14. Machine Learning#

The basic issue in finance is that we want to know how expected returns move around, but we only observe realized returns

We can compile lots and lots of information/data about different assets

We saw how to run OLS regression of returns on a large set of characteristics ( I think it was 30)

But we didn;t even think interactions among them–say the value characteristic might have different information for returns for small vs big stocks–considering all these interactions would leads us to estimate 900 coefficients. And of course there are potentially many more characteristics and their lags that could be informative for expected returns and co-movement

You can see that very quickly you run out of data

Here where recent advances in machine learning can be super useful

In the end of the day we want to estimate a function F that maps observed characteristics in future returns

This function can be linear

or linear in the interactions

Or have even higher order or non-linear relationships, that is instead of including the chracteristic , we include dummies according to the rank of the characteristic relative to other stocks in the cross-sectional

Here where the tools if machine learning can be useful to us

We will now discuss a few of the most used methods

Lasso Regression (L1 regularization)

Random Forest Regression

Gradient Boosted Regression Trees (GBRT)

Elastic Net Regression (combination of L1 and L2 regularization)

Neural Network Regression (customizable number of layers)

We will apply those to our data set

We will have a training/estimation sample (1972-1992) and a tuning sample (1992-2002)

We will not use it today but I also reserved a test sample (2002-2016) for you to evaluate your favorite model.

url = "../../assets/data/characteristics_raw.csv"

df_X = pd.read_csv(url)

# This simply shits the date to be in an end of month basis

df_X['date'] = pd.to_datetime(df_X['date'], format='%m/%Y')

df_X.set_index(['date','permno'],inplace=True)

df_X['1972':'1991'].to_pickle('../../assets/data/characteristics19721991.pkl')

df_X['1992':'2001'].to_pickle('../../assets/data/characteristics19922001.pkl')

df_X['2002':].to_pickle('../../assets/data/characteristics20022016.pkl')

url = "../../assets/data/characteristics19721991.pkl"

df_train = pd.read_pickle(url)

df_train=df_train.drop(columns=['rf','rme'])

display(df_train)

url = "../../assets/data/characteristics19922001.pkl"

df_tuning = pd.read_pickle(url)

df_tuning=df_tuning.drop(columns=['rf','rme'])

display(df_tuning)

| re | size | value | prof | fscore | debtiss | repurch | nissa | growth | aturnover | ... | momrev | valuem | nissm | strev | ivol | betaarb | indrrev | price | age | shvol | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| date | permno | |||||||||||||||||||||

| 1972-07-01 | 10006 | 0.028600 | 12.399869 | -0.125361 | -1.662274 | 1 | 0 | 0 | 0.691632 | 0.055546 | -0.402127 | ... | 0.241023 | 0.046338 | 0.691632 | -0.025281 | 0.015680 | 0.875315 | -0.033445 | 3.769883 | 5.135798 | 0.264547 |

| 10102 | 0.039757 | 12.217334 | 0.354954 | -1.533574 | 3 | 0 | 0 | 0.702357 | 0.032625 | -0.280661 | ... | 0.280555 | 0.525299 | 0.702357 | -0.066667 | 0.013668 | 1.167972 | -0.029807 | 2.862201 | 5.135798 | 0.159992 | |

| 10137 | -0.044767 | 13.069874 | -0.088697 | -2.285618 | 2 | 1 | 0 | 0.735522 | 0.130297 | -1.473819 | ... | -0.024738 | -0.042177 | 0.735522 | -0.034483 | 0.010347 | 0.755496 | -0.020019 | 3.044522 | 5.135798 | 0.102413 | |

| 10145 | -0.062422 | 13.608366 | 0.075484 | -1.563468 | 3 | 0 | 0 | 0.693165 | 0.033959 | -0.210598 | ... | 0.529800 | 0.062691 | 0.693165 | -0.036735 | 0.018345 | 1.097189 | -0.011115 | 3.384390 | 5.135798 | 0.208178 | |

| 10153 | -0.065600 | 11.752572 | 0.944457 | -1.443505 | 2 | 0 | 1 | 0.688459 | 0.016692 | 0.087675 | ... | 0.158727 | 1.029572 | 0.688459 | -0.107407 | 0.020491 | 1.246057 | -0.079017 | 2.484907 | 5.135798 | 0.215979 | |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 1991-01-01 | 90369 | 0.047830 | 12.802441 | -0.693011 | -3.167399 | 3 | 1 | 0 | 0.693650 | 0.204222 | -1.182231 | ... | 0.431073 | -0.612392 | 0.692859 | 0.028794 | 0.020753 | 0.789805 | -0.019639 | 3.496508 | 4.174387 | 0.482675 |

| 90609 | 0.297830 | 14.421899 | -1.469354 | -0.192073 | 5 | 0 | 0 | 0.795055 | 0.421466 | 0.196485 | ... | -0.311436 | -2.001907 | 0.725049 | 0.047619 | 0.023579 | 1.373399 | -0.001491 | 3.496508 | 4.304065 | 1.249267 | |

| 91380 | 0.277409 | 14.513939 | -0.929698 | -0.441911 | 6 | 1 | 0 | 0.697018 | 0.092376 | 0.446092 | ... | 0.253155 | -0.340558 | 0.695715 | 0.052273 | 0.026668 | 1.325531 | -0.026854 | 2.442347 | 4.219508 | 0.417471 | |

| 91695 | 0.110589 | 12.718260 | -1.582293 | -0.409848 | 5 | 1 | 0 | 0.693282 | -0.004634 | 0.234171 | ... | -0.006908 | -1.302569 | 0.692102 | 0.117647 | 0.028104 | 0.783925 | 0.045506 | 3.167583 | 4.204693 | 0.589516 | |

| 92655 | 0.177596 | 12.899849 | -1.385607 | -0.341648 | 6 | 1 | 0 | 0.884419 | 0.340396 | 0.553001 | ... | 0.298045 | -1.877044 | 0.875576 | 0.148148 | 0.028847 | 1.096923 | 0.099715 | 3.146305 | 4.343805 | 1.262840 |

204284 rows × 30 columns

| re | size | value | prof | fscore | debtiss | repurch | nissa | growth | aturnover | ... | momrev | valuem | nissm | strev | ivol | betaarb | indrrev | price | age | shvol | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| date | permno | |||||||||||||||||||||

| 1992-01-01 | 10078 | 0.071490 | 14.803577 | -0.821429 | -0.351670 | 5 | 1 | 0 | 0.713175 | 0.337526 | 0.326859 | ... | -0.375068 | -0.827133 | 0.688756 | 0.182292 | 0.036514 | 1.279770 | 0.143753 | 3.345508 | 4.276666 | 1.612871 |

| 10095 | -0.131137 | 13.042999 | -1.288738 | -2.907817 | 2 | 1 | 1 | 0.823573 | 0.299850 | -2.007233 | ... | 0.097856 | -2.439453 | 0.879456 | 0.497268 | 0.044026 | 1.046930 | 0.331867 | 4.226834 | 4.276666 | 2.038652 | |

| 10104 | 0.272462 | 13.962658 | -0.943996 | 0.072345 | 3 | 0 | 0 | 0.712626 | 0.536861 | 0.209624 | ... | -0.919460 | -1.741446 | 0.710315 | 0.074074 | 0.032754 | 1.434134 | -0.091418 | 2.674149 | 4.276666 | 1.062730 | |

| 10107 | 0.077499 | 16.289499 | -2.240325 | -0.123331 | 5 | 1 | 1 | 0.703894 | 0.427835 | 0.068269 | ... | -0.010327 | -2.681148 | 0.708289 | 0.143959 | 0.013396 | 1.383749 | -0.021534 | 4.711780 | 4.276666 | 0.735207 | |

| 10119 | 0.158277 | 13.891799 | -0.598919 | -2.420088 | 4 | 1 | 0 | 0.693147 | 0.153250 | -0.435732 | ... | 0.056359 | -0.886515 | 0.693128 | 0.098684 | 0.015079 | 0.760442 | -0.015104 | 3.038552 | 4.276666 | 0.145575 | |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 2001-01-01 | 88664 | -0.270994 | 14.544541 | -2.222151 | -0.639122 | 6 | 1 | 1 | 0.706994 | 0.415774 | 0.054443 | ... | 0.117828 | -2.832748 | 0.734983 | 0.158508 | 0.030403 | 0.917149 | 0.241260 | 4.129148 | 5.214936 | 1.044554 |

| 90100 | -0.004434 | 14.481504 | -0.821788 | -1.134622 | 7 | 0 | 1 | 0.655505 | 0.036674 | -0.057457 | ... | -0.123972 | -0.702888 | 0.694680 | 0.291677 | 0.043108 | 0.593961 | 0.162599 | 2.560130 | 4.997212 | 0.430254 | |

| 90609 | 0.647295 | 14.915539 | -2.160840 | -0.608490 | 6 | 1 | 1 | 0.673995 | 0.009418 | -0.422648 | ... | -0.183386 | -0.172097 | 0.679562 | -0.017647 | 0.038304 | 1.443601 | 0.065105 | 1.652258 | 5.267858 | 1.329642 | |

| 91380 | -0.009058 | 13.713922 | 0.137959 | -0.303891 | 6 | 1 | 1 | 0.699451 | -0.106341 | 0.617338 | ... | -0.792238 | -1.032178 | 0.701598 | 0.282815 | 0.037141 | 0.831341 | 0.137473 | 3.308351 | 5.236442 | 1.157457 | |

| 92655 | -0.086296 | 16.449309 | -0.847793 | -0.821228 | 6 | 0 | 1 | 0.661662 | 0.057290 | 0.644070 | ... | -0.115775 | -1.687913 | 0.674296 | 0.046351 | 0.021378 | 0.834816 | -0.021866 | 4.117003 | 5.283204 | 0.619079 |

99615 rows × 30 columns

14.1. 1. Lasso Regression#

Lasso (Least Absolute Shrinkage and Selection Operator) regression is a linear regression model with L1 regularization. It minimizes the following objective:

Key Characteristics:

Shrinks some coefficients to exactly zero, effectively performing feature selection.

Useful for sparse models where only a subset of predictors are important.

Struggles with multicollinearity, as it tends to arbitrarily select one among correlated predictors.

Feature Extraction:

Xis extracted from the columns after the first 3.Yis the excess return.Feature Standardization: Standardizes

XusingStandardScaler, which is important for Lasso because it is sensitive to feature scaling.Lasso Regression: Fits a Lasso regression model with a specified regularization strength (

alpha).Evaluation: Outputs the coefficients and ( R^2 ) score on test data, if a train-test split is used.

You can adjust the alpha parameter in Lasso() to tune the regularization strength. A smaller value of alpha reduces regularization, while a larger value increases it.

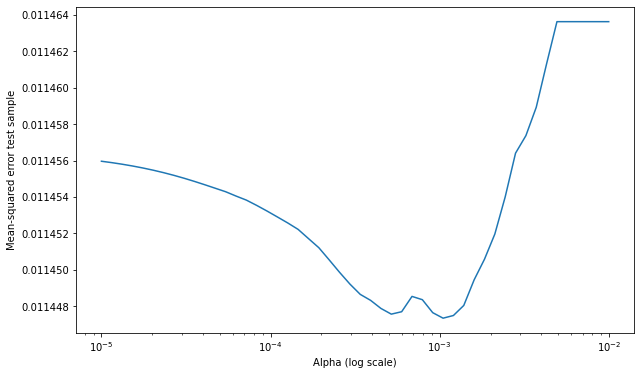

Note that here we are implicitly using the tuning sample to pick the amount of regularization. So once we pick our favorite alpha, which looks like to 0.002, we need to look at some other sample to if that worked

#We will start by standardizing our characteristics. This is done by subtracting the mean and dividing by the standard deviation.

X_train = df_train.iloc[:, 1:]

X_train= X_train.groupby('date').apply(lambda x: (x - x.mean()) / x.std())

X_tuning = df_tuning.iloc[:, 1:]

X_tuning= X_tuning.groupby('date').apply(lambda x: (x - x.mean()) / x.std())

from sklearn.linear_model import Lasso

from sklearn.model_selection import train_test_split

from sklearn.metrics import mean_squared_error, mean_absolute_error, r2_score

# Extract Y (excess return) and X (characteristics)

Y_train = df_train.iloc[:, 0] # Excess return

Y_tuning = df_tuning.iloc[:, 0] # Excess return

# # Perform Lasso regression

lasso = Lasso(alpha=0.0025) # You can adjust the alpha (regularization strength)

lasso.fit(X_train, Y_train)

# Coefficients and intercept

print("Lasso Coefficients:", lasso.coef_)

print("Intercept:", lasso.intercept_)

Y_pred = lasso.predict(X_tuning)

# Compute Mean Squared Error (MSE)

mse = mean_squared_error(Y_tuning, Y_pred)

print("Mean Squared Error (MSE):", mse)

mae= mean_absolute_error(Y_tuning, Y_pred)

print("Mean Absolute Error (MAE):", mae)

r2 = r2_score(Y_tuning, Y_pred)

print("R-squared (R2):", r2)

Lasso Coefficients: [-0. 0. 0. 0. -0. 0.

-0. -0. 0. -0. 0. -0.

0. -0. 0. 0. 0. 0.

0.00031046 -0. 0. -0. -0. -0.

-0. -0.00223662 -0. 0. -0. ]

Intercept: 0.005779088395769684

Mean Squared Error (MSE): 0.01145434617567078

Mean Absolute Error (MAE): 0.07446115851398497

R-squared (R2): -0.00030052087524023996

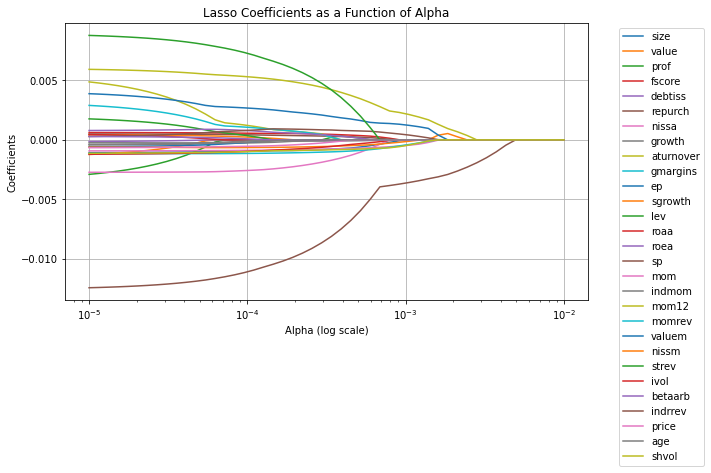

# Define a range of alpha values

alphas = np.logspace(-5, -2, 50) # range for alphas

coefficients = []

mses=[]

# Perform Lasso regression for each alpha

for alpha in alphas:

lasso = Lasso(alpha=alpha, max_iter=10000) # Ensure convergence with high iterations

lasso.fit(X_train, Y_train)

coefficients.append(lasso.coef_)

Y_pred = lasso.predict(X_tuning)

mse = mean_squared_error(Y_tuning, Y_pred)

mses.append(mse)

# Convert coefficients to a NumPy array for plotting

coefficients = np.array(coefficients)

# Plot the coefficients as a function of alpha

plt.figure(figsize=(10, 6))

for i in range(coefficients.shape[1]):

plt.plot(alphas, coefficients[:, i])

plt.xscale('log')

plt.xlabel('Alpha (log scale)')

plt.ylabel('Coefficients')

plt.title('Lasso Coefficients as a Function of Alpha')

plt.legend(df_train.iloc[:, 1:].columns, bbox_to_anchor=(1.05, 1), loc='upper left')

plt.grid(True)

plt.tight_layout()

plt.show()

plt.figure(figsize=(10, 6))

plt.plot(alphas, mses)

plt.xlabel('Alpha (log scale)')

plt.ylabel('Mean-squared error test sample')

plt.xscale('log')

plt.show()

Note we are using Mean-squared error as way to evaluate our model

To compute the Mean Squared Error (MSE) for the Lasso model after fitting it to the training data, you can use the mean_squared_error function from sklearn.metrics. Here’s how you can do it based on your original code:

Steps to Compute MSE:

Make Predictions:

Use

lasso.predict(X_test)to get predictions on the test set.

Compute MSE:

Compare the predicted values (

Y_pred) with the actual values (Y_test) usingmean_squared_error.

MSE Calculation:

The formula for MSE is: [ \text{MSE} = \frac{1}{n} \sum_{i=1}^n (y_i - \hat{y}_i)^2 ]

mean_squared_errorautomates this calculation.

Scaling:

Ensure the test set features (

X_test) are transformed using the same scaler fitted on the training set to maintain consistency.

Output:

The MSE provides a measure of how well the model is predicting the excess returns on unseen data. Lower values indicate better performance.

#I will save below our lasso model at our optimal alpha

lasso = Lasso(alpha=0.002, max_iter=10000) # Ensure convergence with high iterations

lasso.fit(X_train, Y_train)

Y_pred = lasso.predict(X_tuning)

mean_squared_error(Y_tuning, Y_pred)

0.011444912722223555

14.1.1. Including Interactions#

One possibility here is that the information is in the interactions of the characteristics, i.e., we want to augment the model to

from sklearn.preprocessing import PolynomialFeatures

# Assuming X_train contains the characteristics

degree = 2 # Degree of interactions (2 means pairwise interactions)

poly = PolynomialFeatures(degree=degree, interaction_only=True, include_bias=False)

# Generate cross-product features

X_train_interactions = poly.fit_transform(X_train)

X_tuning_interactions = poly.fit_transform(X_tuning)

# Feature names (optional: useful for understanding what each column represents)

feature_names = poly.get_feature_names_out(input_features=df_train.iloc[:, 1:].columns)

# Print the shape of the transformed dataset

print("Original X_train shape:", X_train.shape)

print("Transformed X_train shape:", X_train_interactions.shape)

print("Feature Names:", feature_names)

# Get the number of input features

input_dim = X_train_interactions.shape[1]

Original X_train shape: (204284, 29)

Transformed X_train shape: (204284, 435)

Feature Names: ['size' 'value' 'prof' 'fscore' 'debtiss' 'repurch' 'nissa' 'growth'

'aturnover' 'gmargins' 'ep' 'sgrowth' 'lev' 'roaa' 'roea' 'sp' 'mom'

'indmom' 'mom12' 'momrev' 'valuem' 'nissm' 'strev' 'ivol' 'betaarb'

'indrrev' 'price' 'age' 'shvol' 'size value' 'size prof' 'size fscore'

'size debtiss' 'size repurch' 'size nissa' 'size growth' 'size aturnover'

'size gmargins' 'size ep' 'size sgrowth' 'size lev' 'size roaa'

'size roea' 'size sp' 'size mom' 'size indmom' 'size mom12' 'size momrev'

'size valuem' 'size nissm' 'size strev' 'size ivol' 'size betaarb'

'size indrrev' 'size price' 'size age' 'size shvol' 'value prof'

'value fscore' 'value debtiss' 'value repurch' 'value nissa'

'value growth' 'value aturnover' 'value gmargins' 'value ep'

'value sgrowth' 'value lev' 'value roaa' 'value roea' 'value sp'

'value mom' 'value indmom' 'value mom12' 'value momrev' 'value valuem'

'value nissm' 'value strev' 'value ivol' 'value betaarb' 'value indrrev'

'value price' 'value age' 'value shvol' 'prof fscore' 'prof debtiss'

'prof repurch' 'prof nissa' 'prof growth' 'prof aturnover'

'prof gmargins' 'prof ep' 'prof sgrowth' 'prof lev' 'prof roaa'

'prof roea' 'prof sp' 'prof mom' 'prof indmom' 'prof mom12' 'prof momrev'

'prof valuem' 'prof nissm' 'prof strev' 'prof ivol' 'prof betaarb'

'prof indrrev' 'prof price' 'prof age' 'prof shvol' 'fscore debtiss'

'fscore repurch' 'fscore nissa' 'fscore growth' 'fscore aturnover'

'fscore gmargins' 'fscore ep' 'fscore sgrowth' 'fscore lev' 'fscore roaa'

'fscore roea' 'fscore sp' 'fscore mom' 'fscore indmom' 'fscore mom12'

'fscore momrev' 'fscore valuem' 'fscore nissm' 'fscore strev'

'fscore ivol' 'fscore betaarb' 'fscore indrrev' 'fscore price'

'fscore age' 'fscore shvol' 'debtiss repurch' 'debtiss nissa'

'debtiss growth' 'debtiss aturnover' 'debtiss gmargins' 'debtiss ep'

'debtiss sgrowth' 'debtiss lev' 'debtiss roaa' 'debtiss roea'

'debtiss sp' 'debtiss mom' 'debtiss indmom' 'debtiss mom12'

'debtiss momrev' 'debtiss valuem' 'debtiss nissm' 'debtiss strev'

'debtiss ivol' 'debtiss betaarb' 'debtiss indrrev' 'debtiss price'

'debtiss age' 'debtiss shvol' 'repurch nissa' 'repurch growth'

'repurch aturnover' 'repurch gmargins' 'repurch ep' 'repurch sgrowth'

'repurch lev' 'repurch roaa' 'repurch roea' 'repurch sp' 'repurch mom'

'repurch indmom' 'repurch mom12' 'repurch momrev' 'repurch valuem'

'repurch nissm' 'repurch strev' 'repurch ivol' 'repurch betaarb'

'repurch indrrev' 'repurch price' 'repurch age' 'repurch shvol'

'nissa growth' 'nissa aturnover' 'nissa gmargins' 'nissa ep'

'nissa sgrowth' 'nissa lev' 'nissa roaa' 'nissa roea' 'nissa sp'

'nissa mom' 'nissa indmom' 'nissa mom12' 'nissa momrev' 'nissa valuem'

'nissa nissm' 'nissa strev' 'nissa ivol' 'nissa betaarb' 'nissa indrrev'

'nissa price' 'nissa age' 'nissa shvol' 'growth aturnover'

'growth gmargins' 'growth ep' 'growth sgrowth' 'growth lev' 'growth roaa'

'growth roea' 'growth sp' 'growth mom' 'growth indmom' 'growth mom12'

'growth momrev' 'growth valuem' 'growth nissm' 'growth strev'

'growth ivol' 'growth betaarb' 'growth indrrev' 'growth price'

'growth age' 'growth shvol' 'aturnover gmargins' 'aturnover ep'

'aturnover sgrowth' 'aturnover lev' 'aturnover roaa' 'aturnover roea'

'aturnover sp' 'aturnover mom' 'aturnover indmom' 'aturnover mom12'

'aturnover momrev' 'aturnover valuem' 'aturnover nissm' 'aturnover strev'

'aturnover ivol' 'aturnover betaarb' 'aturnover indrrev'

'aturnover price' 'aturnover age' 'aturnover shvol' 'gmargins ep'

'gmargins sgrowth' 'gmargins lev' 'gmargins roaa' 'gmargins roea'

'gmargins sp' 'gmargins mom' 'gmargins indmom' 'gmargins mom12'

'gmargins momrev' 'gmargins valuem' 'gmargins nissm' 'gmargins strev'

'gmargins ivol' 'gmargins betaarb' 'gmargins indrrev' 'gmargins price'

'gmargins age' 'gmargins shvol' 'ep sgrowth' 'ep lev' 'ep roaa' 'ep roea'

'ep sp' 'ep mom' 'ep indmom' 'ep mom12' 'ep momrev' 'ep valuem'

'ep nissm' 'ep strev' 'ep ivol' 'ep betaarb' 'ep indrrev' 'ep price'

'ep age' 'ep shvol' 'sgrowth lev' 'sgrowth roaa' 'sgrowth roea'

'sgrowth sp' 'sgrowth mom' 'sgrowth indmom' 'sgrowth mom12'

'sgrowth momrev' 'sgrowth valuem' 'sgrowth nissm' 'sgrowth strev'

'sgrowth ivol' 'sgrowth betaarb' 'sgrowth indrrev' 'sgrowth price'

'sgrowth age' 'sgrowth shvol' 'lev roaa' 'lev roea' 'lev sp' 'lev mom'

'lev indmom' 'lev mom12' 'lev momrev' 'lev valuem' 'lev nissm'

'lev strev' 'lev ivol' 'lev betaarb' 'lev indrrev' 'lev price' 'lev age'

'lev shvol' 'roaa roea' 'roaa sp' 'roaa mom' 'roaa indmom' 'roaa mom12'

'roaa momrev' 'roaa valuem' 'roaa nissm' 'roaa strev' 'roaa ivol'

'roaa betaarb' 'roaa indrrev' 'roaa price' 'roaa age' 'roaa shvol'

'roea sp' 'roea mom' 'roea indmom' 'roea mom12' 'roea momrev'

'roea valuem' 'roea nissm' 'roea strev' 'roea ivol' 'roea betaarb'

'roea indrrev' 'roea price' 'roea age' 'roea shvol' 'sp mom' 'sp indmom'

'sp mom12' 'sp momrev' 'sp valuem' 'sp nissm' 'sp strev' 'sp ivol'

'sp betaarb' 'sp indrrev' 'sp price' 'sp age' 'sp shvol' 'mom indmom'

'mom mom12' 'mom momrev' 'mom valuem' 'mom nissm' 'mom strev' 'mom ivol'

'mom betaarb' 'mom indrrev' 'mom price' 'mom age' 'mom shvol'

'indmom mom12' 'indmom momrev' 'indmom valuem' 'indmom nissm'

'indmom strev' 'indmom ivol' 'indmom betaarb' 'indmom indrrev'

'indmom price' 'indmom age' 'indmom shvol' 'mom12 momrev' 'mom12 valuem'

'mom12 nissm' 'mom12 strev' 'mom12 ivol' 'mom12 betaarb' 'mom12 indrrev'

'mom12 price' 'mom12 age' 'mom12 shvol' 'momrev valuem' 'momrev nissm'

'momrev strev' 'momrev ivol' 'momrev betaarb' 'momrev indrrev'

'momrev price' 'momrev age' 'momrev shvol' 'valuem nissm' 'valuem strev'

'valuem ivol' 'valuem betaarb' 'valuem indrrev' 'valuem price'

'valuem age' 'valuem shvol' 'nissm strev' 'nissm ivol' 'nissm betaarb'

'nissm indrrev' 'nissm price' 'nissm age' 'nissm shvol' 'strev ivol'

'strev betaarb' 'strev indrrev' 'strev price' 'strev age' 'strev shvol'

'ivol betaarb' 'ivol indrrev' 'ivol price' 'ivol age' 'ivol shvol'

'betaarb indrrev' 'betaarb price' 'betaarb age' 'betaarb shvol'

'indrrev price' 'indrrev age' 'indrrev shvol' 'price age' 'price shvol'

'age shvol']

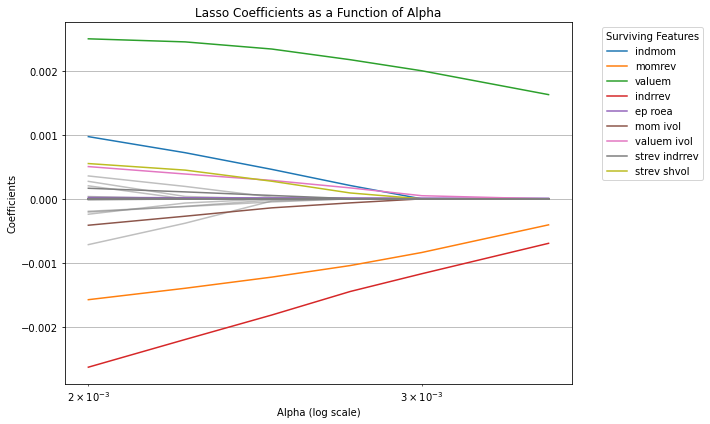

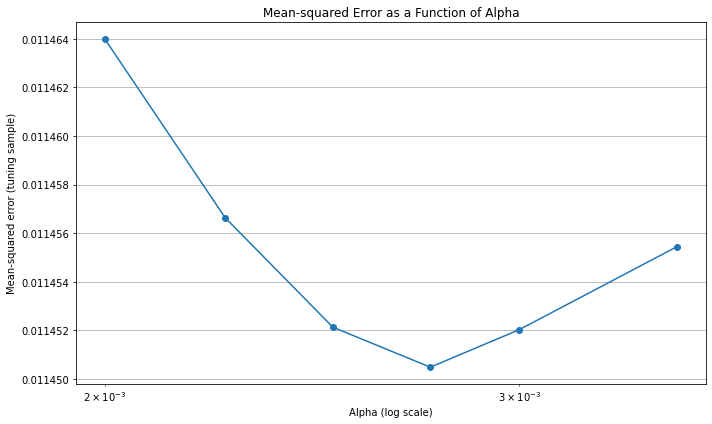

# Define a range of alpha values

alphas = [0.002,0.00225,0.0025,0.00275,0.003,0.0035] # range for alphas

coefficients = []

mses=[]

# Perform Lasso regression for each alpha

for alpha in alphas:

lasso = Lasso(alpha=alpha, max_iter=10000) # Ensure convergence with high iterations

lasso.fit(X_train_interactions, Y_train)

coefficients.append(lasso.coef_)

Y_pred = lasso.predict(X_tuning_interactions)

mse = mean_squared_error(Y_tuning, Y_pred)

mses.append(mse)

# Convert coefficients to a NumPy array for plotting

coefficients = np.array(coefficients)

alpha_index = alphas.index(0.00275)

surviving_features = np.where(coefficients[alpha_index, :] != 0)[0]

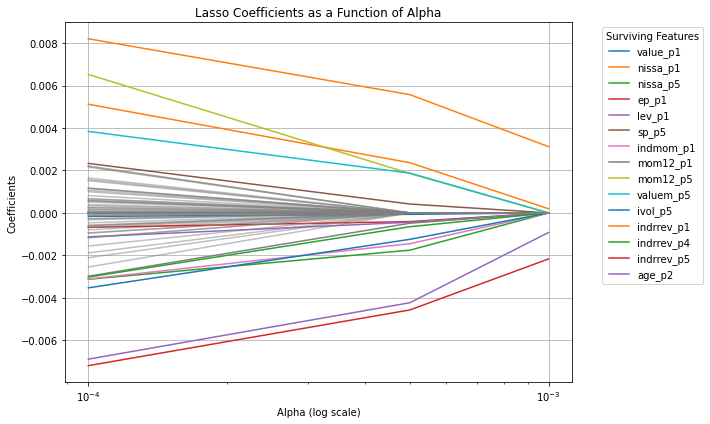

# Plot the coefficients as a function of alpha

plt.figure(figsize=(10, 6))

for i in range(coefficients.shape[1]):

if i in surviving_features:

# Plot surviving features with legend

plt.plot(alphas, coefficients[:, i], label=feature_names[i])

else:

# Plot non-surviving features without legend

plt.plot(alphas, coefficients[:, i], color='gray', alpha=0.5)

plt.xscale('log')

plt.xlabel('Alpha (log scale)')

plt.ylabel('Coefficients')

plt.title('Lasso Coefficients as a Function of Alpha')

plt.legend(bbox_to_anchor=(1.05, 1), loc='upper left', title="Surviving Features")

plt.grid(True)

plt.tight_layout()

plt.show()

# Plot Mean-squared error for tuning sample

plt.figure(figsize=(10, 6))

plt.plot(alphas, mses, marker='o')

plt.xlabel('Alpha (log scale)')

plt.ylabel('Mean-squared error (tuning sample)')

plt.xscale('log')

plt.title('Mean-squared Error as a Function of Alpha')

plt.grid(True)

plt.tight_layout()

plt.show()

Note that there is virtually no improvement out of sample

14.1.2. Non-Parametric Models#

Instead of assuming that the relationship between the dependent variable $ y ) and the characteristic ( size ) is linear, we consider a more flexible model. In this approach, the relationship is linear in terms of the percentiles of the characteristic.

14.1.2.1. Original Linear Model#

In a linear regression, the model is typically expressed as:

where:

\( y_{i, t+1} \): The dependent variable (e.g., return of asset \( i \) at time \( t+1 \)).

\( size_{i, t} \): A characteristic of asset \( i \) at time \( t \) (e.g., market capitalization).

\( \beta \): A regression coefficient indicating the relationship between \( size_{i, t} \) and \( y_{i, t+1} \).

14.1.2.2. Non-Parametric Percentile-Based Model#

To introduce non-linearity, we instead model \( y_{i, t+1} \) as a function of the percentiles of \( size \) within each time period. The model becomes:

[ y_{i, t+1} = \sum_p \beta_p \cdot 1_{{size_{i, t} \in \text{Percentile}(p, \text{size}_t)}} ]

where:

\( p \): The percentile group (e.g., \( p = 1 \) for the 0-20% percentile, \( p = 2 \) for the 20-40% percentile, etc.).

\( \beta_p \): The regression coefficient for percentile \( p \).

\( 1_{\{size_{i, t} \in \text{Percentile}(p, \text{size}_t)\}} \): An indicator function that equals 1 if \( size_{i, t} \) falls in the \( p \)-th percentile of the \( size \) distribution for time \( t \), and 0 otherwise.

14.1.2.3. Explanation#

Intuition: Instead of assuming a linear relationship between \( y \) and \( size \), the model captures how \( y \) varies across different percentile ranges of \( size \).

Flexibility: The model allows for different effects (\( \beta_p \)) for each percentile range, enabling it to capture non-linear relationships.

Interpretation: For example, \( \beta_1 \) represents the average effect of assets in the lowest 20% of \( size \) on \( y \), while \( \beta_5 \) represents the effect for assets in the highest 20%.

This approach is particularly useful when the relationship between \( y \) and \( size \) is not well-approximated by a straight line but instead varies across different ranges of \( size \).

# Define the number of percentiles

num_percentiles = 5

# Initialize an empty list to store the new columns

new_columns = []

df=df_train.iloc[:, 1:].copy()

# Loop through each characteristic

for characteristic in df.columns:

# Group by date and calculate percentiles

grouped = df[characteristic].groupby(level='date')

# Apply percentile binning for each date

percentile_bins = grouped.apply(

lambda x: pd.qcut(x, q=num_percentiles, labels=False, duplicates='drop') # Bins from 0 to 4

)

# Create binary columns for each percentile

for percentile in range(num_percentiles):

col_name = f"{characteristic}_p{percentile+1}"

df[col_name] = (percentile_bins == percentile).astype(int)

df=df.copy()

new_columns.append(col_name)

# Keep the new columns only for verification (if needed)

new_characteristics_df = df[new_columns].copy()

# Output the shape of the new DataFrame

print("Original DataFrame shape:", df_train.iloc[:, 1:].shape)

print("New DataFrame shape after adding percentiles:", new_characteristics_df.shape)

new_characteristics_df

Original DataFrame shape: (204284, 29)

New DataFrame shape after adding percentiles: (204284, 145)

| size_p1 | size_p2 | size_p3 | size_p4 | size_p5 | value_p1 | value_p2 | value_p3 | value_p4 | value_p5 | ... | age_p1 | age_p2 | age_p3 | age_p4 | age_p5 | shvol_p1 | shvol_p2 | shvol_p3 | shvol_p4 | shvol_p5 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| date | permno | |||||||||||||||||||||

| 1972-07-01 | 10006 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | ... | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 1 | 0 |

| 10102 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | ... | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | |

| 10137 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 1 | 0 | ... | 0 | 0 | 1 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | |

| 10145 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 1 | ... | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | |

| 10153 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | ... | 0 | 0 | 1 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 1991-01-01 | 90369 | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | ... | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 |

| 90609 | 0 | 0 | 0 | 1 | 0 | 1 | 0 | 0 | 0 | 0 | ... | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | |

| 91380 | 0 | 0 | 0 | 1 | 0 | 0 | 1 | 0 | 0 | 0 | ... | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | |

| 91695 | 1 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | ... | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | |

| 92655 | 1 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 | ... | 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 |

204284 rows × 145 columns

# Define a range of alpha values

alphas = [0.0001,0.0005,0.001] # range for alphas

coefficients = []

mses=[]

# Perform Lasso regression for each alpha

for alpha in alphas:

lasso = Lasso(alpha=alpha, max_iter=10000) # Ensure convergence with high iterations

lasso.fit(new_characteristics_df.values, Y_train)

coefficients.append(lasso.coef_)

# Convert coefficients to a NumPy array for plotting

coefficients = np.array(coefficients)

alpha_index = alphas.index(0.0005)

surviving_features = np.where(coefficients[alpha_index, :] != 0)[0]

# Plot the coefficients as a function of alpha

plt.figure(figsize=(10, 6))

for i in range(coefficients.shape[1]):

if i in surviving_features:

# Plot surviving features with legend

plt.plot(alphas, coefficients[:, i], label=new_characteristics_df.columns[i])

else:

# Plot non-surviving features without legend

plt.plot(alphas, coefficients[:, i], color='gray', alpha=0.5)

plt.xscale('log')

plt.xlabel('Alpha (log scale)')

plt.ylabel('Coefficients')

plt.title('Lasso Coefficients as a Function of Alpha')

plt.legend(bbox_to_anchor=(1.05, 1), loc='upper left', title="Surviving Features")

plt.grid(True)

plt.tight_layout()

plt.show()

14.1.3. 2. Random Forest Regression#

Random Forest is an ensemble method that combines multiple decision trees to make predictions. Each tree is trained on a bootstrap sample of the data, and predictions are averaged:

Where \( h_t(X) \) is the prediction of the ( t )-th tree.

Key Characteristics:

Reduces overfitting by averaging predictions across trees.

Handles non-linear relationships and interactions between features well.

Relatively robust to noisy data and outliers.

Does not extrapolate beyond the range of the training data.

Random Forest Regressor:

A

RandomForestRegressoris initialized with:n_estimators=100: Builds 100 decision trees.max_depth=None: Allows trees to grow until all leaves are pure or contain less than the minimum samples.random_state=42: Ensures reproducibility.n_jobs=-1: Utilizes all available CPU cores for faster training.

Feature Importances:

The relative importance of each feature is extracted using the

feature_importances_attribute and displayed in a sorted DataFrame.

Adjusting Hyperparameters:

You can tune the following hyperparameters to optimize model performance:

n_estimators: Increase or decrease the number of trees.max_depth: Limit the depth of trees to prevent overfitting.min_samples_split: Minimum number of samples required to split an internal node.min_samples_leaf: Minimum number of samples required to be at a leaf node.

from sklearn.ensemble import RandomForestRegressor

# Build the Random Forest Regressor

random_forest = RandomForestRegressor(

n_estimators=250, # Number of trees in the forest

max_depth=10, # Maximum depth of the trees

random_state=42, # Ensures reproducibility

n_jobs=-1 # Use all available cores for training

)

# Train the Random Forest model

random_forest.fit(X_train, Y_train)

# Make predictions on the test set

Y_pred = random_forest.predict(X_tuning)

# Evaluate the model

mse = mean_squared_error(Y_tuning, Y_pred)

r2 = r2_score(Y_tuning, Y_pred)

mse = mean_squared_error(Y_tuning, Y_pred)

print("Mean Squared Error (MSE):", mse)

mae= mean_absolute_error(Y_tuning, Y_pred)

print("Mean Absolute Error (MAE):", mae)

r2 = r2_score(Y_tuning, Y_pred)

print("R-squared (R2):", r2)

# Optional: Feature importance

feature_importances = random_forest.feature_importances_

feature_names = df_train.iloc[:, 1:].columns

importance_df = pd.DataFrame({

'Feature': feature_names,

'Importance': feature_importances

}).sort_values(by='Importance', ascending=False)

print("\nFeature Importances:")

print(importance_df)

Mean Squared Error (MSE): 0.01148951126275974

Mean Absolute Error (MAE): 0.07460830016978094

R-squared (R2): -0.003371464811474878

Feature Importances:

Feature Importance

27 age 0.186314

26 price 0.086422

25 indrrev 0.065550

16 mom 0.065456

22 strev 0.064356

19 momrev 0.053585

18 mom12 0.052670

10 ep 0.048531

28 shvol 0.045249

17 indmom 0.038484

24 betaarb 0.034132

23 ivol 0.030491

0 size 0.029805

20 valuem 0.028786

8 aturnover 0.017810

21 nissm 0.017426

11 sgrowth 0.016147

2 prof 0.014705

1 value 0.013960

15 sp 0.013442

6 nissa 0.012874

13 roaa 0.012841

7 growth 0.012358

9 gmargins 0.011966

14 roea 0.011521

12 lev 0.010726

3 fscore 0.002920

4 debtiss 0.000890

5 repurch 0.000584

14.1.4. 4. Gradient Boosted Regression Trees (GBRT)#

GBRT is an ensemble technique that builds trees sequentially, where each tree corrects the errors of the previous one. The prediction is updated iteratively:

Where:

\( g_t(X) \): Gradient of the loss function with respect to predictions.

\( \nu\): Learning rate, controlling the contribution of each tree.

Key Characteristics:

Optimizes a differentiable loss function (e.g., squared error for regression).

Can capture complex, non-linear patterns in the data.

Requires careful tuning of hyperparameters (e.g., learning rate, number of trees, maximum tree depth).

Gradient Boosted Regression Trees:

A

GradientBoostingRegressoris initialized with:n_estimators=100: Builds 100 trees.learning_rate=0.1: Controls the contribution of each tree to the final prediction.max_depth=3: Limits the depth of individual trees to prevent overfitting.random_state=42: Ensures reproducibility.

Adjusting Hyperparameters:

You can tune the following hyperparameters to optimize the model:

n_estimators: Increase for more stages of boosting.learning_rate: Decrease for smaller incremental updates (often requires increasingn_estimators).max_depth: Control tree depth to balance bias and variance.subsample: Use a fraction of samples for each stage (e.g.,subsample=0.8for 80% of the data).

from sklearn.ensemble import GradientBoostingRegressor

# Build the Gradient Boosting Regressor

gbrt = GradientBoostingRegressor(

n_estimators=300, # Number of boosting stages to perform

learning_rate=0.2, # Shrinks the contribution of each tree

max_depth=5, # Maximum depth of each tree

random_state=42 # Ensures reproducibility

)

# Train the Gradient Boosting model

gbrt.fit(X_train, Y_train)

# Make predictions on the test set

Y_pred = gbrt.predict(X_tuning)

# Evaluate the model

mse = mean_squared_error(Y_tuning, Y_pred)

r2 = r2_score(Y_tuning, Y_pred)

mse = mean_squared_error(Y_tuning, Y_pred)

print("Mean Squared Error (MSE):", mse)

mae= mean_absolute_error(Y_tuning, Y_pred)

print("Mean Absolute Error (MAE):", mae)

r2 = r2_score(Y_tuning, Y_pred)

print("R-squared (R2):", r2)

# Optional: Feature importance

feature_importances = gbrt.feature_importances_

feature_names = df_train.iloc[:, 1:].columns

importance_df = pd.DataFrame({

'Feature': feature_names,

'Importance': feature_importances

}).sort_values(by='Importance', ascending=False)

print("\nFeature Importances:")

print(importance_df)

Mean Squared Error (MSE): 0.012230932833230374

Mean Absolute Error (MAE): 0.07760391337870105

R-squared (R2): -0.06811932311395719

Feature Importances:

Feature Importance

27 age 0.294144

16 mom 0.057104

22 strev 0.055204

18 mom12 0.052066

19 momrev 0.050959

28 shvol 0.045834

25 indrrev 0.045597

26 price 0.040428

17 indmom 0.040013

24 betaarb 0.035627

10 ep 0.029968

20 valuem 0.027339

23 ivol 0.027101

0 size 0.024653

21 nissm 0.018743

8 aturnover 0.017848

15 sp 0.016247

11 sgrowth 0.016003

6 nissa 0.015233

7 growth 0.014040

12 lev 0.013535

1 value 0.013454

9 gmargins 0.013224

2 prof 0.013146

14 roea 0.010066

13 roaa 0.008488

3 fscore 0.002793

5 repurch 0.000652

4 debtiss 0.000489

14.1.5. 5. Elastic Net Regression#

Elastic Net combines L1 (Lasso) and L2 (Ridge) regularization to balance feature selection and multicollinearity handling. The objective function is:

Where:

\( \|\beta\|_1 \): Lasso penalty encourages sparsity.

\( \|\beta\|_2^2 \): Ridge penalty shrinks coefficients to reduce multicollinearity.

Key Characteristics:

Balances Lasso’s feature selection and Ridge’s stability with correlated predictors.

Controlled by two hyperparameters:

\( \alpha \): Overall regularization strength.

\( \rho \) (mixing ratio): Balance between L1 and L2 penalties.

Elastic Net Regressor:

The

ElasticNetregressor is initialized with:alpha=0.1: Controls the overall strength of regularization.l1_ratio=0.5: Specifies the mix of L1 (Lasso) and L2 (Ridge) penalties:l1_ratio=0 : Equivalent to Ridge regression.

l1_ratio=1 : Equivalent to Lasso regression.

l1_ratio=0.5 : Balances L1 and L2 penalties.

random_state=42: Ensures reproducibility.

Adjusting Hyperparameters:

alpha:Larger values apply stronger regularization, reducing overfitting but increasing bias.

l1_ratio:Adjust to control the balance between L1 and L2 penalties:

Increase towards 1 for more sparsity (feature selection).

Decrease towards 0 to favor Ridge-like behavior (handles multicollinearity).

from sklearn.linear_model import ElasticNet

# Initialize and train the Elastic Net regressor

elastic_net = ElasticNet(

alpha=0.005, # Regularization strength (higher values = stronger penalty)

l1_ratio=0.5, # Balance between L1 (Lasso) and L2 (Ridge) regularization

random_state=42 # Ensures reproducibility

)

# Train the Elastic Net model

elastic_net.fit(X_train, Y_train)

# Make predictions on the test set

Y_pred = elastic_net.predict(X_tuning)

# Evaluate the model

mse = mean_squared_error(Y_tuning, Y_pred)

r2 = r2_score(Y_tuning, Y_pred)

mse = mean_squared_error(Y_tuning, Y_pred)

print("Mean Squared Error (MSE):", mse)

mae= mean_absolute_error(Y_tuning, Y_pred)

print("Mean Absolute Error (MAE):", mae)

r2 = r2_score(Y_tuning, Y_pred)

print("R-squared (R2):", r2)

# Print the coefficients

coefficients = pd.DataFrame({

'Feature': df_train.iloc[:, 1:].columns,

'Coefficient': elastic_net.coef_

}).sort_values(by='Coefficient', ascending=False)

print("\nCoefficients:")

print(coefficients)

Mean Squared Error (MSE): 0.01144784660786539

Mean Absolute Error (MAE): 0.07444204750342037

R-squared (R2): 0.0002670821080715813

Coefficients:

Feature Coefficient

20 valuem 0.002396

17 indmom 0.000461

15 sp 0.000052

0 size -0.000000

1 value 0.000000

27 age 0.000000

26 price -0.000000

24 betaarb -0.000000

23 ivol 0.000000

22 strev 0.000000

21 nissm -0.000000

18 mom12 0.000000

16 mom -0.000000

14 roea 0.000000

13 roaa 0.000000

12 lev 0.000000

11 sgrowth 0.000000

10 ep 0.000000

9 gmargins -0.000000

8 aturnover 0.000000

7 growth -0.000000

6 nissa -0.000000

5 repurch 0.000000

4 debtiss -0.000000

3 fscore 0.000000

2 prof 0.000000

28 shvol -0.000000

19 momrev -0.001270

25 indrrev -0.001636

14.1.6. 6. Neural Network Regression#

A neural network is a flexible, non-linear model that uses layers of neurons to approximate complex relationships between inputs (( X )) and outputs (( Y )). The simplest form of a feedforward neural network can be expressed as:

Key Characteristics:

Consists of an input layer, hidden layers, and an output layer.

Activation functions (\(\sigma\), e.g., ReLU or sigmoid) introduce non-linearity.

\(ReLU(x)=max(0,x)\)

\(Sigmoid(x)=1/(1+e^{−x})\)

The number of layers and neurons can be tuned to fit data complexity.

Requires careful tuning of hyperparameters (e.g., learning rate, number of layers, epochs).

Building the Neural Network:

Function

build_and_train_model:Parameters:

num_layers: Number of layers in the neural network (free parameter).input_dim: Number of input features (dimensions).

Model Architecture:

Input Layer:

Uses

Denselayer with 64 neurons andreluactivation function.input_dimspecifies the number of input features.

Hidden Layers:

Adds additional hidden layers based on

num_layers.Each hidden layer has 64 neurons with

reluactivation.

Output Layer:

A single neuron without activation (linear activation) for regression output.

Compilation:

Uses the

adamoptimizer andmean_squared_errorloss function suitable for regression tasks.

Training: In addition to the network structure (layers and neurons), you also have to pick parameters that control the training process

Epochs: Controls the total number of training cycles. More epochs mean more opportunities for the model to learn, but excessive epochs can lead to overfitting.

Batch Size: Controls how the dataset is split into smaller subsets for gradient updates. Balances memory usage and convergence speed.

Validation Split: Reserves a portion of the data to monitor generalization during training and guide callbacks like early stopping.

By carefully tuning these parameters, you can balance training efficiency, model generalization, and computational resources.

Adjusting the Number of Layers:

Free Parameter:

You can adjust the

num_layersvariable to change the depth of the neural network.For example, setting

num_layers = 5will create a network with one input layer and four hidden layers.

Additional Considerations:

Hyperparameter Tuning:

You might want to experiment with different numbers of neurons, activation functions, epochs, and batch sizes to improve model performance.

from tensorflow.keras.models import Sequential

from tensorflow.keras.layers import Dense

def build_and_train_model(num_layers, input_dim, X_train, Y_train,neurons,validation_data,epochs):

"""

Builds and trains a neural network model.

Parameters:

- num_layers: int, number of layers in the neural network

- input_dim: int, number of input features

- X_train: training features

- Y_train: training target

Returns:

- model: Trained Keras model

"""

model = Sequential()

# Add the input layer

model.add(Dense(neurons, activation='relu', input_dim=input_dim))

# Add hidden layers

for _ in range(num_layers - 1):

neurons = max(1, int(neurons * 0.5))

model.add(Dense(neurons, activation='relu'))

# Add the output layer

model.add(Dense(1)) # Single neuron for regression output

# Compile the model

model.compile(optimizer='adam', loss='mean_squared_error')

# Train the model

model.fit(

X_train, Y_train,

epochs=epochs, # You can adjust the number of epochs

batch_size=128, # You can adjust the batch size

validation_data=validation_data,

)

return model

# Specify the number of layers (free parameter)

num_layers = 5 # Adjust this number as needed

input_dim = X_train.shape[1]

# Build and train the model

model = build_and_train_model(2, input_dim, X_train ,Y_train.values,16,(X_tuning, Y_tuning.values),epochs=10)

Epoch 1/10

1596/1596 ━━━━━━━━━━━━━━━━━━━━ 3s 1ms/step - loss: 0.0362 - val_loss: 0.0121

Epoch 2/10

1596/1596 ━━━━━━━━━━━━━━━━━━━━ 2s 1ms/step - loss: 0.0098 - val_loss: 0.0117

Epoch 3/10

1596/1596 ━━━━━━━━━━━━━━━━━━━━ 2s 1ms/step - loss: 0.0096 - val_loss: 0.0115

Epoch 4/10

1596/1596 ━━━━━━━━━━━━━━━━━━━━ 2s 1ms/step - loss: 0.0096 - val_loss: 0.0118

Epoch 5/10

1596/1596 ━━━━━━━━━━━━━━━━━━━━ 2s 1ms/step - loss: 0.0095 - val_loss: 0.0116

Epoch 6/10

1596/1596 ━━━━━━━━━━━━━━━━━━━━ 2s 1ms/step - loss: 0.0095 - val_loss: 0.0115

Epoch 7/10

1596/1596 ━━━━━━━━━━━━━━━━━━━━ 2s 1ms/step - loss: 0.0093 - val_loss: 0.0116

Epoch 8/10

1596/1596 ━━━━━━━━━━━━━━━━━━━━ 2s 1ms/step - loss: 0.0094 - val_loss: 0.0116

Epoch 9/10

1596/1596 ━━━━━━━━━━━━━━━━━━━━ 2s 1ms/step - loss: 0.0094 - val_loss: 0.0116

Epoch 10/10

1596/1596 ━━━━━━━━━━━━━━━━━━━━ 2s 1ms/step - loss: 0.0093 - val_loss: 0.0116

from tensorflow.keras.utils import plot_model

# Visualize the model architecture

plot_model(model, to_file='model.png', show_shapes=True, show_layer_names=True)

You must install pydot (`pip install pydot`) for `plot_model` to work.

14.1.7. The Whole Shebang#

You can potentially combine the Non-Parametric Percentile-Based Model with the interactions.

The key issue is tha as you make the model richer and richer the scope for the training to produce garabage increases

You need to do much more validation/model regularization

Examples include

L1 regularization:L1 regularization adds a penalty to the loss function based on the absolute values of the weights, encouraging sparsity by driving some weights to zero. This prevents overfitting and simplifies the model, making it useful in high-dimensional data or feature selection.

Early stopping: Early stopping monitors validation loss during training and halts when the loss stops improving, preventing overfitting. It ensures the model generalizes well and avoids unnecessary training.

Batch normalization: Batch normalization normalizes layer inputs to have a mean of 0 and variance of 1, speeding up training and reducing sensitivity to initialization. It also acts as a regularizer by introducing noise during training.

Ensembles: Ensembles combine predictions from multiple models, reducing variance and improving accuracy. They are effective for generalization but increase computational cost.

14.2. Wrap up#

Comparison Table across methods

Model |

Type |

Key Strengths |

Limitations |

|---|---|---|---|

Lasso Regression |

Linear |

Feature selection, interpretable coefficients |

Struggles with multicollinearity |

Neural Network Regression |

Non-linear |

Flexible, captures complex patterns |

Requires significant tuning and data |

Random Forest Regression |

Non-linear |

Robust to overfitting, handles feature interactions well |

Computationally expensive for large data |

GBRT |

Non-linear |

Accurate, optimizes for specific loss functions |

Sensitive to hyperparameters, overfitting |

Elastic Net Regression |

Linear |

Handles multicollinearity, balances selection & stability |

Can be slower than Ridge or Lasso |

Let me know if you’d like additional detail or comparisons!

For an academic investigation of these methods see “Empirical Asset Pricing via Machine Learning” (https://academic.oup.com/rfs/article/33/5/2223/5758276?login=true). The figures used in this notebook are also from that paper.