# start by loading data on the returns of the market portfolio and the risk-free rate

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

%matplotlib inline

11.3. Signal Construction#

We have build portfolios using pre-constructed signals.

These signals are well known and therefore made them an unlikely source of large Sharpe ratios.

A quant fund aims to construct new characteristics based on new data or new ideas of how to combine the relevant public information.

So signal construction is ART and not science. There is no recipe here and each signal is constructed differently.

We will have an overview of the main factors used in the industry–hold tight!

Now our goal is to learn one particular technique of factor construction that is based on past returns. I like to over this one because it enable you to do many different variations as we will see

11.3.1. Momentum#

Momentum is the fact that stocks that have performed relatively well in the past continue to perform relatively well in the future, and stocks that have performed relatively poorly, continue to perform relatively poorly.

A Momentum investment or “relative strength” strategy buys stocks which have performed relatively well in the past and sells (shorts) stocks which have performed relatively poorly. Over the 1963-1990 time period, Jegadeesh and Titman (1993) found that a strategy that ranked stocks based on their past 6 months to a year returns, and bought the top 10% and shorted the bottom 10% based on this ranking, produced abnormal returns of 12% per year.

Momentum portfolios bet on cross-sectional continuation. That is, in a stock did well relative to others in the recent past, the bet is that will continue to do better than the average going forward.

In some ways momentum is the opposite of a value strategy , since value stocks are stocks that have had very low returns (how else they would be value?)

The difference is that value/growth focus on the valuation ratio as the signal of how low the price is. So the valuation ratio captures the entire history of returns (what is price if not the result of the historical returns). Momentum instead focus on the last 12 months. Recent, but not too recent. But there many versions of Momentum.

Construction

Here is how Daniel and Moskowitz construct their portfolios

To form the momentum portfolios, we first rank stocks based on their cumulative returns from 12 months before to one month before the formation date (i.e., the t-12 to t-2-month returns), we use a one month gap between the end of the ranking period and the start of the holding period to avoid the short-term reversals documented by Jegadeesh (1990) and Lehmann (1990). In particular we will focus on 10% and 90% quantiles of the signal distribution and will construct portfolios of all stocks that are in the bottom and top quintiles

Get monthly returns and market equity data for all us firms

Compute rolling cumulative 11 month returns

Lag signal by one month because rolling average includes current month.

This makes the signal cumulative returns form t-11 to t-1

It is a valid signal to bu at closing price of date t-1 to earn date t returns

But that is not yet what we want

Lag another month to be consistent with the t-12 to t-2 month construction

Groups stocks according to this signal

Form portfolios

1. Load return and market cap data by firm/date

import datetime as dt

import wrds

import psycopg2

from dateutil.relativedelta import *

from pandas.tseries.offsets import *

###################

conn=wrds.Connection()

crsp = conn.raw_sql("""

select a.permno,a.permco, a.date, b.shrcd, b.exchcd,b.ticker,

a.ret, a.shrout, a.prc,a.retx

from crsp.msf as a

left join crsp.msenames as b

on a.permno=b.permno

and b.namedt<=a.date

and a.date<=b.nameendt

where a.date between '01/31/1990' and '12/31/2023'

and b.exchcd between 1 and 3

and b.shrcd between 10 and 11

""", date_cols=['date'])

# construction of market equity

crsp=crsp[['permco','permno','ticker','date','ret','shrout','prc']].copy()

# change variable format to int

crsp[['permno']]=crsp[['permno']].astype(int)

crsp[['permco']]=crsp[['permco']].astype(int)

# Line up date to be end of month

crsp['date']=crsp['date']+MonthEnd(0)

# calculate market equity

# why do we use absolute value of price?

crsp['me']=crsp['prc'].abs()*crsp['shrout']

# drop price and shareoustandng since we won't need it anymore

crsp=crsp.drop(['prc','shrout'], axis=1)

crsp_me=crsp.groupby(['date','permco'])['me'].sum().reset_index()

# largest mktcap within a permco/date

crsp_maxme = crsp.groupby(['date','permco'])['me'].max().reset_index()

# join by jdate/maxme to find the permno

crsp=pd.merge(crsp, crsp_maxme, how='inner', on=['date','permco','me'])

# drop me column and replace with the sum me

crsp=crsp.drop(['me'], axis=1)

# join with sum of me to get the correct market cap info

crsp=pd.merge(crsp, crsp_me, how='inner', on=['date','permco'])

# sort by permno and date and also drop duplicates

crsp=crsp.sort_values(by=['permno','date']).drop_duplicates()

crsp.head()

# this saves it

#crsp_m.to_pickle('../../assets/data/crspm2005_2020.pkl')

WRDS recommends setting up a .pgpass file.

Created .pgpass file successfully.

You can create this file yourself at any time with the create_pgpass_file() function.

Loading library list...

Done

| permco | permno | ticker | date | ret | me | |

|---|---|---|---|---|---|---|

| 2561 | 7953 | 10001 | GFGC | 1990-01-31 | -0.018519 | 10156.125 |

| 2562 | 7953 | 10001 | GFGC | 1990-02-28 | -0.006289 | 10092.250 |

| 2563 | 7953 | 10001 | GFGC | 1990-03-31 | 0.012658 | 10141.625 |

| 2564 | 7953 | 10001 | GFGC | 1990-04-30 | 0.000000 | 10141.625 |

| 2565 | 7953 | 10001 | GFGC | 1990-05-31 | -0.012658 | 10013.250 |

2. Construct rolling cumulate the returns

We need to construct the returns from t-11 to t:

We will now cumulate the returns of each asset on a rolling basis. As described in the procedure we wll look back for 11 months and compute the cumulative return in the period.

TIP We will be grouping by

permnoand applying therolling()operator, we will them apply the functionnp.prodwhich returns the product of the variables in the group. Thegroupby('permno')is what makes the rolling to be applied firm by firm

df=crsp.copy()

df['1+ret']=(df['ret']+1)

df=df.set_index(['date'])

temp=(df.groupby('permno')[['1+ret']]).rolling(window=11,min_periods=7).apply(np.prod, raw=True)

temp=temp.rename(columns={'1+ret':'cumret11'})

temp =temp.reset_index()

temp.tail(5)

| permno | date | cumret11 | |

|---|---|---|---|

| 2009967 | 93436 | 2023-08-31 | 0.972970 |

| 2009968 | 93436 | 2023-09-30 | 1.099676 |

| 2009969 | 93436 | 2023-10-31 | 1.031537 |

| 2009970 | 93436 | 2023-11-30 | 1.949019 |

| 2009971 | 93436 | 2023-12-31 | 1.434477 |

We now merge back this cumret11 variable with our data set

Reset the

dfindex so bothpermnoanddateare normal columns.This makes the merge easier

df = pd.merge(df.reset_index(), temp[['permno','date','cumret11']], how='left', on=['permno','date'])

We lag the signal by two months. -The first month to make sure the signal is tradable, so that is mandatory to make this a valid strategy without look-ahead bias -We do an additional month, so lag by 2, because we will be skipping a month between the last return data used in the signal and the time we buy the stock

so we cumulate returns up to t-2, and form the portfolio in beginning of month t, so return t-1 does not go either in the signal or in our strategy

For example, for the portfolio formed in the last day of december-2024 and held till the last day of january-2025, our signal is the cumulative return from the last day of december-2023 till the last day of november-2024.

So the returns for he month of december-2024 are skipped

Before lagging it always important to sort the values so the result is what you intended

df=df.sort_values(['date','permno'])

df['mom']=df.groupby('permno')['cumret11'].shift(2)

# why I am groupby permno here befroe lagging?

# drop the row if any of 'mom' is missing

df=df.dropna(subset=['mom'], how='any')

df=df.drop(['1+ret','cumret11'], axis=1)

# lag market cap

df['me_l1']=df.groupby('permno')['me'].shift(1)

df.tail()

| date | permco | permno | ticker | ret | me | mom | me_l1 | |

|---|---|---|---|---|---|---|---|---|

| 2008259 | 2023-12-31 | 53423 | 93397 | LMNR | 0.362171 | 3.712162e+05 | 1.136158 | 2.735088e+05 |

| 2009158 | 2023-12-31 | 53440 | 93423 | SIX | 0.007229 | 2.095108e+06 | 0.826068 | 2.080071e+06 |

| 2009320 | 2023-12-31 | 53443 | 93426 | VPG | 0.117416 | 4.262157e+05 | 0.737491 | 3.814299e+05 |

| 2009785 | 2023-12-31 | 53427 | 93434 | SANW | 0.065449 | 3.012730e+04 | 0.603332 | 2.827662e+04 |

| 2009971 | 2023-12-31 | 53453 | 93436 | TSLA | 0.034988 | 7.898983e+08 | 1.031537 | 7.631954e+08 |

Portfolio formation

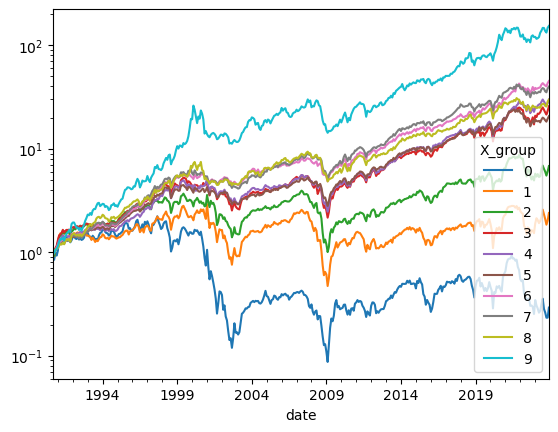

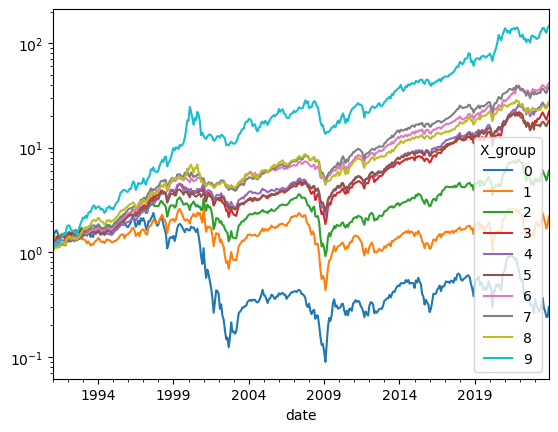

We can now simply use the function we just build to construct characteristic-based portfolios

Just make sure that our labels here are consistent with what we had before

def returnbyX(df,y='ret',X='value',ngroups=10,plot=True):

df['X_group']=df.groupby(['date'])[X].transform(lambda x: pd.qcut(x, ngroups, labels=False,duplicates='drop'))

ret =df.groupby(['date','X_group']).apply(lambda x:(x[y]*x['me_l1']).sum()/x['me_l1'].sum())

ret=ret.unstack(level=-1)

if plot:

if y=='ret':

(ret+1).cumprod().plot(logy=True)

else:

ret.plot()

return ret

returnbyX(df,y='ret',X='mom',ngroups=10,plot=True)

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_19288\3636907694.py:3: RuntimeWarning: invalid value encountered in scalar divide

ret =df.groupby(['date','X_group']).apply(lambda x:(x[y]*x['me_l1']).sum()/x['me_l1'].sum())

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_19288\3636907694.py:3: DeprecationWarning: DataFrameGroupBy.apply operated on the grouping columns. This behavior is deprecated, and in a future version of pandas the grouping columns will be excluded from the operation. Either pass `include_groups=False` to exclude the groupings or explicitly select the grouping columns after groupby to silence this warning.

ret =df.groupby(['date','X_group']).apply(lambda x:(x[y]*x['me_l1']).sum()/x['me_l1'].sum())

| X_group | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

|---|---|---|---|---|---|---|---|---|---|---|

| date | ||||||||||

| 1990-09-30 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 1990-10-31 | -0.148808 | -0.077181 | -0.072827 | -0.019251 | -0.011158 | -0.003951 | -0.012652 | -0.005185 | 0.004153 | -0.024024 |

| 1990-11-30 | 0.158662 | 0.140878 | 0.126285 | 0.118606 | 0.059501 | 0.083143 | 0.064784 | 0.050134 | 0.055601 | 0.078626 |

| 1990-12-31 | -0.058611 | 0.031542 | 0.062004 | 0.052065 | 0.055192 | 0.027416 | 0.054146 | 0.023344 | 0.017398 | 0.024007 |

| 1991-01-31 | 0.115342 | 0.123455 | 0.121477 | 0.134420 | 0.086784 | 0.055833 | 0.054715 | 0.028440 | 0.021298 | 0.068415 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 2023-08-31 | -0.204803 | -0.099874 | -0.071198 | -0.050686 | -0.044484 | -0.020282 | -0.028352 | -0.015879 | 0.006240 | -0.002667 |

| 2023-09-30 | -0.074350 | -0.098032 | -0.058756 | -0.056787 | -0.040755 | -0.038142 | -0.024087 | -0.055519 | -0.045267 | -0.064872 |

| 2023-10-31 | -0.110952 | -0.118956 | -0.084544 | -0.047251 | -0.044152 | -0.029873 | -0.019787 | -0.020695 | -0.013982 | -0.033724 |

| 2023-11-30 | 0.002542 | 0.097048 | 0.097524 | 0.087736 | 0.049911 | 0.067308 | 0.077873 | 0.088729 | 0.116613 | 0.113587 |

| 2023-12-31 | 0.249595 | 0.181803 | 0.125790 | 0.104477 | 0.087086 | 0.057749 | 0.045906 | 0.042359 | 0.041259 | 0.041137 |

400 rows × 10 columns

Note that this sample is after the momentum paper we published, so it is true out of sample.

Wrapping all in a function that goes from the Return/market cap data to the final signal-sorted portfolio

Things to try

Play with different look-back windows

Play with how many months to skip (1 is the minimum to make the strategy valid. 2 is the standard.) - What do you think it will happen if you don’t skip and let the signal overlap with the return data? - What happens if you skip more months?

What happens if you sort only on the month that the standard momentum skips?

what if you sort on very long-term momentum, like 60 months?

Cumulative returns is just one possible moment to look at

What about volatility?

What about covariance with the market?

What about maximum/minimum return?

# put it all together in a fuction

def momentum(df,ngroups=10,lookback=11,extraskip=1):

df['1+ret']=(df['ret']+1)

df=df.set_index(['date'])

temp=(df.groupby('permno')[['1+ret']]).rolling(window=lookback,min_periods=lookback).apply(np.prod, raw=True)

temp=temp.rename(columns={'1+ret':'signal_contemp'})

temp =temp.reset_index()

df = pd.merge(df.reset_index(), temp[['permno','date','signal_contemp']], how='left', on=['permno','date'])

df=df.sort_values(['date','permno'])

df['me_l1']=df.groupby('permno')['me'].shift(1)

df['signal']=df.groupby('permno')['signal_contemp'].shift(1+extraskip)

df=df.dropna(subset=['signal'], how='any')

ret=returnbyX(df,y='ret',X='signal',ngroups=10,plot=True)

return ret

momentum(crsp,ngroups=10,lookback=11,extraskip=1)

C:\Users\alan.moreira\AppData\Local\Temp\ipykernel_19288\3636907694.py:3: DeprecationWarning: DataFrameGroupBy.apply operated on the grouping columns. This behavior is deprecated, and in a future version of pandas the grouping columns will be excluded from the operation. Either pass `include_groups=False` to exclude the groupings or explicitly select the grouping columns after groupby to silence this warning.

ret =df.groupby(['date','X_group']).apply(lambda x:(x[y]*x['me_l1']).sum()/x['me_l1'].sum())

| X_group | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

|---|---|---|---|---|---|---|---|---|---|---|

| date | ||||||||||

| 1991-01-31 | 0.113977 | 0.123368 | 0.121564 | 0.134447 | 0.086775 | 0.056062 | 0.054355 | 0.028442 | 0.021337 | 0.067651 |

| 1991-02-28 | 0.342850 | 0.176918 | 0.135603 | 0.112137 | 0.084677 | 0.073092 | 0.069951 | 0.064866 | 0.062943 | 0.095270 |

| 1991-03-31 | 0.062126 | 0.061158 | 0.041783 | 0.014742 | 0.038475 | 0.011460 | 0.017723 | 0.026697 | 0.024460 | 0.068706 |

| 1991-04-30 | 0.018582 | -0.008934 | 0.016253 | 0.030825 | 0.034372 | -0.009351 | 0.016612 | 0.009086 | -0.010582 | -0.015520 |

| 1991-05-31 | -0.075714 | 0.023718 | 0.083954 | 0.070792 | 0.048429 | 0.046285 | 0.038407 | 0.029638 | 0.040514 | 0.044975 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 2023-08-31 | -0.200407 | -0.099046 | -0.071375 | -0.053064 | -0.044406 | -0.019954 | -0.028805 | -0.015799 | 0.006243 | -0.002667 |

| 2023-09-30 | -0.075222 | -0.098350 | -0.058665 | -0.057555 | -0.030818 | -0.046053 | -0.024102 | -0.055529 | -0.045170 | -0.064867 |

| 2023-10-31 | -0.112877 | -0.120038 | -0.084968 | -0.047023 | -0.043967 | -0.033107 | -0.018236 | -0.020657 | -0.013869 | -0.033726 |

| 2023-11-30 | 0.002152 | 0.097079 | 0.106346 | 0.084094 | 0.050288 | 0.067282 | 0.077833 | 0.088695 | 0.116660 | 0.113667 |

| 2023-12-31 | 0.249429 | 0.192899 | 0.121122 | 0.104346 | 0.087925 | 0.059036 | 0.044755 | 0.042362 | 0.041256 | 0.041157 |

396 rows × 10 columns

Past Cross-sectional Return Predictability a summary

Long-term reversals

DeBondt and Thaler (1985)

3-5 year contrarian strategy

Short-term (< 1 month) reversals

Jegadeesh (1990), Lehman (1990), Lo andMacKinlay (1988)

Intermediate horizon continuation

Jegadeesh and Titman (1993)

3-12 month momentum strategy

profits dissipate over 1-year and start to reverse after 2-3 years -> temporary price effect.

see similar pattern around earnings announcements (both earnings and price momentum).

Why this might work?

Behavioral view: The idea here is that markets might be slow to incorporate information, so good/bad news gets into prices slowly over time. For example investors might only slowly get into prices the consequences of a Trump second term.

Rational view: Maybe all these stocks are exposed to the same missing risk-factor. They all went up and down at the same time after all! For example all firms that went down in march 2020 are particularly exposed to Covid and the ones that did well are positively exposed. So they will move together as COVID risk fluctuate. It is hard to use a story like that to explain the premium, but it is easy to see how it explains the co-movement.

My overall sense is that the majority of academics think that momentum is driven by “behavioral” factors. Note however that momentum tends to crash very badly in high volatility periods such as 2008 and 2020, so it is certainly risky if you zoom out a bit.

Literature

Lots of work on this.

Other “returns” based strategies

One can easily adapt the code to reproduce a variety of investment strategies that only rely on return information, broadly described as “technical” strategies

Short-term Reversals: Sort stocks based on returns in month t-1, but in the beggining of month t

Long-term reversals: Sort on cumulative returns of the last 5 years

Volatility: sort on the return volatiltiy of the last 24 months, say using returns between t-24 to t-1 and form the portfolio in beggining of date t.

(HARDER) Market beta: Sort stocks based on their beta with the market porfolio. Say estimate beta using the last 60 months of data (t-60 to t-1) and form portfolio at the beggining of date t.

Below is a plot that summarizes the emprical evidence on return-based strategies. It shows the Sharpe Ratio as a function of the lookback period of the reutrn signal

Can you reproduce this plot?