

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\2254644634.py:25: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['alpha'] = regresult.params[0]*12

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\2254644634.py:26: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['t_alpha']= regresult.tvalues[0]

| 6 | 12 | 24 | 36 | 48 | 60 | 72 | 120 | |

|---|---|---|---|---|---|---|---|---|

| SR | 0.249437 | 0.556364 | 0.503349 | 0.613069 | 0.611484 | 0.630255 | 0.823954 | 0.900404 |

| SR_factor | 0.385763 | 0.375313 | 0.358242 | 0.377903 | 0.409500 | 0.465408 | 0.502565 | 0.448958 |

| Vol | 0.604420 | 0.272795 | 0.266212 | 0.243699 | 0.237008 | 0.235094 | 0.212832 | 0.188124 |

| Vol_factor | 0.194159 | 0.194376 | 0.194693 | 0.192961 | 0.191656 | 0.185698 | 0.172489 | 0.160638 |

| mean | 0.150765 | 0.151773 | 0.133997 | 0.149404 | 0.144927 | 0.148169 | 0.175364 | 0.169387 |

| t_mean | 2.167380 | 4.818255 | 4.329969 | 5.238064 | 5.188617 | 5.310620 | 6.893696 | 7.314919 |

| mean_factor | 0.074899 | 0.072952 | 0.069747 | 0.072921 | 0.078483 | 0.086425 | 0.086687 | 0.072120 |

| t_mean_factor | 1.076744 | 2.315961 | 2.253803 | 2.556569 | 2.809837 | 3.097629 | 3.407746 | 3.114459 |

| alpha | 0.180957 | 0.165089 | 0.138750 | 0.151628 | 0.147182 | 0.153550 | 0.171887 | 0.179607 |

| t_alpha | 2.605933 | 5.252170 | 4.462758 | 5.283166 | 5.231259 | 5.457830 | 6.686502 | 7.743873 |

| AR | 0.301932 | 0.610361 | 0.521849 | 0.622376 | 0.621167 | 0.653936 | 0.808048 | 0.961795 |

| tails | 0.006623 | 0.018889 | 0.019144 | 0.019406 | 0.019676 | 0.018779 | 0.015476 | 0.013889 |

| tails_factor | 0.014349 | 0.014444 | 0.014640 | 0.013699 | 0.013889 | 0.014085 | 0.011905 | 0.010101 |

| min_ret | -3.805899 | -0.633400 | -0.634620 | -0.502321 | -0.475441 | -0.470448 | -0.458410 | -0.400294 |

| min_factor | -0.291300 | -0.291300 | -0.291300 | -0.291300 | -0.291300 | -0.238200 | -0.238200 | -0.238200 |

| t_SR | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| t_SR_factor | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| fraction_tohalf | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| fraction_tohalf_factor | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

What else would you want to look at before peeking at the hold out sample?

Recall that once you look, you have to stop!

Is this pattern consistent with a better more reliable estimate of Expected returns? And Volatilities? And correlations?

How to figure out where the results are coming from?

Are you ready to look at the hold out sample?

Window=0

# Returns=RollingEval(df_hold,window)

# # Returns=Returns.dropna()

# # Diagnostics(0,Returns,R=Returns['Strategy'])

So what do you conclude?

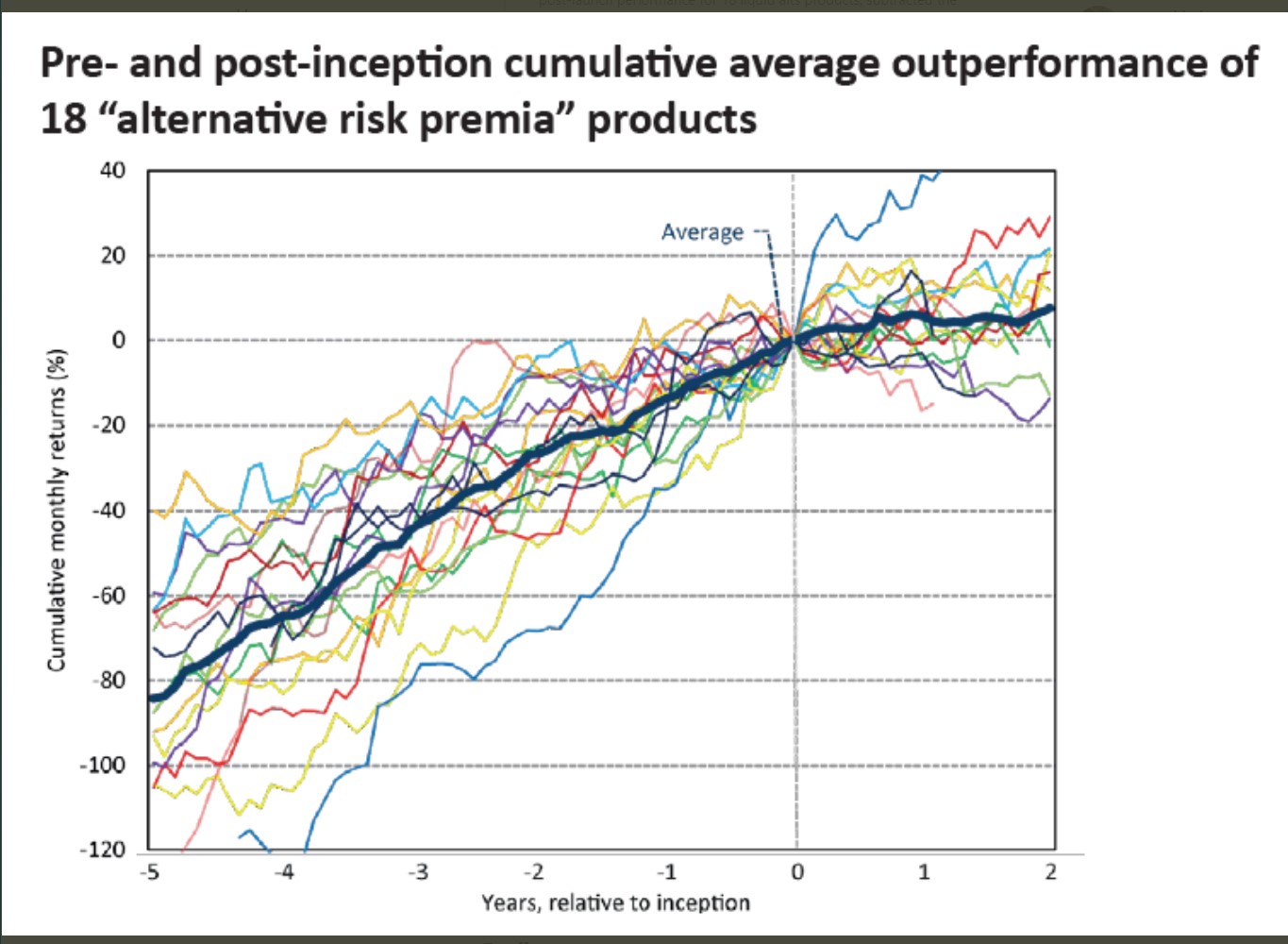

12.8. Publication bias (or Famous bias or incubation bias…)#

We discussed that we often look at past performance exactly because a strategy did well. This mechanism of selection renders our statistical analysis biased in the direction of findings that the strategy is amazing.

It is often hard to deal with this because you need all the data of strategies that look like the one you are interested from the perspective of someone in the start of the reliant sample. That is hard.

One way to deal with this is to use some hard metric of saliency.

For example, check when Bitcoin became popular and we did our analysis after that.

See when a fund manager became well known because of his/her performance. While google trends is only available after 2004 there is data from New York Times and Wall Street Journal that allows you to go back to the start of the Last century. (for example, I use data like that that in this paper)

A setting where we can do this very cleanly is in the context of academic work. We know exactly when the paper was first published and what the sample that was used there

A nice paper that investigates this for a bunch of strategies is Does academic research destroy stock return predictability?

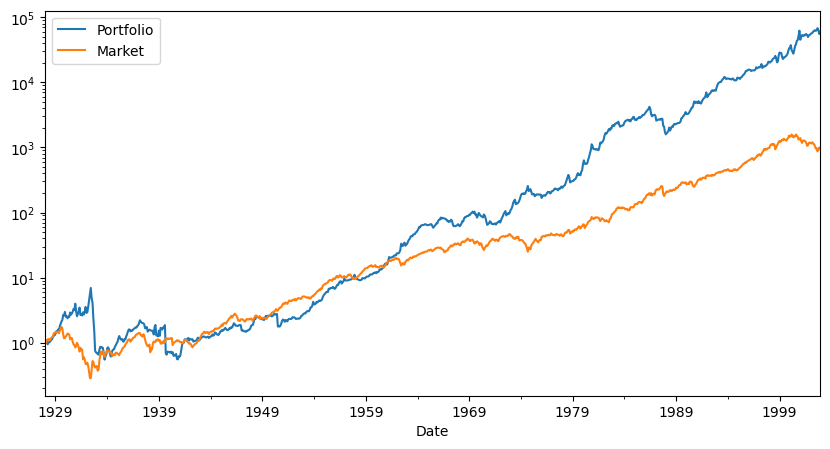

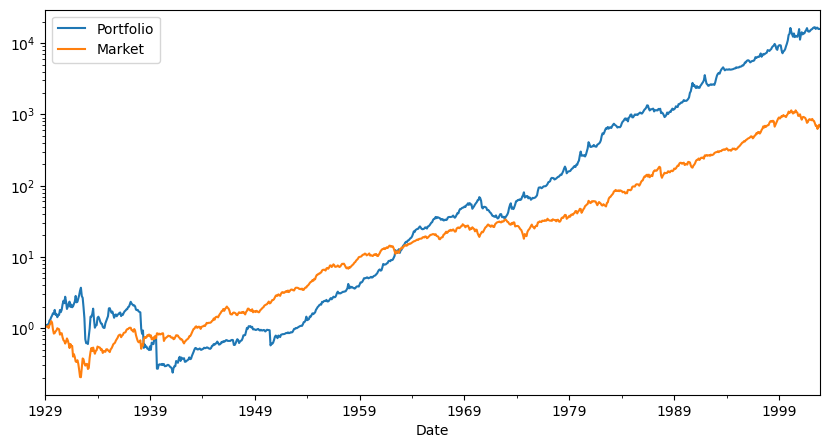

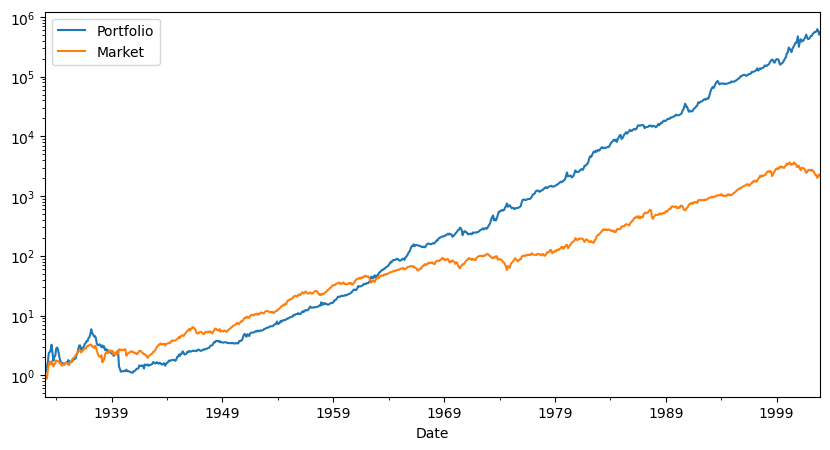

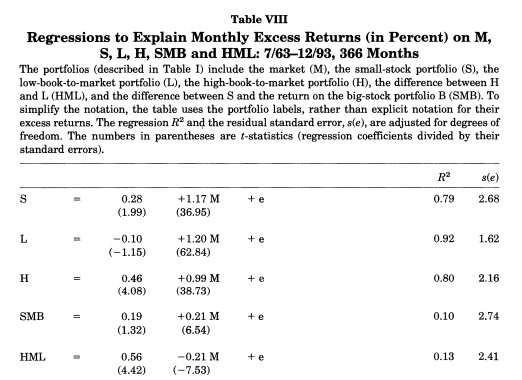

Application: Evaluating the publication bias in Fama French 1996, Multifactor Anomalies…

The original paper has the following table

You see here that the sample runs from 63 to 93. Back in 93 we didn’t have digitalized accounting data that went back to the 30’s

Looking at the very last row we see that the alpha of the HML withresepect to the market is enormous, 0.56% per month, and it has a negative beta with the market!

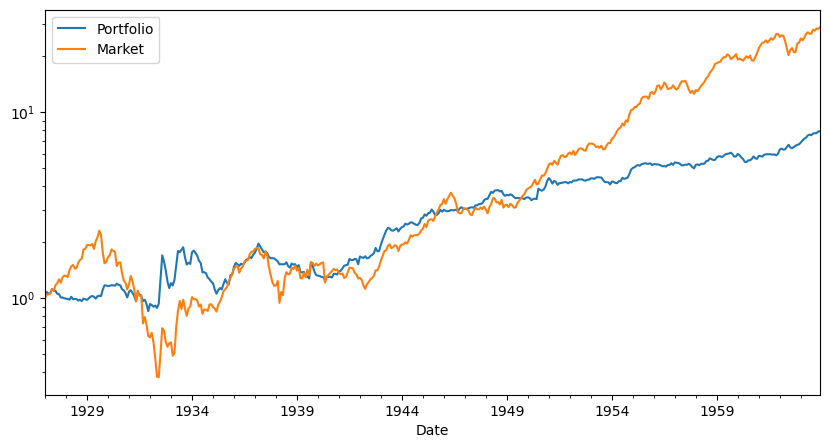

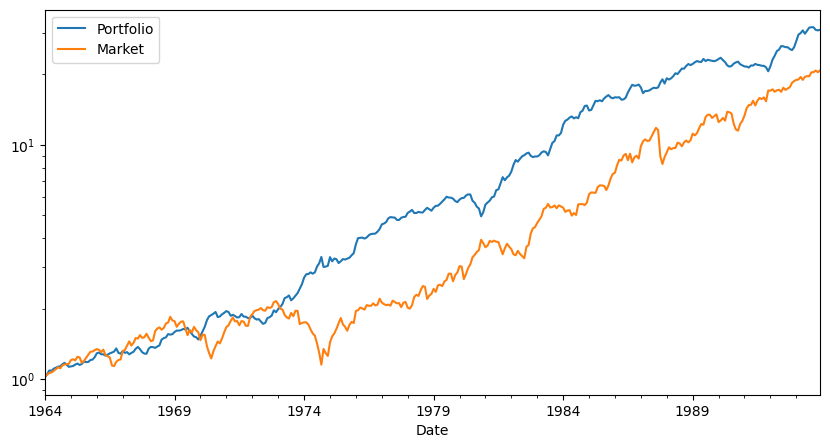

so now we will look at two different samples that the authors never looked before doing their study.

The pre 63 sample

the post 93.

sample1=df_ff6.index.year<1964

sample2=df_ff6.index.year>1993

sample3=((df_ff6.index.year>=1964) &(df_ff6.index.year<=1993))

df=df_ff6[sample1]

Results=pd.DataFrame()

Results['Pre-publication']=Diagnostics(0,df,R=df['HML'])

df=df_ff6[sample3]

Results['publication']=Diagnostics(0,df,R=df['HML'])

df=df_ff6[sample2]

Results['Post-publication']=Diagnostics(0,df,R=df['HML'])

Results

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\2254644634.py:25: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['alpha'] = regresult.params[0]*12

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\2254644634.py:26: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['t_alpha']= regresult.tvalues[0]

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\2254644634.py:25: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['alpha'] = regresult.params[0]*12

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\2254644634.py:26: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['t_alpha']= regresult.tvalues[0]

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\2254644634.py:25: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['alpha'] = regresult.params[0]*12

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_7236\2254644634.py:26: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

results['t_alpha']= regresult.tvalues[0]

| Pre-publication | publication | Post-publication | |

|---|---|---|---|

| SR | 0.352361 | 0.604132 | 0.108077 |

| SR_factor | 0.455849 | 0.314978 | 0.573769 |

| Vol | 0.150529 | 0.090140 | 0.115868 |

| Vol_factor | 0.225104 | 0.155725 | 0.155565 |

| mean | 0.053041 | 0.054457 | 0.012523 |

| t_mean | 2.143329 | 3.308967 | 0.601745 |

| mean_factor | 0.102614 | 0.049050 | 0.089258 |

| t_mean_factor | 4.146536 | 2.980440 | 4.289102 |

| alpha | 0.014157 | 0.064679 | 0.018235 |

| t_alpha | 0.687582 | 4.189373 | 0.866463 |

| AR | 0.114143 | 0.769107 | 0.157960 |

| tails | 0.018018 | 0.011111 | 0.013441 |

| tails_factor | 0.022523 | 0.008333 | 0.008065 |

| min_ret | -0.131100 | -0.098700 | -0.138800 |

| min_factor | -0.291300 | -0.232400 | -0.172300 |

| t_SR | 0.000000 | 0.000000 | 0.000000 |

| t_SR_factor | 0.000000 | 0.000000 | 0.000000 |

| fraction_tohalf | 0.000000 | 0.000000 | 0.000000 |

| fraction_tohalf_factor | 0.000000 | 0.000000 | 0.000000 |

Takeaways

In the Pre-publication sample HML has a respectable SR, but the asset is much more correlated with the market so it’s betas with respect to the market leaves only a statistically insignifcant 0.37% per month, 1.2% per year.

Thus in the pre-sample the HML has a nice SR but the CAPM works so you would not have gained/lost too much of tilting your portfolio towards the HML strategy

In the post-publication sample the results are very ugly

Sharpe ratio is now 0.08–compared with the 0.58 SR on the market

the alpha is still about the same as in the pre-publication, but now the betas become negative

the HML premium goes away almost completely

To have a sense of the shift we can look at the risk-return trade-off of the market and HML across samples.

The optimal weight on HML shifts from 0.72 in the publication sample to 0.34 in the pre publication and 0.2 in the post publication

someone that jsut invested on the market would be actually be closer to the optimal portfolio than someone that invested 0.7 in HML

Does that mean it was data snooping?

We don’t know. It is possible that the publication drove people to the strategies which made the resuls go away goign forward. This paper I cited before argues that this is the case

Literature

Predicting Anomaly Performance with Politics, the Weather, Global Warming, Sunspots, and the Stars by Rober Novy Marx

A comprehensive look at the empirical performance of equity premium prediction

Inspecting whether your discovery is TRUE or just a statistical abnormality is science as much as it is art.

The more complicated a trading strategy, the more the in sample results are often a poor guide to how things behave out of sample

Looking for large t-stats only partially guard against that because you will be searching for things that have high t-stats and you are bound to find high t-stat strategies in sample even if no true large alpha strategy exists.

the literature on the biases that the “strategy discovery” process creates is vast and growing

Patterns that are so statistically reliable that everyone can easily detect are unlikely to stay for long unless it is compensation for true risk.

So you are unlikely to find something that makes sense only based on the stats and you will need to use your economic logic to evaluate if you cna understand why the premium is as high as it is. We will discuss this less “quantitative” part of the process in the chapter Equilibrium Thinking.

Here are a few Twitter threads from people in the industry about this

📝 Key Takeaways

Sharpe and alpha complement each other. The Sharpe ratio ranks the strategy standalone risk-return efficiency, while factor α and appraisal ratio reveals skill over systematic risks

Subtract the risk-free rate and test against factors—always. Raw excess returns can look great until market beta or other factor loadings are accounted for.

Statistical significance is fragile. A high in-sample t-stat may vanish once you allow for multiple trials, shifting windows, or fresh data. Especially true when you did optimization in sample!

Hold-out and cross-validation are your best friends. True out-of-sample Sharpe ratios provide the clearest window on future performance.

Over-fitting is the default, not the exception. Without disciplined controls you will gravitate toward noise that “worked” by chance.

Strategy blends demand covariance awareness. Combining two high-Sharpe ideas poorly can lower overall risk-adjusted returns; optimizing weights on one half and testing on the other guards against that trap.

Publication bias is real and costly. Many celebrated anomalies fade once they become popular; splitting the sample before and after notoriety helps set realistic alphas.

A rigorous evaluation process is an edge in itself. Clear goals, transparent diagnostics, and robust testing protect capital better than any single clever signal.